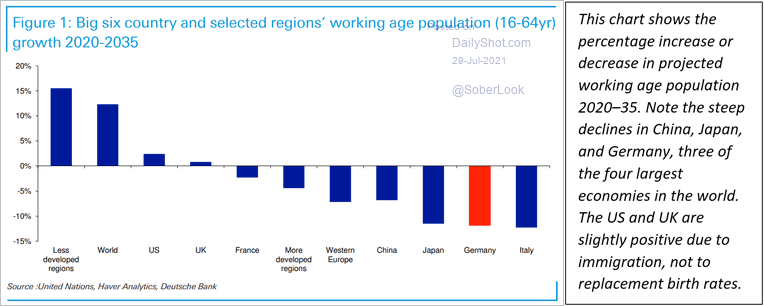

Birth rates are declining globally, and urbanisation, education, and women’s emancipation are the primary drivers. As the chart below shows, the difference between those economies that have slightly growing work forces and those that do not is not a difference in birth rates, but a difference in immigration policies. The process of declining birth rates in early industrial economies such as the UK, US, and Germany played out over 100 years. But the same process is playing out in 10 years or less in places like Nigeria, Kenya, and India because large cities are already in place and the numbers of migrants (who become, in effect, ‘instant urbanites’) is so much greater.

|

|

|

Source: Deutsche Bank |

Reliance on high birth rates in less developed economies will not alleviate the problem because those birth rates are declining rapidly from high levels as explained below.

Replacement rates in developed economies

The declining birth rate situation in developed economies — primarily the EU, US, UK, Japan, Australia, Canada, Scandinavia, and New Zealand — is now at an acute stage. The figures speak for themselves. Bearing in mind the 2.1 replacement rate, here are the latest birth rate figures for major developed economies as provided by the World Bank:

- US 1.7

- UK 1.6

- Germany 1.5

- France 1.9

- Spain 1.2

- Italy 1.3

- Netherlands 1.6

- Norway 1.5

- Sweden 1.7

- Japan 1.4

- Australia 1.7

- Austria 1.5

- Belgium 1.6

- Denmark 1.7

- Canada 1.5

- Ireland 1.7

The figures for important economic aggregations are no better:

- European Union 1.5

- Euro Area (€) 1.5

- Central Europe 1.6

- OECD Members 1.7

- North America 1.7

These figures are not merely low, they are a demographic disaster.

Once birth rates fall below replacement rates for a sustained period of time, it becomes impossible to regain the replacement rate for decades. With each age cohort smaller than the one before, and with the persistence of the demographic drivers described above, no amount of government policy or official cheerleading about ‘big families’ can bend the curve in less than 40 or 50 years.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

The grim realities of falling populations

Here are some of the grim realities that emerge from these birth rates.

In certain parts of Spain, there are two deaths for every birth. Madrid estimates that Spain’s population will decline by one million people by 2030 and will decline by 5.6 million by 2080. Spain’s population today is 46.7 million, so the 2080 projection represents a 12% population decline.

Japan’s population will decline 25% between now and 2055, taking the population from 127 million to 95 million. Bulgaria’s population has fallen from nine million in 1989 to seven million today and is expected to drop another 30% to 4.9 million by 2050.

These examples are not outliers. They’re entirely typical of many other countries from Switzerland (1.5) to Singapore (1.1).

Rapidly declining populations are a fact of life for the remainder of the 21st century. The economic consequences of this and recommendations for investors are discussed below.

The collapse of birth rates in developing economies

Reliance on developing economies to sustain high birth rates to make up for declining birth rates in developed economies is misplaced. The developing economy birth rates are collapsing also.

Here are the birth rates for some of the most populated countries among the developing economies:

- Nigeria 5.3

- Indonesia 2.3

- Brazil 1.5

- Pakistan 3.5

- Bangladesh 2.0

- Russia 1.5

- Mexico 2.1

- Ethiopia 4.1

- Philippines 2.5

- Egypt 3.3

- Vietnam 2.0

These 11 population giants have a combined population of 1.8 billion, equal to 22% of the global population and a total greater than either China or India alone.

The first thing that jumps out of these numbers is how many of these major developing populations are already at or below the 2.1 replacement rate including Brazil (1.5), Bangladesh (2.0), Russia (1.5), Mexico (2.1), and Vietnam (2.0). Depopulation in developing economies is not the trend of the future — it’s already here.

There are developing economies with materially higher birth rates including Nigeria (5.3), Pakistan (3.5), Ethiopia (4.1), and Egypt (3.3). Those focused on global population trends should not expect that these high birth rate countries will offset the impact of low birth rates in the developed world.

The reason is that these high birth rates are collapsing fast based on the drivers described last week — urbanisation, education, and women’s emancipation. Existing major urban complexes are expanding in Lagos, Nairobi, Mombasa, Cairo, Abidjan, Dhaka, and elsewhere in Sub-Sahara Africa and Southeast Asia.

New arrivals from the countryside succumb quickly to the influence of cities, where large families are a burden and peer support can change attitudes. In many cases, especially Brazil, women have one or perhaps two children and use the birth process to have additional procedures for sterilisation. This caps their reproduction at 1.0 or 2.0 each, for an average of 1.5, well below the 2.1 replacement rate.

Ties to tribes, clans, and families are left behind to some extent as the urban small-family ethic takes hold. The average marriage age rises, and many women remain single or childless in order to pursue professional and educational opportunities. The tempo of this transition is measured in years or decades, not centuries.

In short, the distinction between developed and developing economy birth rates is not stable. The developing economy birth rates are dropping rapidly and are converging with the 1.9 or lower rates found in the developed world. The entire world is moving quickly to sub-replacement birth rates.

Perhaps the most important stats come out of China and India. Tune in to the next edition of The Daily Reckoning Australia to learn more about how their dropping birth rates could result in a crisis…

Regards,

|

Jim Rickards,

Strategist, The Daily Reckoning Australia

PS: This content was originally published by Jim Rickards’ Strategic Intelligence Australia, a financial advisory newsletter designed to help you protect your wealth and potentially profit from unseen world events.