Most of us know that cycles are part and parcel in the financial markets. Everything has their ups and downs.

Each asset has their unique cycle. How they differ is the length of the cycle and how much the price moves.

To succeed, you can do two things. Time your entries and exits precisely or hang on through the tough times to enjoy the good times.

With the cost of living rising, now is even more important that the ordinary Australian finds their means to stay afloat.

Your bank accounts may pay more interest than three years ago, but I don’t think it’s enough to help you build your wealth in the long term.

Our financial markets are a mess, more so since 2020. You’ve seen the crazy rallies in cryptos, lithium, oil, uranium, and tech stocks. They’ve all crashed hard some time during this period, destroying personal wealth and egos.

Even as many take risks in these markets, it doesn’t translate to rewards. You need to play the game right.

For me, I allocate a large proportion of my family wealth in gold mining companies. It’s worked quite well for me for several years.

However, the last three years have proven to be a testing period. Many gold enthusiasts experienced disappointment and endured serious losses. Some even threw in the towel.

It’s been more painful since the way gold and gold stocks moved during this time, having puzzled many — even those who’ve invested in this space for decades.

I’m not here to post sob stories though.

Instead, let’s look at why this played out as it did and see how it could present an opportunity in the coming year.

Similar but different…

Many believe that gold and gold stocks are similar assets, that they should move in the same direction with gold stocks magnifying gold’s movements.

Truth be told, they follow a similar but different cycle.

In this gold price cycle that started in 2020, the differences between gold and gold stocks were more pronounced. It’s this difference that has created heartache and frustration.

Since the start of 2019, when the US Federal Reserve walked back on the first wave of rate hikes after the 2008–09 subprime crisis, gold has enjoyed a whopping 61% and 67% return.

That’s a solid performance for a ‘safe-haven’ asset!

To compare, the S&P 500 Index [SPX] rallied 90% from 2019–24, while the ASX 200 Index [XJO] managed only 34%.

Normally, a rally in gold would translate to multiplied gains with gold stocks. This is because gold mining companies would normally enjoy significant increases in their profit margins with a rising gold price.

Gold and gold stocks rallied in 2019–20 as central banks around the world cut interest rates before and during the global outbreak of the Wuhan virus. The lockdowns around the world led to the biggest borrowing and spending spree in history, boosting almost every asset market, not just gold.

However, the lockdowns massively hurt the global supply chain and industrial production.

An abnormal relationship between gold and gold stocks

As the world came out of lockdowns, gold and gold stocks began decoupling. Gold kept rising, but gold stocks went on a roller coaster ride, falling more than it rose.

Unlike currencies that are created, you can’t flick a switch and expect the physical economy to crank up to full capacity. Even now, business activities haven’t fully recovered.

Gold and gold stocks are the same. Gold can rise with the flood of liquidity flowing into the system. But gold mining companies must overcome the challenges of scaling down their operations and subsequently reviving them.

Gold mining companies needed to rehire staff that they laid off, often offering higher salaries/wages to attract talent. They also faced backlogs on maintenance and repairs, contended with delays in ordering new equipment and spare parts, and managed staff absentees from illness or travel delays.

Beyond these challenges, gold mining companies faced economic headwinds, including inflation and a rising oil price that ate into their profit margins.

This was especially painful in 2022. A brutal gold bear market rocked even the most resilient gold producers.

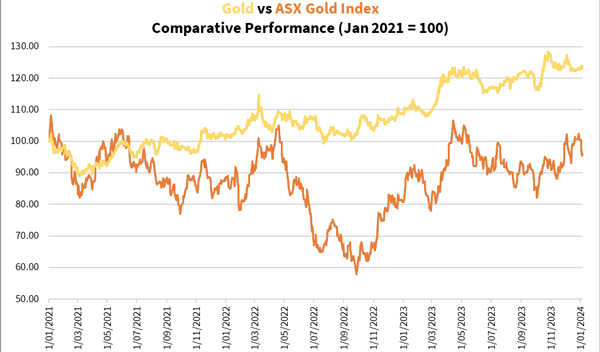

As you can see, the price of gold diverged a lot to that of gold stocks:

| |

| Source: Refinitiv Eikon |

Gaining momentum and awaiting lift off

While conditions improved in 2023, it was at best a bittersweet year for gold stock investors.

Gold rose around 13% in both US dollar and Australian dollar terms during 2023, ending the year at US$2,065 and AU$3,029 an ounce.

The ASX Gold Index [ASX:XGD] ended the year up 24%, a surprising result thanks to an 18% rally in the last quarter.

That said, you can see above how there’s still a significant valuation gap between gold and gold stocks.

It’s worth noting that the ASX Gold Index may have ended higher last year, you’re seeing this because leading gold producers such as Northern Star Resources [ASX:NST], Evolution Mining [ASX:EVN], Gold Road Resources [ASX:GOR], Westgold Resources [ASX:WGX], and Ramelius Resources [ASX:RMS] rallied.

Meanwhile, many individual companies (producers, developers, and explorers) closed the year at a lower price. But since most of them have a lower market value, it would hardly move the index.

More surprising is that several early-stage explorers are trading at near 52-week lows right now! These companies mightn’t be facing any urgent financial or operational problems as junior producers whose operations are burning cash, but the market sentiment is so poor that speculators have steered clear while some throw in the towel.

If you ask me, there’s an abundance of opportunities floating around in the gold stock space.

It’s possible the lull in gold stock prices could continue this year, as it did the past three years. After all, market sentiment towards gold stocks is just starting to warm. And some of the staunchest gold enthusiasts are having second thoughts given the price weakness has lingered.

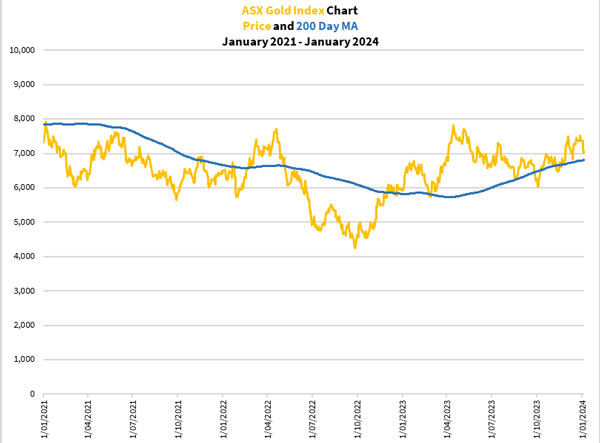

Let’s look at the ASX Gold Stock Index and its set up:

| |

| Source: Refinitiv Eikon |

The index has clearly been rising in the past six months. The 200-day moving average has gained momentum too.

I believe that this will continue unless central banks set off another period of rate rises…that or the oil price rises faster than gold, like in 2022.

This year is election year in the US. To add, the global economy is showing further signs of recession. Therefore, I believe there’s a small likelihood the rising momentum for gold stocks will break.

Therefore, my prognosis is that this could spell a great year for gold stocks. And those that lagged last year could catch up and become the star performers of 2024.

If I’m right about how 2024 could play out, gold stocks are a fantastic contrarian trade to consider adding to your watchlist. The market is starting to move in on the leading gold stocks.

So you should seize the opportunity!

To find out more, why not check out my precious metals investment newsletter, The Australian Gold Report? This is a one-stop shop for you to learn about how to build up a precious metals portfolio containing physical bullion, gold, and silver ETFs, and a selection of established gold producers. I’ve also included two speculative gold stocks that are in the earlier stages of the mining life cycle.

Regards,

|

Brian Chu,

Investment Director, Fat Tail Daily

Comments