In today’s Money Morning…passive investing has its day in the sun…the divergence…opportunity knocks…and more…

Today, I want to talk about how the next crash might play out.

Did you see Murray Dawes’s recent warning of the bearish price action we are seeing in the S&P 500? You see, the share market is at record-high valuations. Bond yields are also not far off record lows, meaning prices are near record highs too. Government debts are off the charts. The prices of many assets, in general, seem unsustainable.

That doesn’t mean a crash is imminent, or a given. But you do need to be very careful right now about where you invest. After all, you have to invest in something. As Ray Dalio has repeatedly said, ‘Cash is trash’.

So it is useful to understand where the risks are and how they came to exist.

When we say the market is at record highs, we need to get a little more specific. You see, not all areas of the share market are performing the same way.

There is one big recent theme that has created a large divergence in the market.

Passive investing has its day in the sun

That theme is passive investing.

In the last decade, since the fallout of the global financial crisis in 2008, it seems to me that more distrust has arisen towards the financial system. This distrust has been aimed at banks, central banks, and financial advisors.

I think this is one of the main reasons that cryptocurrencies have become so popular. It is a way for people to take back the power and control of their money.

At the same time, people have been taking control of their investing. They are sick of giving their financial advisors and fund managers high fees for oftentimes very underwhelming performance.

Most people don’t have the time to research the market extensively. In the past, ‘mum and dad investors’ would simply put their money to work by buying shares in a few large companies that they knew and trusted.

However, more recently, we have seen the rise of passive investing mostly through index funds. In fact, in 2010, passive funds made up 25% of all fund assets. In 2019, they had grown to 49%.

That’s a big change.

Now, the thing with index investing is that it has concentrated all the money into the biggest companies. In fact, more than 27% of the weighting of the S&P 500 comes from just the top eight companies.

On top of that, the S&P 500 is by far the most popular index for passive investing. Three of the top four index funds track the S&P 500.

So what impact does all of this have?

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

The divergence

The top eight companies in the Nasdaq 100 Index happen to be the same as those in the S&P 500. However, in the Nasdaq 100, those companies make up more than 51% of the index.

So that is just eight companies getting a large chunk of global investment inflows.

Therefore, it is worth looking at how this has impacted the market.

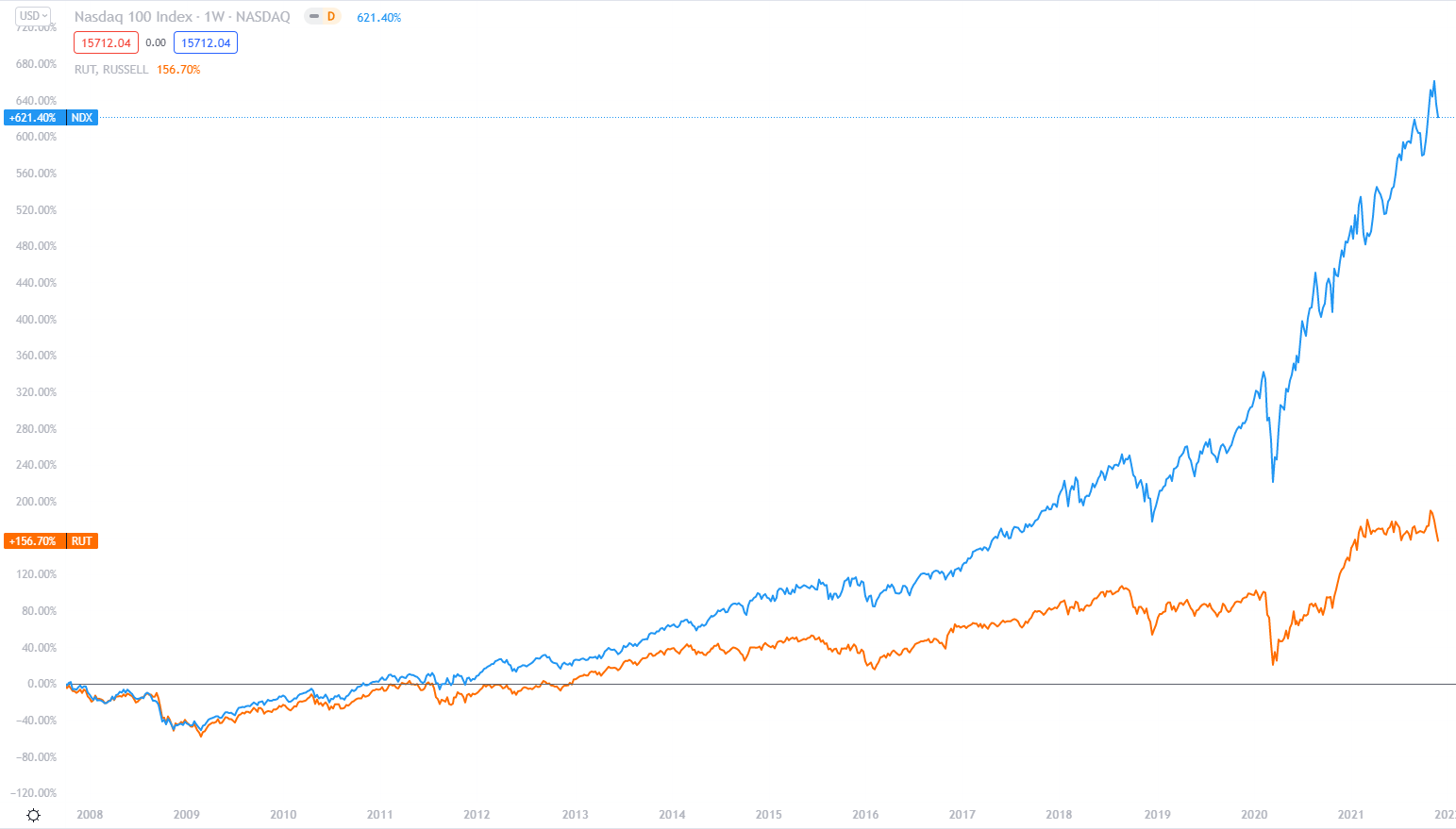

The below chart shows the divergence between the Nasdaq 100 Index and the Russell 2000. For a bit of context, the Russell 2000 is a small-cap index. It doesn’t include any of those eight stocks. The chart starts around the high point of the markets, right before the 2008 financial crisis.

Check it out:

|

|

|

Source: Trading View |

I think it is important to point out that when people talk about the share market being at record highs or expensive, they are mostly talking about just eight companies.

The price to earnings ratio (P/E) of the Nasdaq 100 is just over 29. That means if you buy the Nasdaq 100 today, and all those companies continue to make the same amount of money in the future, it will take 29 years before they earn the amount you paid for the index.

That’s a long time.

The Russell 2000 P/E is almost 18.

Opportunity knocks

When the next crash happens, whenever that may be, one thing looks certain: All that lazy, passive money pumping up those eight stocks is going to unravel pretty fast when the music stops.

But opportunity knocks every day in the small-cap sector. Opportunity that can shine even during a large market crash. You just have to look for it.

Granted, this in itself is no easy task. If you aren’t careful, and don’t have a sound strategy in place, you can be stuck punting mindlessly on small-caps that end up heading nowhere or shoot back down before you have time to take profits.

But the beauty of small-caps is that the surges to the upside on winning stocks can be quite impressive.

The below chart covers late 2007 to early 2010 and shows the pre-crisis high and the low of the 2008 crash. The orange line is the S&P 500 Index. The blue line is Netflix, Inc [NASDAQ:NFLX].

|

|

|

Source: Trading View |

At the end of 2007, Netflix was valued at about US$1.7 billion. It is now the 10th biggest company in the Nasdaq 100, with a current market cap of around US$266 billion.

This is just one example of a small-cap stock that defied a market crash to give exceptional returns.

It’s also exactly the kind of explosive growth that my colleague Ryan Dinse and I look out for in Exponential Stock Investor.

With the Fed tightening, stock markets look like they might come under pressure in 2022. If it plays out this way, it’s likely to be led by the mega-cap tech stocks.

Meanwhile, well-priced small-caps with genuine growth opportunities could be set to outperform.

Until next week,

|

Izaac Ronay,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here