Today’s Daily Reckoning Australia tips its hat to another publisher: SQM Research!

Every year the main man there, Louis Christopher, releases his ‘Boom and Bust Report’. It’s his forecast for the Aussie property market for the next 12 months.

I eagerly await it every year. And hey…he doesn’t disappoint!

Louis has a cracking track record.

Does he get it right every time? No.

Unlike some, he openly admits that. The world is simply too volatile and unpredictable to get every call right.

What I like about Louis is that he has the guts to stick his neck out.

Generally, there are enough nutters out there to spit various forms of vile, disrespect, and general rudeness his way for doing so.

Case in point: his base case is for the Aussie housing market to recover in 2023.

Let’s put this in some wider context.

The supposed whizz kids at ANZ Bank came out last month and said they expect house prices to fall 11% in 2023.

Personally, I couldn’t care less what this mob say, and I’ll show you why below.

But back to Louis…

The ‘Boom and Bust Report’ always lays out four different scenarios depending on which variables kick in over the next 12 months.

Louis has the unenviable task of picking the most likely…and being held accountable to his audience.

What is his base case?

Inflation moderates. That takes the pressure off the RBA rate rises. This would mean the cash rate peaks at less than 4% — a crucial level.

That will return the housing market to a modest upswing across the Aussie capitals except for Darwin.

That’s scenario 1.

But it could get better too…

Scenario 2 is a ‘Goldilocks’ outcome. For this to happen, the RBA would have to moderately cut rates in the second half of 2022.

Buyer confidence would surge, and the current fear around consumer spending and defaults would ease.

Likely? Maybe!

The other two scenarios tabled are if the markets conspire against the housing market and they go into further distress.

Who to believe? ANZ? SQM? And which scenario anyway?

That brings us to the stock market…

I’ve been following property stocks for a long time.

Over the years, I’ve recommended many during different points in the cycle.

Here’s what I can tell you…

Right now, the stock market agrees with Louis!

What makes me say that?

Property stocks have had a torrid time in the last 12 months. Many are down 30–60%.

However, here’s what I’ve noticed lately.

Several property stocks have come out recently and downgraded their earnings for this financial year compared to the last one.

You know the reasons…higher mortgage rates, falling prices, etc.

One was non-bank lender Resimac Group. Another was Maas Group. A third was McGrath Real Estate.

What was notable about these announcements?

The stocks didn’t sell off!

You have to know a bit about the stock market to see the significance of this.

Normally, when a stock cuts its earnings guidance or points out weak growth, the stock gets hammered on the day as investors dump it.

In the case of the above three stocks, investors have already dumped them.

That means the current housing market slowdown is priced into these businesses.

The fact that they didn’t sell-off further suggests investors are looking for the Aussie housing market to stabilise from next year.

The stock market is always looking ahead. In this case, the market is pricing in what it expects to happen around the middle of next year.

That’s why I say the stock market agrees with Louis’ base case and not the ANZ forecast.

Now, here’s where it gets interesting if you’re a stock investor.

If Louis’ ‘Goldilocks’ scenario comes into play, property stocks have every chance of jumping higher as the market prices in the better news to come.

Sometimes in the share market, all you need is for the news to be ‘less bad’ than investors expect for the shares to jump.

Here’s an example from last week…

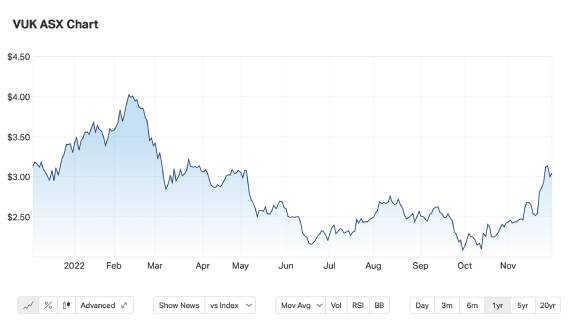

Virgin Money UK [ASX:VUK] is a UK bank. It’s been bashed around over the years from a myriad of issues. It was cheap.

But Britain and the British housing market aren’t super-hot right now either.

However, Virgin came out with its latest results last week and, they were positive.

Investors had been too bearish…and the stock jumped up as a result.

Check it out:

|

|

|

Source: Market Index |

You can see the nice rally since October. All the while, the news coming out of Britain has been terrible.

I don’t know if VUK can keep pushing higher from here. It needs to get its mortgage book growing again.

The same is true of Resimac here in Australia.

And that’s the point…

If Louis’s ‘Goldilocks’ scenario kicks in, Resimac Group [ASX:RMC] is going to look very cheap relative to its earnings potential.

Now that’s what we want to see as share investors!

We can’t know yet how 2023 will pan out.

But I’ll be watching like a hawk for this massive potential opportunity around housing shares.

I urge you to come join me to see what happens! I’ve already got five ideas to get you started right now. Go here to check them out.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: If you’re interested in more of these types of property-related market updates, be sure to check out Catherine Cashmore’s new free e-letter Land Cycle Investor. Find out more by clicking here.