Investors reacted positively today to news that Core’s largest shareholder will double its lithium output.

Core Lithium Ltd’s [ASX:CXO] share price were up 11.5% at noon, exchanging hands for 29 cents per share.

Today’s announcement sustains CXO’s recent climb, with the stock up 11% over the last seven days following a positive lithium exploration update last Friday.

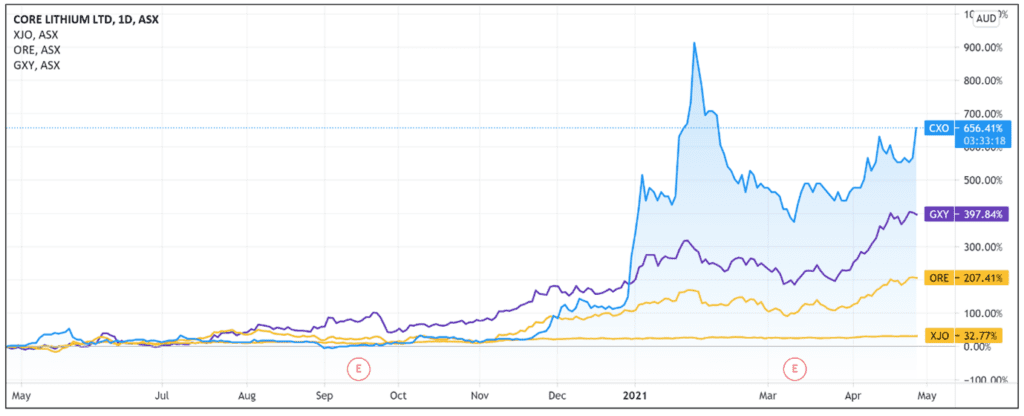

Year-to-date, the CXO share price is up 95% while also gaining 600% over the last 12 months.

Core’s largest shareholder to double lithium output

The lithium developer today announced its largest shareholder, who is also a key Tesla supplier, plans to double its lithium hydroxide production capacity.

The shareholder — China’s Sichuan Yahua Industrial Group (Yahua) — divulged its Yaan plant will increase its output from 20,000 tonnes per annum to 50,000 tonnes per annum of battery grade lithium hydroxide.

In December 2020, Tesla agreed to purchase US$630 million to US$880 million worth of battery grade lithium hydroxide from Yahua over a five-year period.

How does this benefit Core?

CXO thinks that it can meet a ‘significant portion of Yahua’s lithium concentrate supply requirements for Yaan.’

Core noted that it signed a binding offtake agreement to supply Yahua with 75,000 tonnes per annum of lithium spodumene concentrate.

The offtake agreement represents 40% of the 175,000 tonnes per annum production at Core’s Finniss lithium project.

CXO labelled its 100%-owned Finniss project as ‘one of the most capital-efficient lithium projects in Australia and has arguably the best logistics chain to markets of any Australian lithium project.’

CXO outlook: the offtake agreement arms race

With lithium prices surging again on the back of a concerted shift to electric vehicles, lithium producers are positioning themselves to take advantage by aiming to ramp-up production and secure forward sales.

A key target consumer for lithium materials is China.

China dominated BloombergNEF’s lithium-ion battery supply chain ranking in 2020.

BloombergNEF attributed the dominance to China’s large domestic battery demand of 72GWh, control of 80% of the world’s raw material refining, 77% of the world’s cell capacity and 60% of the world’s component manufacturing.

So CXO’s connection to Yahua could prove a strategic success.

However, the white metal is an ample commodity, and other ASX lithium players are seeking out offtake opportunities in China.

As I’ve covered earlier this year, Pilbara Minerals Ltd [ASX:PLS] announced on 15 March that China’s Yibin Tianyi will provide a US$15 million unsecured prepayment to Pilbara’s operating subsidiary Pilgangoora Operations, increasing their existing offtake agreement.

According to Pilbara, the offtake agreement will total up to 115,000 tonnes per annum of spodumene concentrate.

This follows AVZ Minerals Ltd [ASX:AVZ] signing a binding offtake agreement with Yibin Tianyi on 30 March.

Yibin Tianyi agreed to purchase up to 200,000 metric tonnes per annum of spodumene concentrate for an initial three-year term following AVZ commencing production.

It could be that the rising demand for lithium creates a pie large enough to nourish all lithium stocks.

However, it is likely that players who can ramp-up production and secure long-term offtake agreements during the current supply squeeze will stand to benefit the most.

Investors sent CXO shares higher on today’s news, but their attention will now turn to Core’s ability to meet its production capacity targets.

Lithium stocks are on a lot of investors’ minds. But with so many news items coming out almost daily, it’s hard to keep up and know where to look for lithium investment ideas.

I think this free report on ASX lithium stocks is a great place for anyone who wants further information and ideas.

Additionally, governments and private interests alike are converging on electric vehicles and renewable energy.

But if you’re wondering exactly what this trend means for savvy private investors, then I also recommend reading our free report on the renewables revolution.

There, our energy expert Selva Freigedo reveals three ways you can capitalise on the $95 trillion renewable energy boom.

Regards,

Lachlann Tierney,

For Money Morning