In today’s Money Morning…remittances in El Salvador are the catalyst for BTC move, but what’s the endgame?…CBDCs will come soon, Facebook’s Diem and digital yuan, what next?…the new dynamic we’re about to enter…and more…

Yesterday, Ryan Dinse wrote to you about a ‘shot heard around the world’ — El Salvador will make Bitcoin [BTC] legal tender.

Translated to English, the country means ‘the Saviour’. So, it’s fitting.

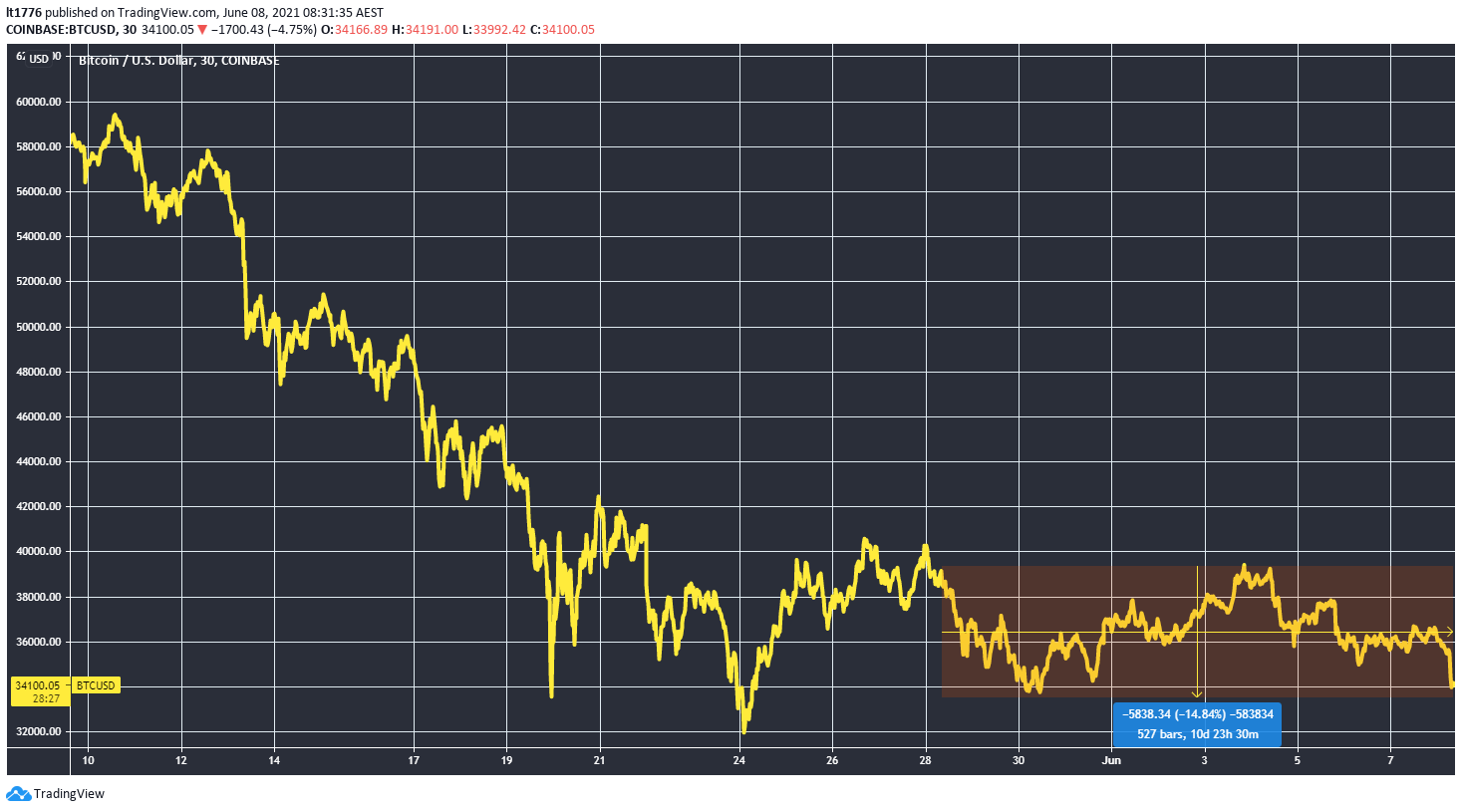

After a lengthy bout of fear, uncertainty, and doubt (FUD), the news out of Central America did little for the bitcoin price as the crypto is still tracking sideways since the end of May:

|

|

|

Source: Tradingview.com |

Make no mistake, though, what’s about to happen in El Salvador has monumental implications for your wealth.

And it goes right to the core of what’s at stake in the international ‘politics of money’.

So, here’s why El Salvador will use bitcoin and why it matters.

Remittances in El Salvador are the catalyst for BTC move, but what’s the endgame?

Remittances are an international money transfer where an expat sends money back to their family or friends.

Think Western Union.

Doing a bit of a dive into El Salvadorian economics yields some interesting finds, and it all comes back to remittances.

The words ‘vicious cycle’ kept popping up in the readings.

Just as the global financial system is in a debt-fuelled vicious cycle of its own, where debt is money and money is debt, El Salvador just can’t seem to break out of the rut either.

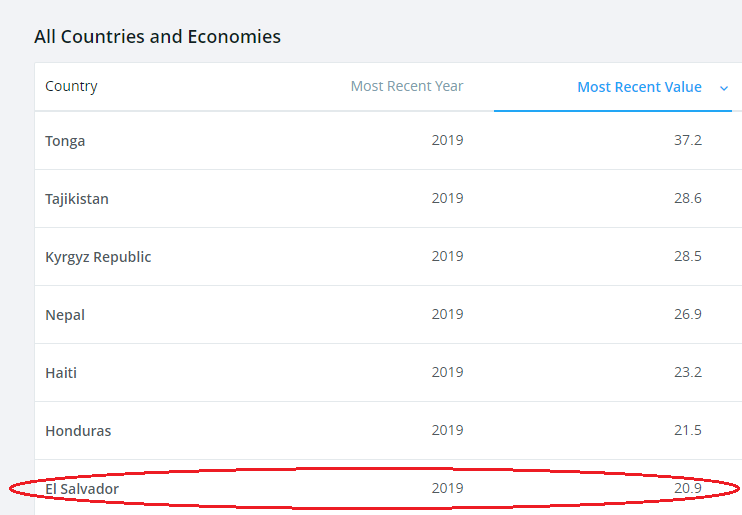

The country’s GDP was nearly 21% remittances in 2019, according to The World Bank:

|

|

|

Source: World Bank |

As one academic points out:

‘El Salvador has the largest informal economy on the continent…the informal sector is constantly growing and nowadays absorbs between 49 and 59 percent of the labor force.’

Later adding:

‘Remittances tend to produce a vicious cycle of social instability. While remaining stable on the macro level, they lead to resource unpredictability and social instability on the micro level. The volatile nature of remittances on the micro level expands throughout the entire economy and immediately (and directly) affects the labor output of the household.’

The result according to the author — an oligopoly:

‘Under these economic conditions, and although remittances mitigate poverty and help the poor to escape from local economic conditions in the first place, they provoke resource unpredictability and ultimately contribute to enormous social instability for the large mass of the population. This process is paralleled by the continuing self-modernization of the Salvadoran elite.’

You could talk about the gangs, the violence, the corruption…but these are more symptom than cause.

The real cause of El Salvador’s woes is that it is an economy that needs remittances.

Accepting bitcoin as legal tender in El Salvador is no panacea.

However, it may well restructure the economy and pull it away from the current anarchy.

A last roll of the monetary dice if you will.

While buying bitcoin in a Western democracy is generally a luxury — El Salvador’s move is desperate.

What’s the endgame for countries that want to follow in El Salvador’s wake?

Enter the international ‘politics of money’.

CBDCs will come soon, Facebook’s Diem and digital yuan, what next?

As per CoinDesk:

‘About 80% of central banks are exploring use cases involving central bank digital currencies (CBDCs), with 40% already testing proof-of-concept programs, according to a new report by blockchain infrastructure platform Bison Trails.

‘The report by Bison Trails, a unit of crypto exchange Coinbase, examines digital currency proof-of-concepts launched by more than 11 countries and cities, including Hong Kong, Thailand, China, Australia, Singapore and Japan.’

Facebook’s impending Diem project (Libra rebrand title) is pushing China to accelerate its digital yuan, which in turn will force the hands of many laggards in the West.

Who decides what’s legal tender in this environment? Who makes the rules?

It’s impossible to rule out raw abuses of power as central banks cling onto any branch that keeps them tethered to relevance after unleashing a flood of free money.

But this is the new dynamic we’re about to enter.

One where politics isn’t just interwoven with money, instead, it’s concerned with the very concept of money.

There’s a fancy word for what happens when countries start formalisng their ties to crypto and others start outlawing it.

It’s called ‘non-territorial jurisdictional unbundling’. Look that up if you want to learn more.

In a nutshell, that means people will vote with their feet (move to countries that are based on the money they want), vote with their digital feet (increased uptake of crypto to avoid fiat-based systems), or start their own governance structures with their own rules.

If this all sounds a bit strange to you, that’s because it is.

The central banks forced El Salvador’s hand and there’s no turning back now.

To wrap your head around what this means as an investor, I urge you to check out Ryan Dinse and Greg Canavan’s latest briefing on the future of money.

This is big picture stuff which you’ll be hard pressed to find anywhere else.

Tomorrow, I’ll bring gold into the picture to see how both gold and bitcoin can coexist as trust in fiat plunges to zero.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.