Shares in junior gold explorer Metalicity Ltd [ASX:MCT] have been pushed lower on the back of new drilling results showing near-surface, high-grade gold.

We first got a taste of what was on offer at MCT’s Kookynie Project last week.

The last round of results saw the MCT share price leap around 79% in one day.

However, new results have sent the share price in reverse.

Shares are trading 16.67% lower at time of writing to trade at three cents per share.

Interestingly, shares had been retreating since Tuesday, which may have been caused by a dip in the gold price.

Are Aussie investors spoiled for choice?

Before we get into the details of MCT’s latest results, I want to point out a phenomenon that I’ve noticed recently with small-cap explorers.

That is: Good news is not enough to drive up shares anymore.

Once expectations have been set about a particular resource, anything less just won’t do.

We saw this with Musgrave Minerals Ltd [ASX:MGV] last week (I encourage you to have a read of that piece).

Could it be that there is so much new gold being discovered at the moment that investors are turning their noses up at anything less than bonanza grades?

This could be the case for MCT.

Last week the explorer announced results that included:

- 3m at 20.7 grams of gold per tonne (g/t)

- 2m at 17.9g/t

- 4m at 16.3g/t.

With all but one drill hole returning a decent intercept.

That is seriously high-grade stuff and located near the surface.

Bear in mind that for open pit mines anything over 1.5g/t is considered high-grade gold ore.

Highlights from step out drilling this week include:

- 10m at 3.21 g/t

- 3m at 4.59 g/t

- 8m at 2.92 g/t

- 6m at 2.87 g/t

Again, these were all located near-surface.

Put it all together

The obvious difference in these results is the grade of gold ore — though both are still very high-grade.

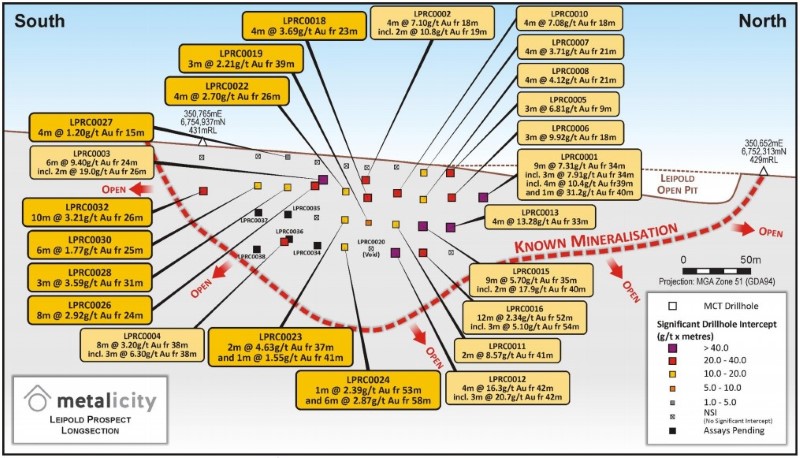

Source: Metalicity

The share price could have taken a dive because investors were expecting more of the same results.

Which may sound like a bit of a pipe dream.

Thus is the nature of speculative gold stocks.

But for those of you interested, or invested in MCT, let’s look at the bigger picture.

The diagram above is a cross-section of the drill from the Leipold Prospect at Kookynie.

Notice how the grades tapper off as the drilling steps out from the existing open pit.

Perhaps investors are worried the resource may be smaller than initially hoped.

But there is also potential to be further high-grade ore under the open pit.

MCT said it plans to commence Phase Two of its drilling program immediately to grow the footprint of the project.

While the share price action of MCT may be confusing or even upsetting, it highlights the difficulties of picking gold stocks.

But if you’re interested in getting invested in gold, then make sure you check out what is probably the easiest way to start investing in gold in Australia. In fact, it’s as easy as buying a book on Amazon! Check out our free guide here.

Kind Regards,

Lachlann Tierney,

For The Daily Reckoning Australia