The AnteoTech Ltd [ASX:ADO] share price is down 7% today. Can ADO’s recent cash flow report explain the fall?

ADO shares fell as much as 9.2% in early trade and currently exchange hands for 40.5 cents a share.

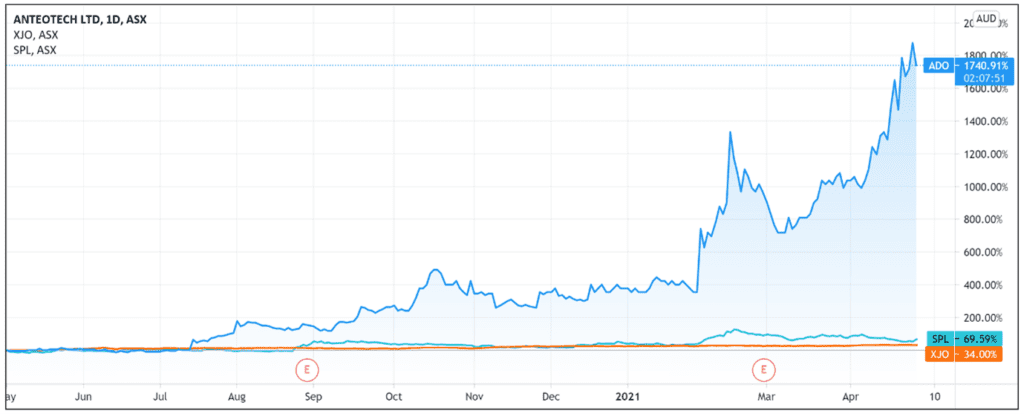

While down today, the ADO share price is still up 285% year-to-date and up 1,740% over the last 12 months.

ADO’s cash flow status

ADO released its quarterly cash flow and activities reports last Friday.

Could its share price slump reflect the market’s delayed reaction to the reports as it mulled over the numbers over the weekend?

Let’s look at AnteoTech’s cash flow position for the quarter ended 31 March 2021.

ADO recorded $112,000 from customer receipts for the March quarter and $675,000 year-to-date (nine months).

These inflows were offset by operating expenses including $728,000 spent on research and development, and $668,000 on staff costs.

In total, AnteoTech recorded a net loss from operating activities of $1.37 million.

Having started the quarter with $6.43 million in cash, ADO ended the March quarter with $5.13 million.

With this cash balance and cash outgoings of $1.37 million, AnteoTech only had 3.7 estimated quarters of funding available at quarter’s end.

Some investors may have been unimpressed with this quarterly cash flow report and decided to exit their positions.

However, investors would have been aware that AnteoTech’s cash burn prompted the company to secure fresh funding last week.

AnteoTech secures $12 million

As we’ve covered here, last week ADO received firm commitments to raise $12 million before costs by issuing more than 46 million new fully paid ordinary shares at 26 cents per share.

The company plans to launch a share purchase plan to raise a further $4 million from ‘eligible, existing shareholders’ at 26 cents per share.

The offer price represents a 20.3% discount to ADO’s 10-day volume-weighted average price.

Importantly, the funds will be used to scale up the rollout of AnteoTech’s EuGeni reader and in vitro rapid diagnostic test for the detection of SARS-CoV-2 nucleocapsid antigen.

It looks like ADO’s immediate focus is on its COVID-19 testing products.

And this could potentially offer another reason for today’s share price slump.

Investors who purchased ADO stock for its ongoing research into improving the energy storage capacity of lithium ion battery anodes may have been disappointed by ADO’s focus on its life science products.

Especially when the lithium sector is heating up.

Given ADO’s March quarter cash position, the $12 million capital raise was needed.

But some investors may think that earmarking the funds primarily for its life science products will sideline ADO’s lithium-ion battery segment.

That said, AnteoTech might think prioritising its COVID testing products is the best direction for the medium-term.

For instance, the March quarter saw ADO pocket a $1.4 million Queensland government grant to develop and commercialise its COVID-19 ART.

Maybe the company sees its life science segment as the segment with the quickest path to commercialisation.

If smaller-cap stocks like AnteoTech interest you but you’re unsure how to find ones with great potential, then I think you will enjoy reading this free report on four high-value small-caps.

Small-cap investment is all about information advantage, so I highly recommend reading through the report.

Regards,

Lachlann Tierney

For Money Morning

Comments