In today’s Fat Tail Daily, Brian Chu’s 2024 prediction. Two key reasons for being excited about gold stocks in 2024

For a few days only, you can jump into my elite gold stock trading advisory, Gold Stock Pro, for half price.

(You can do it by clicking here. But this deal will end at midnight on 1 January.)

On the one hand, I already think my specialist gold exploration stock service is great value. And that shaving a further 50% off is crazy.

On the other, I’m absolutely convinced an epic gold bull run is forming in 2024.

And if we can get a few more like-minded individuals inside my tent…and familiarised with my attack plan…then that can only be a good thing.

If you’ve been put off by the subscription fee of Gold Stock Pro until now…well, here you go. Half price. But for a few days only.

You will be joining at a critical juncture in the gold markets.

Gold enthusiasts like myself have gone through one of the toughest periods in several decades. Don’t just take it from me. Many veterans in this space agree that 2021–23 has been a testing and frustrating period.

We’ve seen cryptos take the prize as the best performing asset in 2021, and the same for lithium and energy stocks in 2022.

I believe uranium and technology stocks could likely be this year’s winners.

When’s gold going to shine? And will gold stocks have a run for next year’s biggest winners?

Gold has delivered solid gains these last three years. Even with a brief bear market last year, it has still finished this year strong.

The last two months have seen gold rally further. Momentum’s gaining.

I can foresee gold rallying into 2024.

Today, I’m going to explore why I hold this positive outlook.

I’ll start by discussing what’s happened in the last three years. Then I’ll show you how the economy and the monetary policies of central banks could benefit gold and gold stocks. To wrap up, I’ll let you know how you can potentially benefit on this.

Unpacking gold’s most peculiar three years

Most of you know gold’s role as money and a safe haven.

People buy gold to store wealth and preserve their purchasing power.

You don’t become rich buying gold. Rather, gold helps people remain rich.

To build your wealth, investors seek to multiply gold’s gains by buying shares in gold mining companies.

As an aside, gold stocks and gold don’t move in the same direction. Many who venture in this space make the mistake of thinking that they do.

So let’s see how they performed in these three years. After reading this, you’ll understand why I emphasise that they’re driven by different factors.

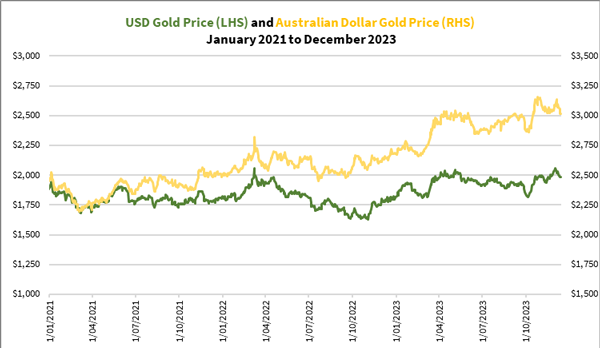

First up, here’s how gold performed in US dollar and Aussie dollar terms since the start of 2021:

| |

| Source: Refinitiv Eikon |

Since last October, you can see gold in US dollar terms in a gently rising trend.

Meanwhile, gold in Aussie dollar terms looks much better. It traded at around AU$2,450 at the start of 2021. It’s now trading at around AU$3,030.

Gold in our dollar terms is officially in a bull market.

What caused the change?

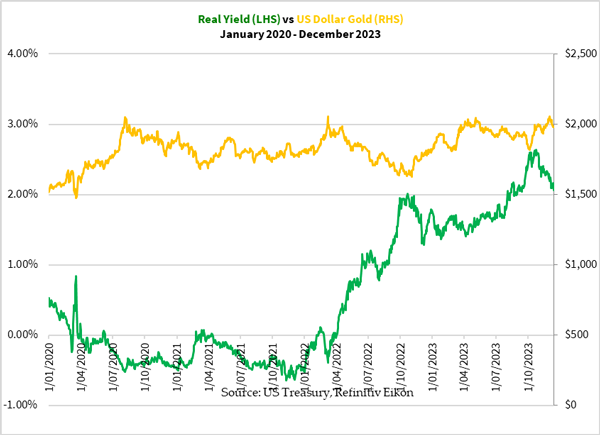

Let’s have a look at the following figure showing the price of gold and the long-term US real yield (long-term interest rate less inflation expectations):

|

| source: US Treasury, Refinitiv Eikon |

Gold and the real yield move in opposite directions. This is because the market weighs up the relative appeal of gold and the US dollar.

The US dollar pays interest. If it beats inflation, the dollar’s purchasing power improves, and vice versa.

Gold, on the other hand, doesn’t pay interest. It benefits from long-term inflation or the weakening dollar.

With the US Federal Reserve slowing down on the pace of raising interest rates during 2023, it’s benefited gold.

Based on gold’s positive performance, you’d expect gold stocks to deliver solid gains over the period, right?

Let’s use the ASX Gold Index [ASX:XGD] as a proxy. It captures the performance of the more established gold stocks in the Australian Stock Exchange.

Here’s how the index performed:

| |

| source: Refinitv Eikon |

The price movement looks like a more volatile version of the price of gold in US dollar terms.

In a way, that’s reasonable. Gold stock returns can multiply gold’s movements.

The ASX Gold Index lost almost 45% as gold sold down from April to October 2022. The recovery was almost as fast as the dip. However, we’ve seen in the last seven months the index traded sideways as it struggles to break past 7,000 points and hold it.

In the past year, the larger producers such as Northern Star Resources [ASX:NST], Evolution Mining [ASX:EVN], Gold Road Resources [ASX:GOR] and Perseus Mining [ASX:PRU] have largely made back the losses sustained in the 2022 bear market. Meanwhile, smaller producers, developers and explorers are now trading at much lower prices.

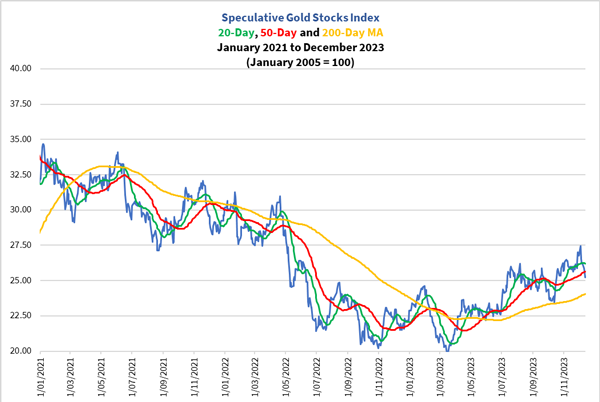

Now let’s have a look at how explorers and early-stage developers performed. I’ll use my in-house Speculative Gold Stocks Index as a proxy. It tracks the performance of over 70 such companies:

| |

| Source: Internal Research |

Those who bought these stocks have suffered significant losses. Even though the index bottomed in March this year, many companies have only recently found their lows.

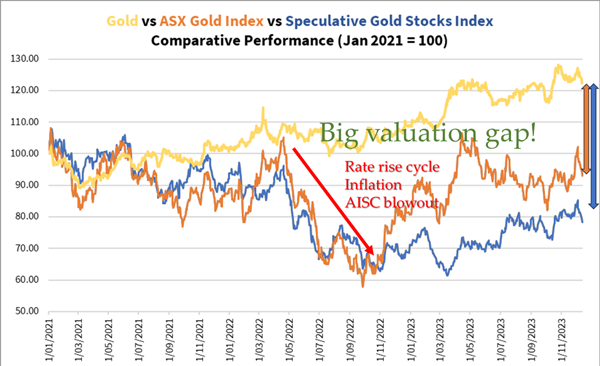

Let me put this together with a figure showing the relative performance between gold, the more established gold stocks and the early-stage explorers and developers:

| |

| Source: Internal Research |

Can you see how gold stocks have decoupled from gold over this period?

Moreover, notice the big valuation gaps that exist.

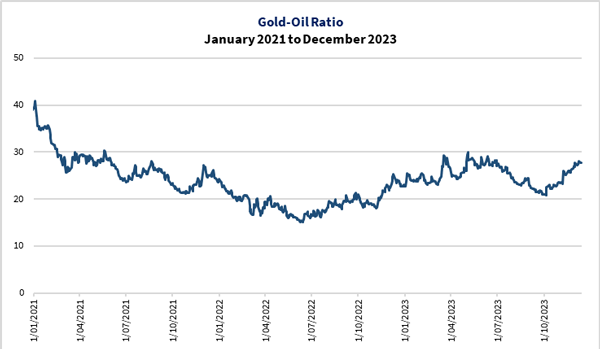

Besides the price of gold falling, the key factor holding down gold stocks is the price of crude oil. Let me show you the relative price of gold and oil using the gold-oil ratio:

| |

| Source: Internal Research |

Notice how the dips in the gold stock indices roughly correspond to the gold-oil ratio?

Moreover, the gold-oil ratio has rallied since this October.

The valuation gap and the gold-oil ratio are my two key reasons for being excited about gold stocks going into 2024.

Why do I think these trends could hold?

Let’s explore that now.

How the stars are aligning to favour gold in 2024

I believe many gold enthusiasts have jumped the gun buying gold stocks over these three years on the rising price of gold. They started off buying gold producers and rode the selloff and recovery. As gold producers recovered, they may’ve shifted some of their funds into the explorers as they took a beating.

Right now, I am guessing many gold stock portfolios are still down from their 2021 levels.

But that can change quickly if things turn around.

As I mentioned earlier, central banks around the world have largely finished raising interest rates. Headline inflation rates have come down from last year’s highs.

It’s not that they’ve killed inflation. Most of us are living through difficult times as we’re paying more to get less. Don’t let them fool you with their manipulated statistics and glossy narratives.

The truth is darker than the fantasy they’re spinning.

Much of the stimulus cash they’ve created since 2020 have gone into financial markets rather than real productivity. The rising interest rates seeking to suck up the liquidity have caused a vacuum in the financial markets and the real economy.

I suspect that governments and the central banks are just as aware that we’ve been living in a recession all this time as we’re experiencing it in our daily lives.

The expected rate cuts by these central banks in 2024 are them attempting to get ahead of the tanking global economy and markets.

If history can help us understand where we’re heading, gold could rise before the rate cuts. Moreover, the weakening economy could see the price of oil fall further.

At the same time, we could see institutions renew their interest in buying gold. We’ve seen gold in US dollars break above US$2,100 earlier this month. If it breaks past this level and holds it, that could bring institutional money into gold, pushing the price up further.

How high could gold move? I would see US$2,500 as a possibility.

In turn, I believe that investors and speculators alike will clamour back into gold stocks on the back of a gold rally.

Earlier this year I saw that there was a strong resistance for the ASX Gold Index at 7,000 points. We’ve seen it break past 7,000 points since this month’s Federal Reserve meeting. If the index can hold this level and gold continues to rally, that could take it past 10,000 points.

But remember, it’s not just about the rising price of gold. Look at oil too!

My opinion on the price of oil in 2024 is that there are two opposite forces in play that could pull oil in both extremes.

An escalation in global conflict, especially in the Middle East, could see an oil supply shock and send oil back above US$120 a barrel. On the other end, a global recession/depression could take oil back below US$40 a barrel, especially if China’s property market continues to implode.

The question that remains is whether the rising price of gold will bring in frenzied buying of gold stocks that outweighs the weakening fundamentals if the gold-oil ratio falls.

It’s possible that emotions will overcome numbers. That happened in 2009–11 as gold set a new record at US$1,921.

We’ve seen it happen in the other extreme over the last three years.

For me, the balance of probabilities favour gold’s rally and the outperformance of gold stocks as it catches up to gold’s performance since 2021.

If you agree with me, then join me.

My speculative gold stock advisory Gold Stock Pro is currently going for half price.

But this 50% off deal expires at midnight, 1 January 2024.

To take it, go to this secure order form while it’s still active and plug in the code COUNTDOWN.

If you want even more detail to what I’ve discussed today, I featured in What’s Not Priced In two weeks ago. In this episode, I talked with host Kiryll Prakapenka about several recent transactions and highlighted a few companies that I like going into 2024.

You can check it out here if you’re interested.

To wrap up, I believe gold stocks could redeem themselves next year of their poor performance these last three years.

The stars are aligned in many aspects. While there’s no guarantees and certain events could shake everything up, I like the odds.

If you agree with my views and projections, why not consider signing up to my precious metals trading service?

I think this could be the year where we see some serious fireworks from the more speculative plays. Investing in gold stocks can be a roller coaster ride, with the potential to fall just as fast as they can rise, but if you’re in a mood for taking bigger risks, join me at Gold Stock Pro for 50% off until midnight 1 January. Here, I’m guiding my readers to consider some early-stage mining companies. There’re several companies with exciting developments lined up in 2024.

And now, I’d like to take this opportunity to thank you and I wish you best of health and good fortunes in 2024!

Regards,

|

Brian Chu,

Editor, Australian Gold Report and Gold Stock Pro

![ASX Gold Index [ASX:XGD]](https://fattail.com.au/wp-content/uploads/2023/12/EDITORIALFTS20231226_imgo3-1.png)

Comments