‘The worst ever debate.’

That’s what the public has crowned the 90-minute mud-slinging match between Trump and Biden.

A torrid, and frankly unseemly fight between two bitter men.

And while both sides (and their supporters) will argue they each won, I think we can all agree on the real loser: the US.

Truthfully, we probably should have expected this from 2020. It is a deserving finish to an utterly forgettable year. Granted, we still have three months left. So, who knows, maybe there is worse to come.

Despite that though, this ‘debate’ was a train wreck that was impossible to look away from.

It has set the tone for a fierce election. Even more so than 2016. Because this time, everyone knows either side could win. And whoever loses is not going to take it lying down.

For that reason, expect things to only devolve further from here.

In two weeks’ time, I expect we’ll see an even uglier second round clash.

But I don’t want to get bogged down in the politics. Rather, I want to focus on the event itself. Because while US presidential races are always followed closely, this one feels extra important…

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Markets brace for impact

As every financial masthead was reporting, markets were nervously watching the debate.

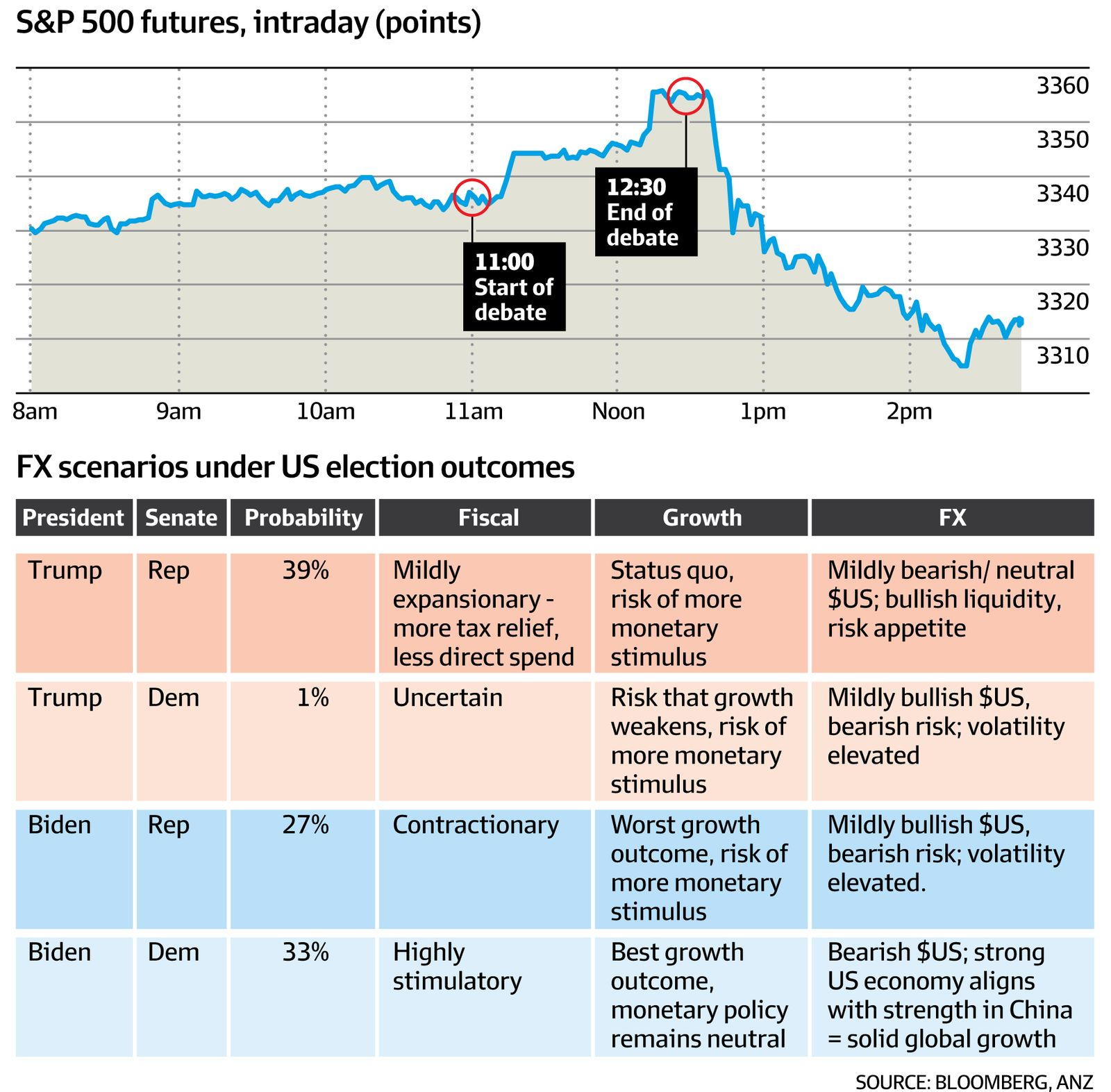

This infographic shared in the AFR perfectly captures the tension:

|

|

|

Source: AFR / Bloomberg / ANZ |

As you can see from the graph, US stocks watched both candidates closely. With a violent fall after the debate came to a close.

And as the table below it shows, there are a few possible outcomes to consider. Though the market response suggests they’re worried it will not be one of the favourable ones for the economy.

Here’s the thing though, as Ryan Dinse noted on Monday, the election is pretty irrelevant in the long term. You can read all about that in his article, here.

People are getting too sucked into this election. Viewing it as the beginning of the end if the wrong side wins. And the wrong side is very different depending on whom you ask.

Smart investors though, will simply drown it all out.

Seriously, the best thing you could probably do is to totally ignore this election.

I’m not suggesting it won’t have an impact; that would be naïve. But I think your efforts would be put to better use by focussing elsewhere. Because right now: everyone else is watching the US in horror. And it is likely to stay that way until the last vote is counted.

In the meantime, you could miss out on incredible stories like Piedmont Lithium Ltd [ASX:PLL]…

Hiding in plain sight

In case you missed it, Piedmont shares were up 153% from Friday’s close to Tuesday’s open. And up 366% for the entire month.

Not bad for a tiny lithium miner that few people had ever heard of.

So, what was the reason for this massive surge?

Well, they landed a deal with Tesla. Agreeing to supply Elon Musk’s electric car company with spodumene — a key mineral that contains lithium for batteries.

Now, you may be thinking that doesn’t mean much to you. After all, the stock has already spiked on the news.

But, if you’ve been listening to one of my other colleagues, Lachlann Tierney, well you might have been able to jump in before the surge. After all, he’s been talking up lithium and the broader renewables story a lot recently.

You can check out his most recent article, right here.

My point is; if you can spot the narrative early, you can pinpoint the stocks that will benefit. Not always with 100% accuracy, but with a far better hit rate than you might think.

Indeed, this is what being a ‘stock picker’ is all about. Something that you’ll be hearing more about from me in the coming weeks.

Which is exactly what I want to conclude on for today.

Because if there is one key takeaway from yesterday’s debate, it is that everyone is watching. And that is going to lead to plenty of overlooked trends and narratives in the coming weeks. I’m certain of it.

So, as an investor, now is not the time to get caught up in political drama. It’s a distraction that will all be over in a matter of weeks.

Instead, the big gains are waiting to be found.

You’ve just got to keep your eyes on the prize.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.