In today’s Money Morning…a supply shock like no other…globalisation’s last gasp…keep an eye out on copper…and more…

Dear Reader,

Once again, headline inflation from the US is dominating headlines.

For the second month in a row, CPI data out of the States has beaten expectations. And not in a good way…

The Fed has reported a 5% increase in inflation for the month of April. Exceeding the 4.6% and 4.7% estimates being touted by some just a few days ago. Led by higher prices for new cars, an ongoing semiconductor shortage, and even clothing.

What will no doubt concern investors, though, is that this is the fastest increase in inflation in 13 years. A sign that the economy may be overheating far faster than the Fed or government anticipated. Which, logically, should prompt selling from the stock market.

After all, if interest rates are pushed higher sooner rather than later, that’s bad news for growth stocks.

And yet, US markets overnight seemed to ignore this inflation agenda. Rising in the face of this new data instead of falling.

It’s not just equities defying inflationary fears either. 10-year bond yields also fell overnight, helping push Wall Street’s demand for stocks.

So, just what the hell are investors meant to make of this counterintuitive narrative?

Well, I suspect the explanation everyone is looking for can be found in Italian tomatoes…

A supply shock like no other

For the unaware, Italy is one of the world’s top suppliers of canned tomatoes. Producing roughly five million tons of the red fruits (not vegetables) every year.

So, right now, as we head into the European summer, the harvest should be about to commence. With the typical process requiring a picked tomato to be canned within 36 hours. Otherwise, they must be thrown away.

A process that is rarely, if ever, a problem.

Not this year though…

See, in 2021, more Italian tomatoes are expected to be left rotting and unpicked than usual. All thanks to a shortage of cans to package and distribute them in. As one food supplier tells Bloomberg:

‘We cannot find cans. Big multinationals are defaulting on their contracts and the price of cans has increased by more than three times.’

A turn of events, like many others, that showcases the increasing failure in supply chain bottlenecks. With this can shortage fuelled by unexpectedly strong demand, particularly from China. As well as some sporadic issues from suppliers to meet production targets or keep facilities online due to the pandemic.

Issues that are all encompassed within the wider breakdown of global supply chains.

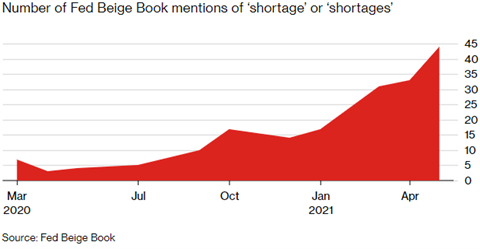

An event that is far more unique and alarming as the aftereffects of 2020 begin to emerge. Just look at this chart showcasing the number of times the Fed mentions ‘shortage’ in one of its key reports:

|

|

|

Source: US Federal Reserve / Bloomberg |

Another record number of mentions — 44 — for the past decade. Which comes right after last month’s (April’s) previous record-breaking 33 mentions.

In other words, shortages are cropping up everywhere. And not just in the US.

Supply chain bottlenecks are a global problem. With the ongoing pandemic still playing a pivotal role in delaying or halting production.

And while some analysts see things resolving themselves in a matter of weeks or months, I’m not so sure. Especially with reports that China, which had seemingly bested the virus, is now facing a new and growing outbreak in Guangzhou.

If it spreads out of control again, it will throw supply chains into even more chaos than they’re already in…

Globalisation’s last gasp?

So, what does this all mean for investors?

Well, for starters, supply chains are certainly going to be tested for the foreseeable future. With the possibility that we could see Chinese-led globalisation as we know it come to an abrupt end.

As for how likely that is, no one can truly say.

But the fact of the matter is, no matter what the world looks like post-COVID, supply chains will change. With domestic production of certain, vital goods almost a guarantee for any major economy.

We’re already seeing this unfold within the semiconductor industry. As both the US and Europe scramble to scale up their local manufacturing efforts. Just a taste of the wider disruption that is likely coming for other sectors.

Indeed, as the BBC posits, we may even be seeing the latest evolution of capitalism.

Moving away from late 20th century ideals that have now become outdated and unworkable. With this pandemic forcing our ideological hand, so to speak. An evolutionary push for economic thinking and perhaps markets as whole.

After all, it’s hard to look at what cryptocurrency is doing to traditional finance and justify the outdated and egregious systems it is replacing. So, perhaps this pandemic can do the same for global supply chains.

Pushing us towards some new paradigms that better addresses our needs in the ‘new normal’.

Whatever the hell that may be…

In the short term, though, and at a more tangible level, what it means for you is opportunity. Because despite whatever qualms we may have with capitalism as we know it, it is damn good at innovation. And the best way to capitalise on innovation is through the stock market.

This means investing in companies with bold new ideas and ambitions, companies that could offer a solution to whatever challenges post-COVID society throws at us.

After all, you can already find some of them right now. With one fantastic example for the supply chain problem that I’ve discussed today, exemplified by an Aussie small-cap known as Yojee Ltd [ASX:YOJ].

A tiny software company that is aiming to optimise logistics with meaningful data insights. Digital solutions that can lead to real-world efficiencies.

Because right now, despite inflationary fears and central bank interreference, we need real-world solutions to real-world problems. And you can count on the ingenuity of people and exciting new businesses to provide that.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.