PointsBet Holdings Ltd’s [ASX:PBH] share price is down 4.5% despite PointsBet completing its Banach acquisition.

Since reaching $17.6 in February, PBH shares have slid in recent months, currently trading at $12.4 per share.

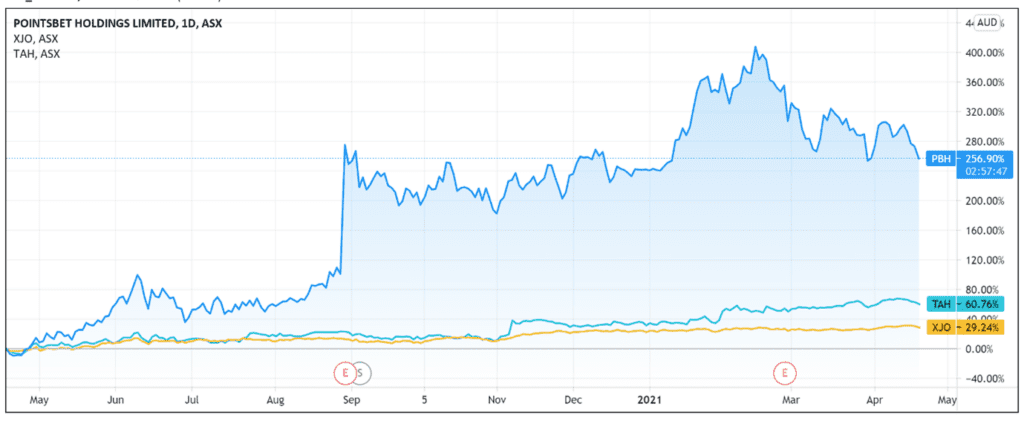

Nonetheless, while the PBH share price is down 11% in the last month, the stock is still up 280% over the last 12 months.

PointsBet completes Banach acquisition

PBH confirmed that the acquisition of Banach Technologies announced on 16 March 2021 was completed yesterday.

PointsBet acquired Banach for US$43 million on a cash and debt-free basis, with 55% of the price paid in cash and the rest in scrip.

As part of the completed deal, PBH today issued 1,752,875 of its shares.

Banach is a Dublin-based B2B provider of proprietary risk management platforms and trading models that support complex betting products.

PointsBet acquired the firm to position itself as a ‘leader of in-play sports wagering in the United States, just as in-play wagering is expected to grow exponentially.’

The company expects in-play wagering to represent 75% of all sports wagering activity in the US within the next three years.

PointsBet’s 48-hour solution

Today’s announcement follows the company responding to an Illinois edict requiring new clients of all online sports wagering operators in Illinois to register in-person at licensed partners’ physical locations before placing online wagers.

The requirement applies from 4 April 2021.

PointsBet reported that it was able to transition from a remote registration to in-person registration, ‘despite only having 48 hours of notice.’

PBH was able to leverage its strategic retail sportsbook locations, including its Hawthorne Race Course 8.5 miles from downtown Chicago and its three off-track betting shops in the greater metro Chicago area.

PBH share price outlook

While PointsBet management is positive about the potential presented by the Banach acquisition, the recent PBH sell-off suggests investors aren’t as enthused.

How come?

As the company pointed out, in-play wagering is expected to dominate all sports wagering in the US within three years and Banach specialises in complex betting products.

This, seemingly, is a good match.

PointsBet stated that Banach’s technology will also ‘allow PointsBet to optimise achieved margin and offer super value to their customers.’

And founder and former CEO of Banach Technology Mark Hughes added that the compatibility of the two businesses presents ‘excellent opportunity to achieve great success together.’

It could be the case that investors are searching for more detail on how Banach’s proprietary algorithms and models will translate to improved earnings for PointsBet.

While the addressable market of in-play wagering in the US is large, investors may be looking for concrete examples of how the acquisition will position PointsBet as the sector’s leading provider.

If you are excited by technology, algorithms, and proprietary machine learning programs, then I think you may also enjoy reading our free report on new small-cap fintech stocks.

The report will go through three innovative Aussie fintech stocks with exciting growth potential. Check it out if you’re interested.

Regards,

Lachlann Tierney,

For Money Morning