Why have many ASX BNPL stocks gained more than 200% this month? What’s the reason?

The US is on the brink of recession.

The US Fed is resolutely raising interest rates regardless.

Australia’s new treasurer is forecasting Aussie inflation to hit almost 8% by the end of 2022, with the RBA flagging more interest rate hikes.

Global energy prices remain elevated as consumers start feeling the pinch.

So who would have thought that the best-performing sector this month would be the long-suffering BNPL.

Sezzle is up 300% in the past month alone.

While Afterpay’s nearest Aussie rival Zip is up 160% in the past month.

Smaller BNPL firms like Openpay and Laybuy aren’t slouching behind, with both stocks up 160% at the same time.

The big question is why?

LBY and SZL shrug shoulders

We won’t find clear answers from the BNPL stocks themselves.

They, too, have been caught off-guard.

This week, both Laybuy and Sezzle addressed the big price moves in the sector. An explanation eluded both.

In a somewhat circular point, Laybuy attributed its recent share price increase to the ‘very material’ share price increases of its peers.

But the firm wasn’t clear why it and its peers have gained so much in recent weeks.

‘Laybuy is not aware of what those factors might be, but notes the report in yesterday’s Australian Financial Review (“Inflation report boosts shares, Zip, Sezzle rocket”) connecting share prices increases in the sector with the better-than-expected June quarter inflation report released at lunchtime yesterday.’

Yet why would better-than-expected inflation numbers affect the BNPL sector drastically and not other sectors?

It seems a tenuous connection.

Sezzle was equally confounded:

‘The Company is not aware of any explanation for the increased securities price and volume. However, we note on the date in question that the entire sector strongly outperformed the market in terms of price and relative historical trading volume. We believe it is likely that investors led the increase in trading activity, because of the sector having been significantly down in recent weeks.’

Yes, the sector has been down significantly — not just in recent weeks but in recent months.

But that in itself doesn’t explain the spike.

Other sectors significantly down in recent weeks haven’t gained 200% in a fortnight.

So, what gives?

A matter of perspective

Amidst the eye-popping recent returns, it pays to have some perspective.

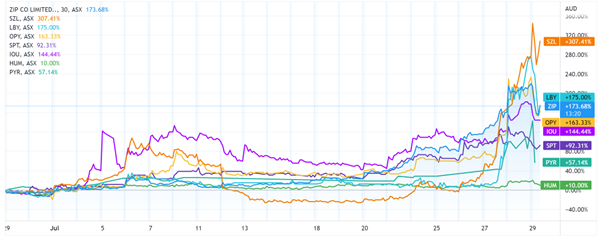

Clipped at one month, BNPL stocks made big gains:

Source: Tradingview.com

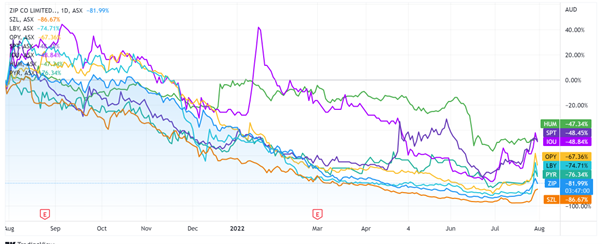

Now zoom out and widen the time horizon:

Source: Tradingview.com

The stellar recent gains are just a blip in a protracted downward trend.

If you’re a long-term shareholder of BNPL stocks, the recent spike is small consolation.

Sezzle’s big spike this month hasn’t done much to offset its yearly performance.

Over the past 12 months, SZL shares are still down 85%.

Which raises a question: Are the recent moves by BNPL stocks temporary or indicative of something more permanent?

Bear market rally or turnaround?

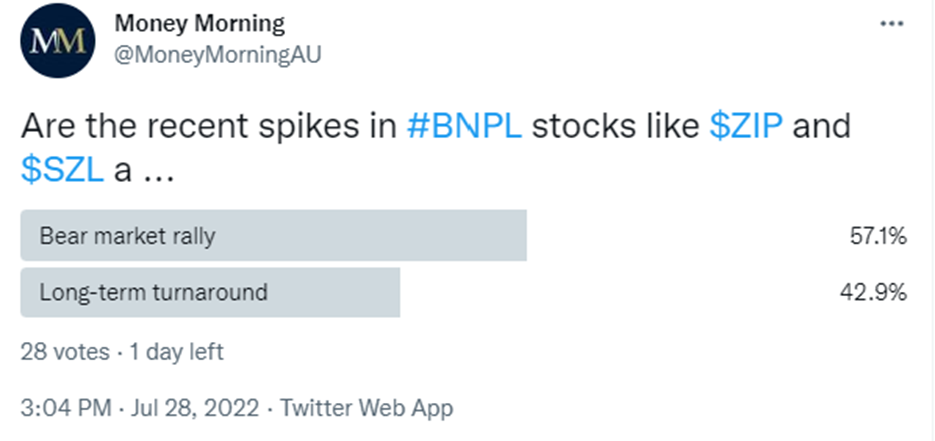

In other words, are BNPL’s July gains a temporary bear market rally or a genuine turnaround?

We asked that very question in a not-so-scientific Twitter poll, with the majority thinking the recent price action resembles a bear market rally:

Source: Twitter

Our own Editorial Director Greg Canavan told me in a chat he thinks the share price increases are more characteristic of bear market rally behaviour than anything else.

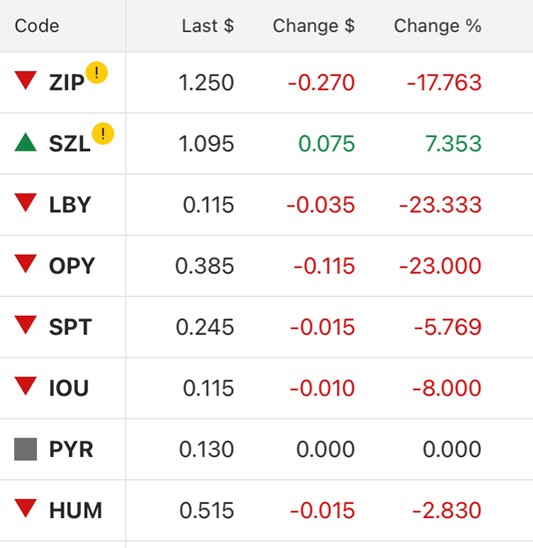

Indeed, after strong surges this week, BNPL stocks broadly fell on Friday:

Source: Commsec

BNPL: Is the worst over?

What may have fuelled the recent BNPL rally is the perception among some buyers that the worst is over.

In its attempt at an explanation, Sezzle did point to the recent significant price decreases in the sector.

The unuttered assumption being that the significant decreases were excessive.

Did the market conclude BNPL stocks were oversold?

John Bogle, founder of The Vanguard Group, often spoke about stocks reverting to the mean.

To Bogle, mean reversion in markets:

‘…was a kind of law of gravity in the stock market, through which returns mysteriously seem to be drawn to norms of one kind or another over time.’

But what’s the mean BNPL stocks are reverting to?

What is the fair value of BNPL stocks?

BNPL stocks: price and value

Brian McNiven, in his Warren Buffett inspired book Value Investing: How to Buy Wonderful Companies at a Fair Price, had a great passage where he wrote (emphasis added):

‘Although business performance is likely to be far from fixed or stable, most listed companies have an average price variation in the course of a 12-month period of about 40 to 50 per cent (meaning that the difference between the 12-month high and low prices is about 40 to 50 per cent of the low price).

‘One would need to be exceedingly credulous to believe that, on average, the value of a business varies by 40 to 50 per cent every 12 months.

‘When a stock market falls 10 per cent or more overnight, does this mean that the value of all businesses comprising the market declines by an average of 10 per cent while we sleep?’

So using McNiven’s idea, we can ask: Has the value of BNPL stocks really changed by 200% in a matter of weeks?

Have Sezzle and Zip become 200% more valuable as businesses in the course of a fortnight?

Unlikely.

The fundamentals behind BNPL stocks have not changed much…and have surely not changed materially in the last few weeks.

BNPL stocks burn through a lot of cash to fund their receivables — receivables plagued by bad debt.

The already slim margins are further pressured by growing competition from big banks to Apple.

That said, BNPL stocks are much more conscious about profit these days.

The era of growth at all costs is over.

Growth versus profit

On Friday, Sezzle held an earnings call with shareholders.

At the call, SZL Chief Executive Charlie Youakim said the BNPL stock will prioritise profitability over growth:

‘We traditionally believe in the concept of exchanging upfront costs for long term gains … but in early 2022, we identified this was not a sustainable approach given the changing market conditions as the cost of capital has gone up dramatically.

‘It was no longer worth the cost of spending that dollar to try to make two dollars later. We knew that every action in the company had to turn into immediate profits.’

If you look at the messaging of other BNPL stocks, you will see a similar pattern: profitability is now the buzzword, not growth.

Expansion is no longer preferred.

In fact, costly markets are exited, and mature markets are prioritised.

‘Path to profitability’ is the new BNPL slogan.

But is that enough to explain the recent rally?

While BNPL stocks are finally focusing on free cash flow and profitability, it’s no guarantee the cash will start flowing.

How sound is the long-term outlook for BNPL as a profitable business model?

With BNPL stocks back at the forefront of investors’ minds, debates about the buy now, pay later model will rage once more.

BNPL as risk-on indicator?

Now, another explanation for the recent BNPL rally is a re-emergence of risk-on sentiment.

If you were feeling like market conditions were improving, what sector would you consider for your more speculative bets?

Likely the small caps sector.

And which small cap stocks would you look into?

Likely ones like Zip and Sezzle, which were — and clearly continue to be — retail favourites during bull runs.

If we were to consider BNPL as a risk-on indicator, would we conclude the market’s risk appetite is growing?

It’s difficult to say.

What may look like the onset of a bull run can be but a brief bear market rally.

The next weeks and months will be telling.

Regards,

Kiryll Prakapenka