We’re fast approaching the end of 2023.

If anything, this year’s events — inside our country and around the world, have shown us that reality is wilder than fantasy.

Look at some of the major events that defined this year.

The ongoing Russia-Ukraine conflict.

The Israel-Palestine conflict raging in the Middle East, threatening to spread to neighbouring regions.

The political and legal circus in the US involving the two leading candidates, Joe Biden and Donald Trump, as next year’s presidential election looms.

The rising tide of nationalism sweeping through the world, led by New Zealand, Argentina and The Netherlands.

Even in Australia we’ve just seen during the weekend the Queensland Premier, Anastasia Palaszczuk, announce her resignation. She is the last of the surviving premiers who governed during the Wuhan virus outbreak.

And our country has started to wake up to the reality of the corruption of our political class and the media’s dishonest narratives to cover for them.

These events are remarkable.

More striking is the way news sources portray these events. Depending on what you read, your perspectives will differ on what’s happening, resulting in more discord in our society.

I’m sure most of us are hoping that 2024 sees some semblance of sanity return.

Of course, few would bet their house that it’ll play out this way.

How did we get here?

Where are we heading?

How can you prepare?

Let’s explore this today…

Identifying the source of chaos

Regular readers will know where I stand on economics, geopolitics and the financial markets.

In the past, I’ve pointed out how the fiat currency system is the source of the world’s malaise. Fake money creates a dishonest society.

It’s now so pervasive it threatens the veneers of a civil society.

We live in a world that can manipulate the value of the efforts of your labour and productivity. Central banks set the interest rate that impacts asset prices and in turn, economic activity.

Since the subprime crisis in 2008–09 till mid-2022, we’ve seen an extended period of near-zero interest rates. This policy initially intended to boost economic activity and avert a total market collapse.

Instead, we’ve seen rampant speculation.

The world gradually diverted more capital into financial assets than physical productivity. Asset prices keep setting new records. Capital moved to financial institutions, widening the wealth gap everywhere.

Meanwhile, businesses in Main Street and ordinary households struggle to make ends meet. They couldn’t benefit much from the avalanche of cheap capital. Instead, they forked out more as inflation hit hard.

At the same time, large corporations and non-government organisations ramp up their influence in politics and public discourse. To this end, we’ve seen censorship, suppressing truth and outright abuse of political power in many democratic nations.

They used to exercise their powers discreetly so the decay is unnoticeable. But it’s now more obvious as the economy crumbles.

Reclaiming control of your life as the global information war turns

Our society has evolved over time to make it hard for people to take a dissenting view.

While many of you are aware of the blatant lies, you might still prefer to hold your tongue around your family, friends and colleagues.

For a long time, most prefer the comfort of going along. They realise that the-powers-that-be won’t let up on controlling society.

Speaking the inconvenient truth might put you at risk of isolation, even direct threat to your livelihood.

Add to that the increasing reliance on debt to own your home and enjoy life’s luxuries. That debt acts as a ball and chain to keep people’s head low.

Faced with speaking up and potentially losing your job, what would most people do?

Talk about a dilemma!

All of this is by design.

But things have been shifting, and I think it will gain momentum next year.

We’ve seen things play out in the global information war via social media. Once Elon Musk purchased Twitter (now X) last October, we’ve realised how it operated as a sophisticated censorship machine.

Not only that, these platforms colluded together to try to keep the illusion going.

Many large corporations including Disney, IBM, Apple, etc. have engaged in double standards. They’ve recently lined up to boycott X, preferring sites friendly to their ideology, such as Facebook. This is despite government agencies revealing and condemning them for criminal activity, including aiding in child sex exploitation.

The revelation of this vast corruption has spurred people around the world to stand up. Many realise they’re almost at breaking point and have little to lose.

Think of the farmers in France, Canada and The Netherlands who are taking on the government. French farmers have recently sprayed government buildings with manure to show their anger at the Macron government’s climate policy.

I’d like to think these farmers are proposing their version of The Green Agenda!

Preparing for what’s to come with gold

Now I’m not advocating that we resort to taking drastic actions here.

Rather, I’m highlighting the need for a strong foundation at home. This means keeping your finances under control to weather next year’s rising turbulence.

Interest rates may have peaked, but costs are likely to keep rising. Many major corporations are set to cut jobs to save on costs.

Don’t let that squeeze you out!

If you do, forget about standing up for what’s right! You might instead find yourself dancing to the tune of your paymasters.

What’s my take on how you could prepare?

I’ve recently written (here and here) about my experiences in Hong Kong.

My view is that gold can help the locals in Hong Kong alleviate the daily challenges they face.

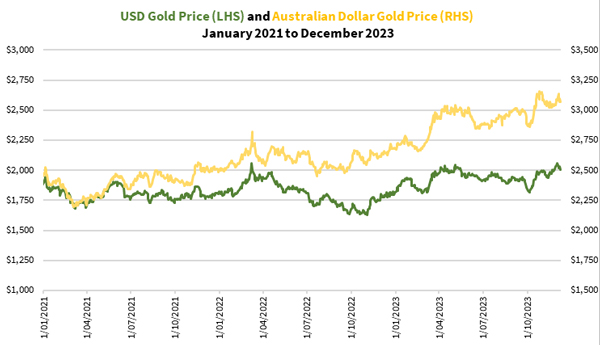

As I’ve been talking about this in the past month, notice how gold has gained momentum. Have a look below:

|

|

| Source: Refinitiv Eikon |

Moreover, gold in US dollars traded as high as US$2,130 an ounce for the first time last Monday. It’s set a new record.

The price has since pulled back 6% to just above US$2,000 now.

That’s ok. I believe there’s renewed interest now that gold has made a new record.

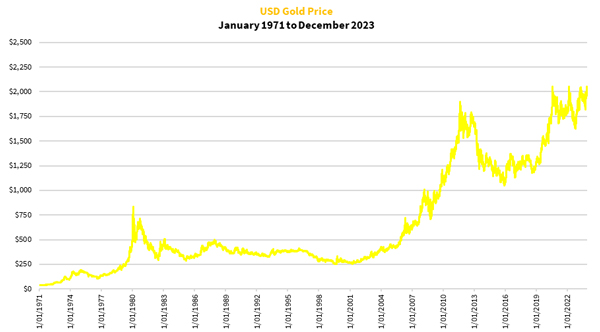

Now I mentioned earlier that interest rates have likely peaked. The market has positioned itself for rate cuts to begin sometime in 2024.

Have a look to see what happened with gold the last three occasions the interest rates fell (2008–09, 2019 and 2020):

|

|

| Source: Refinitiv Eikon |

This should spur you to consider buying gold and getting in before the rush.

There’s another way to help strengthen your portfolio with gold.

Gold had a great run in the last three years as you saw in the figures above. Meanwhile, gold mining companies haven’t performed as well as gold.

This lull has caused many investors to ignore them.

To me, that’s a great reason to pay attention.

Interested? Then click here to learn more about my ‘Ultimate Gold Game Plan’.

God bless,

|

Brian Chu,

Editor, Australian Gold Report and Gold Stock Pro

Comments