With the sharp sell-off in global markets, I’m going to run through several points for you to keep in mind.

Obviously, we’re in a volatile and fluid environment.

Stock markets can move in big swings…up and down!

Speaking of which, volatility has exploded in the last few days.

Context is important here.

The S&P500 went over a year (until late July) without a daily 2% drawdown.

That was the longest stretch since 2007.

Point being: the complete absence of big ‘down days’ was the exception.

The last few days are a return to a more ‘normal’ trading environment, if unexpectedly sharp.

I’ve seen several reasons floated for the vicious self-off.

One involves the Japanese ‘carry’ trade, another the ‘Sahm Rule’ indicating a potential US recession and another is a deflating of the so-called AI ‘bubble’.

Such themes, ideas and rationalisations always swirl around markets after a big move, either way.

The reality is that short, sharp sell downs are a regular feature of share markets if you’re involved for long enough.

The Aussie market is only about 6% off its all time high – hardly the stuff of the Great Depression.

That said, this type of price action always begs the same question…

Is there a big crash brewing?

History would argue no.

Asset markets, at least historically, collapse with rising interest rates and/or a reduction in government spending happening.

Neither factor is in play currently.

US interest rates are dropping as bonds rally, and the US government is running a gigantic deficit at 6% of GDP.

The Australian Treasurer has also flagged substantial deficits over the next four years.

It’s also worth noting that none of the reasons for the sell-off floated above involved banks or a credit-related event.

Historically, this would be a major warning sign.

On the contrary, US banks look in rude health.

Another constant global danger to the world economy is a skyrocketing oil price.

We have the opposite in play currently.

Right now oil looks on the edge of a rout. Even the escalating tension in the Middle East isn’t causing it to rally.

A lower oil price would help consumers everywhere.

Overall, this big swing down looks like positioning in financial markets are changing…but won’t smash the ‘real’ economy.

Now let’s look at a few factors specific

to Australia and the ASX…

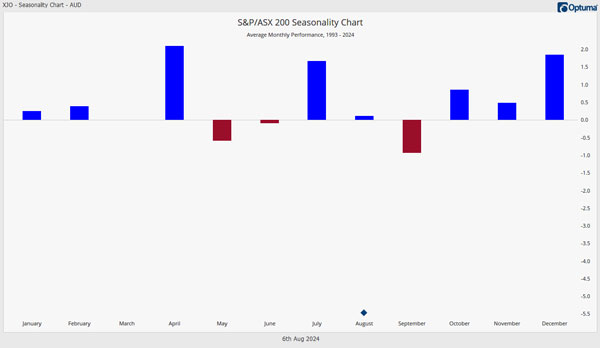

One way to do that is the ‘seasonality’ of the Aussie share market.

You can see that August and September in Australia each year are often weak…

| |

| Source: Optuma |

I’m talking about the index here.

This has little bearing on individual stocks, outside of sentiment perhaps.

If anything, this bolsters the case to be actively trading the market…because the general market is unlikely to do much.

Here are some smaller points I find compelling.

Recall that the core of the Australian economy is property and the debt held against it.

Non-bank lender Resimac [ASX:RMC] recently released their trading update and noted defaults remained very low.

RMC also targets homebuyers with higher credit risk than the Big Four banks.

Again, it suggests Australian borrowers are weathering the pressure currently, as best can be.

I also saw this comment relating to property purchases recently, in the AFR…

‘Sydney-based auctioneer Clarence White said while there was no shortage of home buyers in the market, they remained reluctant to commit.

‘“We’re seeing fewer homes selling above the reserve at the moment,” he said.

‘I think everyone is very cautious. Buyers are certainly very price-sensitive, and you have a large segment of buyers in the market that are waiting and hoping for interest rate cuts.

‘The high borrowing and holding costs has got everyone scared in the current climate. Buyers have very low confidence, they’re tentative, and a bit terrified.’

This might look ‘bearish’ on first look. However, the psychology of people before the great asset collapses in history is never like this.

They’re usually projecting wild gains into the future and greedily overleveraged into speculative positions.

There’s also some grand narrative about why ‘now it’s different this time’ to justify sky-high valuations and the gambling fever gripping society, alongside tales of easy riches and fast money.

Nothing about the current economy suggests this.

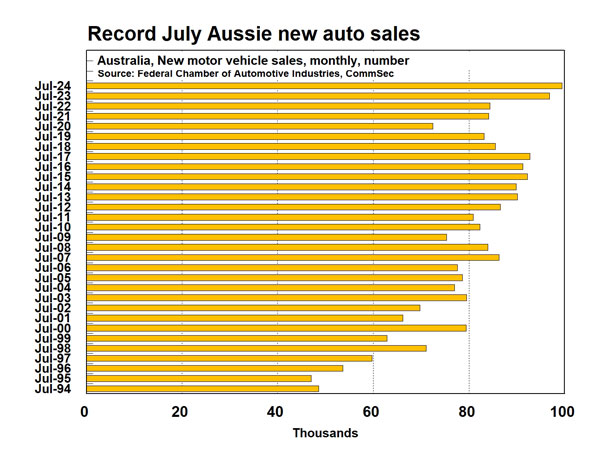

I also saw this data point come through CommSec as well…

Check it out…car sales in Australia are still at record high:

| |

| Source: CommSec |

That doesn’t scream the imminent collapse of the Aussie economy to me.

To conclude: the general share market may remain under pressure as these fears and volatility wash through the markets.

However, none of it is something we haven’t dealt with before.

Individual stocks eventually march to their own drum.

We also have the ‘August’ reporting season happening.

This will allow companies to guide on current conditions, and likely subdue the panicky vibe hitting the market in the last few sessions.

Regards,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Comments