Most of you know my colleague Murray Dawes as an experienced stock trader. He started out in the pits of the Sydney Futures Exchange before he did a stint managing the funds of an influential family.

At Fat Tail Investment Research, he’s well regarded for his trading tips and in reading the markets. He has a good handle on investor sentiment by looking at the charts. It’s almost second nature to him.

For some time, he’s been quite hesitant about taking positions in the market. It’s like a seasoned sailor who is refusing to put the ship out to sea.

Our colleagues have joked about it. But we know that it’s not because he lacks the guts to act. It’s because market conditions have been unusual in these few years.

But recently, you may’ve noticed that his tone has changed. He’s sounding more positive, especially on small-cap companies. Many of these have been hit hard in the last 18 months to three years.

He’s reached out to me recently to ask me about what I’m seeing on the gold stocks front, as he’s sniffing out bargains.

I take that as a very bullish signal.

Emerging from the most challenging conditions for decades

You may recall my disappointment with gold producers when they released their 2023 June quarter performance.

Let me be clear with one thing. I don’t blame them for their results. Some companies had to deal with the challenges of the prevailing economic and operating conditions that have held them down.

We’re at a time when the government stimulus paid out during the global virus outbreak is now behind us. The trillions of dollars that once went into stocks, properties, commodities and cryptos are now coming out of these markets. Aided by central banks worldwide aggressively raising rates in early 2022, speculators have headed for the exit.

The Russia-Ukraine conflict that flared up in late-February 2022 pushed commodity prices and the price of crude oil higher. This helped to boost the case for The Green Agenda which fuelled resources speculators to chase after critical minerals such as lithium, copper, nickel, rare earth elements (REE) and graphite. Even these companies are now seeing sentiment cool, especially as the world is waking up to how unrealistic and potentially damaging this agenda is to society.

Add to that the price of crude oil surging to as high as US$120 a barrel by mid-2022. This created a catch-22 situation for mining companies. Recall that diesel is a major input for their operations, which meant higher operating costs that cut into their margins. In turn, share prices fall as companies downgrade their performance forecasts.

The gold mining industry may’ve been one of the hardest hit among the resources sector. Gold itself held its ground well, even rising almost 20% since the start of 2021. But gold stocks had a rollercoaster ride thanks to weaker profit margins and difficult operating conditions.

Companies reported their full-year results last month. I’ve recently managed to collate and review their performance.

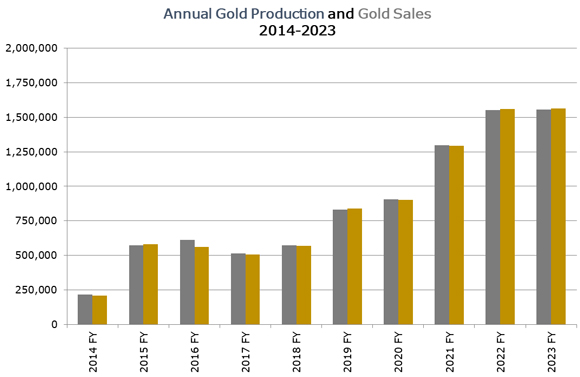

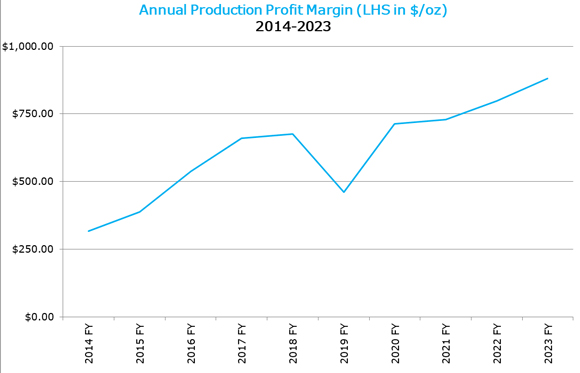

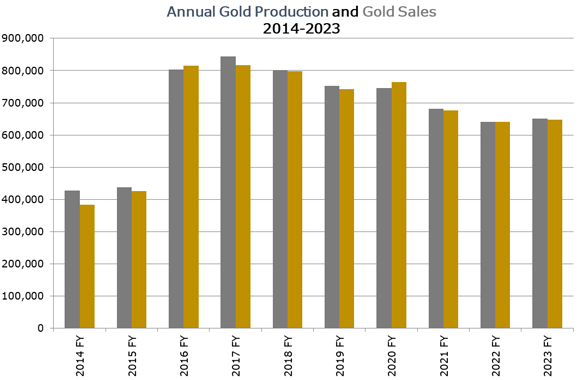

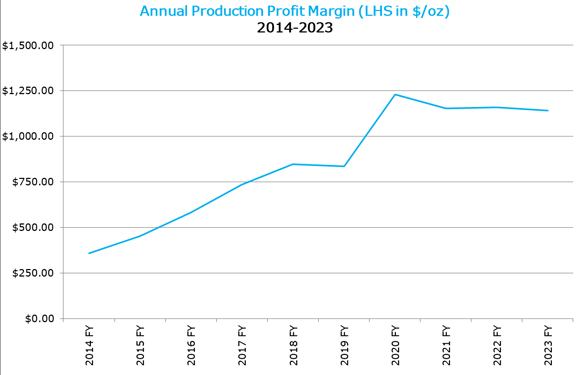

Let’s have a look at the production and profit margins over the past 10 years of a few leading gold producers. I’ll use a few producers to illustrate my point:

Northern Star Resources [ASX:NST]

|

|

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Evolution Mining [ASX:EVN]

|

|

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Regis Resources [ASX:RRL]

|

|

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Ramelius Resources [ASX:RMS]

|

|

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Silver Lake Resources [ASX:SLR]

|

|

|

|

| Source: Thomson Reuters Refinitiv Datastream |

As you can see, 2023 was a mixed year with producers seeing a decline in profit margin even as a few producers managed to increase their production from the previous years.

Northern Star Resources was the exception as the company managed to integrate the operations of its recent acquisitions. Meanwhile, Regis Resources and Silver Lake Resources increased their production but profit margins decreased like the rest of the industry.

Going forward, many producers have issued more conservative production and cost guidances as management expect challenging conditions to prevail. This caused investors to sell down their shares as they’d expected better.

Growth through acquisitions, small-cap resources stocks on the radar

With the larger producers selling down, investor interest in the smaller companies suffered.

I’m noticing the most faithful holders are at the point of giving in as their patience has run out.

I felt the sentiment in the recent Australian Gold Conference last month, on stock discussion forums and seeing the low to no trading daily volume for these companies.

It’s interesting to notice some companies are seeing their share prices swing wildly. We’re talking about double digit percentage moves on a particular day, often from a couple of thousand dollars’ worth of shares changing hands.

This is a sign of capitulation selling.

But there’s a bright spark in the horizon. A handful of gold explorers (and other resources too) have rallied and held their ground, trading more than 50% above their recent lows.

Some speculators are carefully selecting companies that have released exceptional news. And that’s given these companies the momentum to rally.

Will other companies follow this trend, and will it hold? Or is this another dead cat bounce?

It’s hard to be sure.

The case for a dead cat bounce is that hostile economic conditions have tapped out many investors. Make no mistake, we’re going to experience a bit more hardship as central banks aren’t about to walk back on their rate rises just yet. So funds are in limited supply and most investors are cautious so they’re likely to avoid punting on explorers.

On the other hand, explorers are now trading at a steep bargain. Many of the larger companies are running the ruler over the smaller peers as they seek to expand their diminishing resource base. After all, what could be better than paying for good quality deposits for pennies on the dollar?

If company boards are thinking this way, wouldn’t this present a good opportunity?

So it’s now your decision as to whether you’d like to take this opportunity to try your luck with some of these explorers.

Let me tell you upfront that there’s significant risks with these stocks. But if they make a discovery or progress with their developments, the rewards could be handsome.

You can dip your toe in with a small speculative portfolio available to my Premium members over at The Australian Gold Report. Check it out here.

God bless,

|

Brian Chu,

Editor, Fat Tail Commodities

![Regis Resources [ASX:RRL] gold production](https://daily.fattail.com.au/wp-content/uploads/2023/09/COM20230925_5_580.jpg)

![Regis Resources [ASX:RRL] profit margins](https://daily.fattail.com.au/wp-content/uploads/2023/09/COM20230925_6_580.jpg)

![Ramelius Resources [ASX:RMS] gold production](https://daily.fattail.com.au/wp-content/uploads/2023/09/COM20230925_7_580.jpg)

![Ramelius Resources [ASX:RMS] profit margin](https://daily.fattail.com.au/wp-content/uploads/2023/09/COM20230925_8_580.jpg)

![Silver Lake Resources [ASX:SLR] gold production](https://daily.fattail.com.au/wp-content/uploads/2023/09/COM20230925_9_580.jpg)

![Silver Lake Resources [ASX:SLR] profit margin](https://daily.fattail.com.au/wp-content/uploads/2023/09/COM20230925_10_580.jpg)

Comments