In today’s Money Morning…why are small-caps down?…taste differs, but these returns are forever…they’ve got something up their sleeve…and more…

Sometimes the ASX is like your favourite restaurant — so many choices, some specials, and you know your favourite dish.

For more conservative investors, ASX staples like the Commonwealth Bank of Australia [ASX:CBA] and BHP Group Ltd [ASX:BHP] are the bread and butter of portfolios.

Can’t go wrong with the classics, they think.

Other more adventurous investors favoured the tasty returns of Afterpay Ltd [ASX:APT], which is now part of the Square Inc [NYSE:SQ] smorgasbord of fintech offerings.

But what about the long-ignored ASX small-cap investment menu?

Yesterday, Murray Dawes wrote to you about the case for small-caps and why they deserve your attention as an investor.

Today, I’ll lay out why small-caps could be due to come roaring back into vogue, and regardless of what the market does in the next 12 months, why I believe they are a good place to park some of your speculative capital over the next 2–5 years.

Why are small-caps down?

First up, I want to get this little factoid out front and centre as quickly as possible.

Murray Dawes and Ryan Clarkson-Ledward’s Australian Small-Cap Investigator service recommended Afterpay Ltd [ASX:APT], then known as Afterpay Touch Ltd [ASX:APT], all the way back on 21 June 2016, at a measly $1.65.

The publication tapped out of the investment at $40.00 on 5 February 2020.

The naive greed-heads out there would be shaking their noggins saying, ‘You are aware APT just got bought by SQ at a huge premium for an indicative price of $126.21?’

However, the return of 1,448% is not a tiny sum. In light of the March 2020 market crash, it was a more than sensible time to bank the gain.

This is not vicarious bragging about Ryan and Murray’s publication. Not all of their picks had these kinds of results. In fact, some even went down. That’s just the way it goes with highly-volatile small-caps.

I’m simply saying this is a great example of what just a few well-placed small-caps can do for your overall portfolio.

At the moment, though, investors who love small-caps might wonder why their favourite playground on the ASX is so eerily quiet.

There’s a whole host of reasons, which include:

- Lockdown economy favours big companies with economies of scale

- Back in March, the bond yield-driven value pivot took heat out of the speculative end of the market (even though bonds are doing whacky things at the moment)

- Fear-driven narratives in the media pushing investors into the blue chips

- Coupled with the above, a renewed focus on companies with existing revenue, or even better, serious profits

So, given all these factors, it’s pretty contrarian to say small-caps are back on the menu.

Looking at the watchlist and the charts, it’s impossible to ignore the fact that small-caps as a whole were smacked around in the last six months.

This is a little snippet of what I shared with members of Exponential Stock Investor last week:

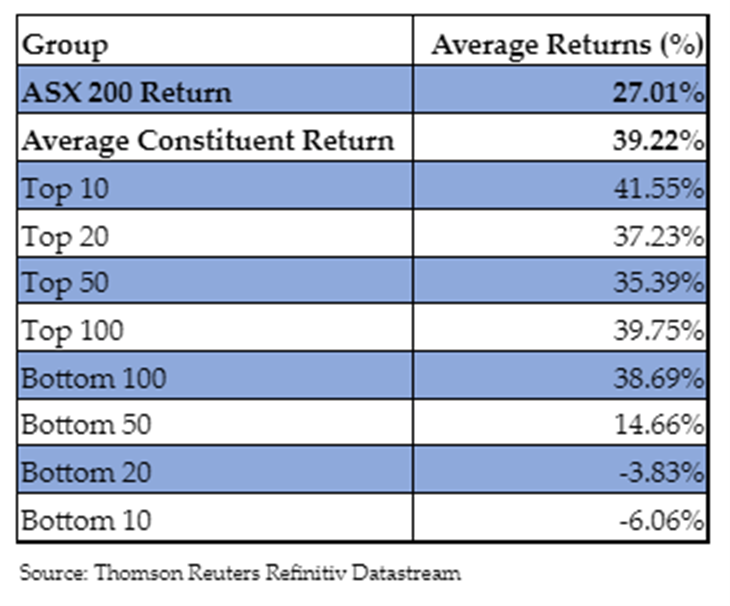

‘Brian Chu of Strategic Intelligence Australia and Hard Money Trader, our latest addition to the editorial team, shared this interesting nugget with us recently:

|

|

|

Source: Brian Chu |

‘What you see here is a concentration of returns at the top end of the index.

‘What about our much smaller companies outside of the ASX 200 [XJO]?

‘We did a bit of digging and decided to use the S&P/ASX Emerging Companies Index [XEC] as a proxy for our more speculative exponential plays.

‘Here’s what’s happened to XEC (orange line) versus XJO (yellow line) over the last six months:

|

|

|

Source: Tradingview.com |

‘The speculative companies in XEC, no matter how exciting, are underperforming the established XJO companies.’

So there’s the chart-based proof that small-caps are not faring well in the current ASX environment.

Taste differs, but these returns are forever

There’s an age-old Latin saying:

‘De gustibus non disputandum est.’

Which roughly translates to:

‘In matters of taste, there can be no disputes.’

Given an accelerating vaccine rollout and the RBA blinking on ‘tapering’ QE bond purchases, I think small-caps are looking pretty tasty in terms of potential returns in the coming few months.

It’s a matter of taste — or maybe more accurately, risk appetite.

Are you willing to see a lot of volatility to try and capture big returns from companies like APT in their early days?

There are many investors out there that would snap your hand off for these kinds of opportunities, risky as they may be.

The distribution of risk appetite and the distribution of investment returns is a constant — forever in this shape:

|

|

|

Source: Skillsyouneed.com |

You’ll notice this chart is the foundation of our company’s logo.

And that APT recommendation? It took about three and a half years for the recommendation to top out at the eye-watering return of 1,448%.

Conclusion: small-caps could well come roaring back in the coming months given how much cash is still on the sidelines of the market. Or in a different light, if the small-caps you back are genuinely disruptive like APT was, this is where you could see APT-like returns in the next 2–5 years.

Small-caps are, of course, risky/speculative beasts.

But if you have a hankering for them, then Australian Small-Cap Investigator is a must-read.

Keep an eye out in the coming two weeks for more from Murray Dawes and Ryan Clarkson-Ledward.

They’ve got something up their sleeve.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.