Vulcan Energy Resources Ltd [ASX:VUL] today released a zero carbon lithium presentation addressing its goal to support Europe’s EV boom.

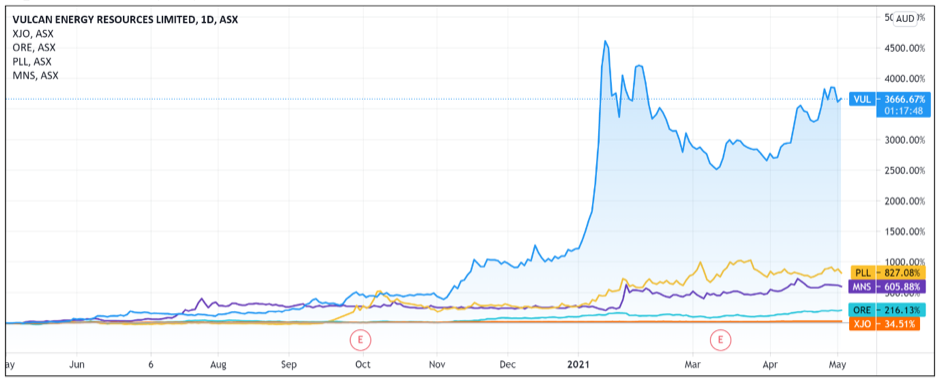

VUL shares were up as much as 5% in early trade before settling to exchange hands at $7.98 a share, up 2.3%.

It follows a mixed start to the week for lithium stocks.

As we’ve covered, Magnis Energy Technologies Ltd [ASX:MNS] shares rose as much as 10% in early trade yesterday before closing down 1.3%.

Piedmont Lithium Ltd [ASX:PLL] is currently down 6.3% while Orocobre Ltd [ASX:ORE] is currently up 3.2%.

VUL’s momentum hasn’t faltered yet, however, with Vulcan shares up 30% in the last month and up 185% year-to-date.

Source: Tradingview.com

Vulcan’s zero carbon lithium ambition

How does one support 30 million electric vehicles by 2030 in the European Union?

That is how Vulcan framed today’s corporate presentation.

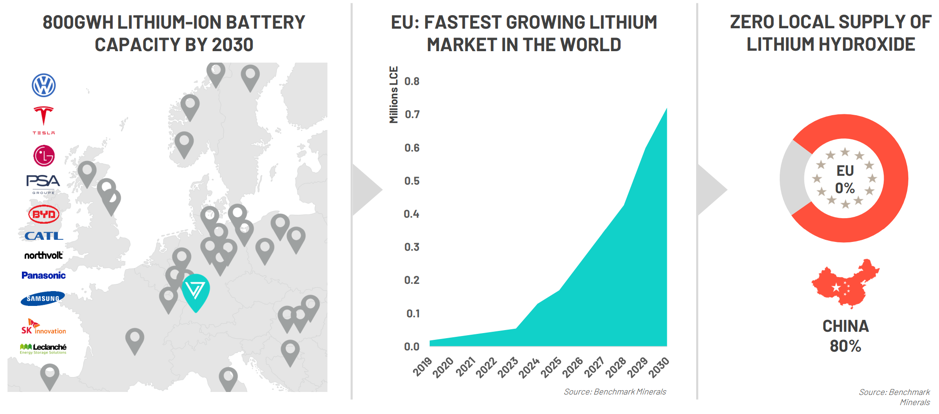

Source: Benchmark Minerals

Vulcan positioned Europe as the fastest growing lithium market in the world, citing research from Benchmark Minerals.

The looming status of the EU as one of the world’s hungriest markets for lithium would not be lost on Vulcan’s investors.

Vulcan seeks to produce ‘world-first’ zero carbon lithium hydroxide products from its strategically located lithium brine project in Germany’s Upper Rhine Valley.

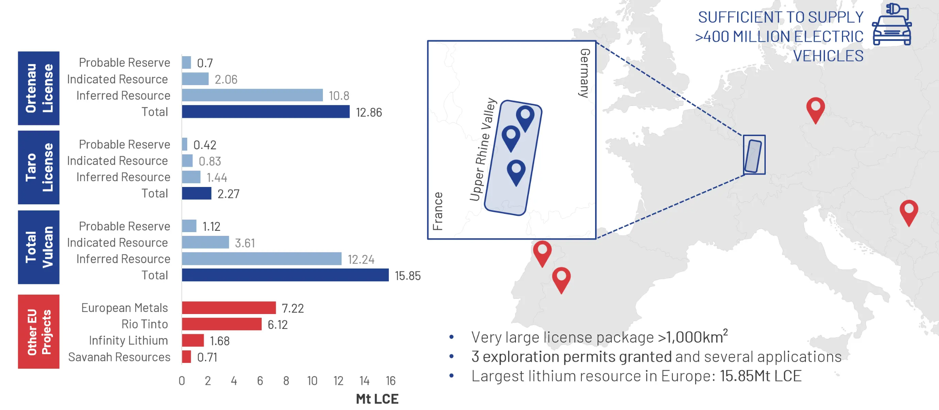

VUL’s presentation emphasised the company’s location and asserted that its lithium project in Germany is the largest JORC lithium resource in Europe.

Source: Company presentation

VUL cash flow status

With a market capitalisation of $855 million, Vulcan recorded no inflows from customer receipts year-to-date (nine months), reflecting the high expectations for the company’s long-term prospects.

VUL posted net cash loss from operating activities of $1.07 million, with the majority of operating outflows going towards administration and corporate costs.

Vulcan also spent $1.40 million on exploration and evaluation as part of its investing activities, bringing its year-to-date (nine months) exploration and evaluation total to $4.71 million.

The company’s coffers were topped up by a $120 million placement supported by ESG-focused institutions.

As a result, VUL’s cash and cash equivalents at the end of the quarter came to $117.47 million.

That means that the company’s cash position more than covered its total relevant outgoings for the quarter.

At current levels, Vulcan has 47 quarters of funding available, a lengthy runway from which to soar.

What next for Vulcan?

Source: Company presentation

Vulcan thinks it is well positioned to capitalise on the EV boom.

It purports to own the largest JORC lithium resource in the fastest growing market for lithium.

It has proprietary methods to reduce its carbon footprint when extracting lithium, attracting ESG-focused partners and investors.

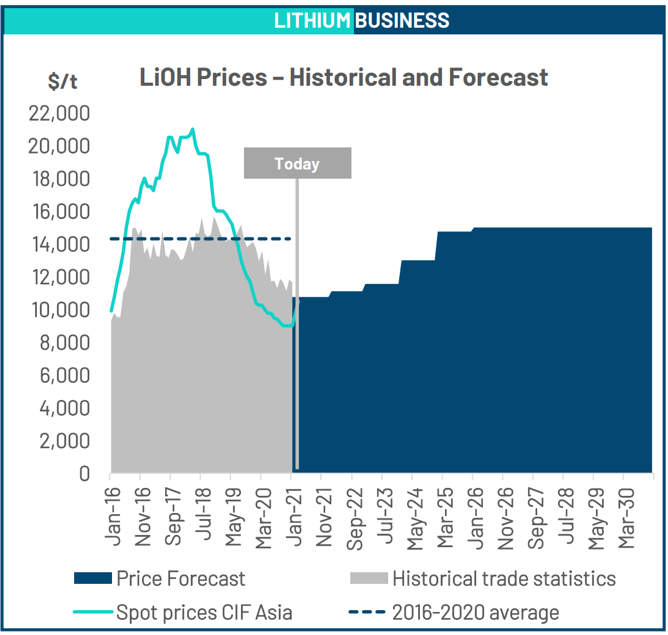

And a week doesn’t go by without articles pointing to the spike in lithium prices.

VUL’s own presentation cited forecasts predicting lithium prices to rise further.

But with a large market cap and plenty of positive sentiment, investors are likely already sold on VUL’s market opportunity and lithium’s expected price appreciation.

What they will likely expect now is VUL turning all of the above into realised sales and a dominant market position.

If you are interested in finding out more about lithium stock investment opportunities, then do make sure to check out this free report.

The report reveals three stocks that could surge on the back of renewed demand for lithium in 2021. It is free to download right now.

Regards,

Lachlann Tierney,

For Money Morning

Comments