2024 could be big for commodities.

So thinks our resident commodities guru James Cooper.

And he outlined several reasons why.

US election. China stimulus. Rate cuts. Falling US dollar. Rising India.

Any of these events can ignite commodities in 2024.

James joined me on this week’s episode of What’s Not Priced In to talk why he’s upbeat about commodities this year.

And, yes, I didn’t waste the opportunity to ask James about uranium’s rally. And lithium’s collapse. And iron ore’s dip.

Suffice to say, James and I covered a lot of ground. But the big topics were:

- Why James thinks 2024 could be a crucial year for commodities

- James’s prescient description of lithium in November 2022 as a ‘one-hit wonder’

- Have lithium stocks bottomed?

- Green energy transition stocks — not just lithium — are struggling…but for how long?

- The role of interest rates in propping up ‘brown’ commodities like coal

- Does the uranium rally have legs?

- Commodities to watch with true scarcity factors

Below, I want to elaborate on a big theme from the episode. The poor performance of energy transition stocks in 2023.

What happened?

Lithium stocks crater

In November 2022, James warned that lithium is a one-hit wonder. It’s too reliant on ‘optimism in the uptake of electric vehicles’.

But that optimism is souring. And EV uptake is slowing.

The share of EVs sold in the UK stalled for the first time last year. EVs accounted for 16.5% of all new vehicles sold in the UK in 2023. 2022’s share was 16.6%.

The Financial Times reported:

‘EV demand is still rising globally. But carmakers across the US, Europe and the UK have warned there is slowing appetite as the market shifts from early adopters to more cautious mass-market consumers.’

The supply side thought demand for EVs would be red hot. So developers rushed to production. And producers expanded theirs.

But people are buying less EVs than envisaged. The lithium price collapsed. And so did lithium stocks.

The 10 worst performing stocks of 2023 on the All Ords included three lithium stocks. Lake Resources [ASX:LKE], Core Lithium [ASX:CXO], and Sayona Mining [ASX:SYA].

Lake has just hit a new 52-week low this week.

The interesting one is Core Lithium. It’s not a speculative junior but a newly minted producer. Yet the realities of the market have not been kind to it.

In early January, Core suspended mining operations at its Finniss lithium mine.

But the Western Australia miner isn’t the only producer struggling with falling lithium prices.

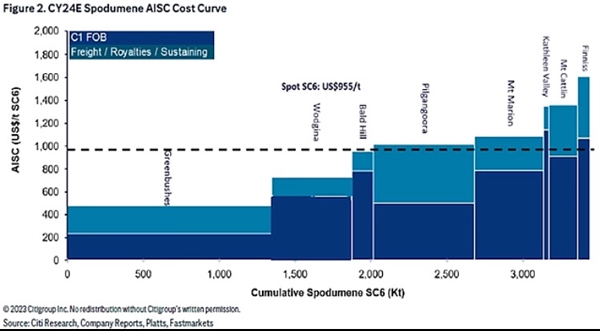

In late December, analysts at Citi assessed Aussie producers along the lithium cost curve.

Core’s Finniss project was among several listed as uneconomical at current spodumene prices.

The Australian ran a nice summary:

‘In a mid-December research note, Citi analyst Kate McCutcheon pointed to Core’s Finnis lithium operation as the most expensive producer, at around $US1600 a tonne for concentrate with a 6 per cent equivalent grade on an all-in sustaining cost basis.

‘But Allkem’s Mt Cattlin mine in WA is also out of the money at current spot lithium prices on Citi’s figures, with average costs of about $US1500 a tonne, with Mineral Resources’ Mt Marion, currently looking to move underground, tipped at about $US1300 a tonne.’

Out of all lithium stocks Citi covers, only IGO generates positive free cash flow at spot prices.

Yikes.

| |

| Source: Citigroup |

Green energy transition stocks floundering

But it’s not just a lithium story.

Stocks associated with metals touted as critical for the energy transition have slumped.

Consider the current most shorted stocks on the ASX.

Pilbara Minerals [ASX:PLS] is top with 21% short interest.

Graphite producer Syrah Resources [ASX:SYR] is second with 15.4% short interest.

Core Lithium is third with 13%.

Sayona Mining is fourth with 10.3%.

Liontown Resources [ASX:LTR] is ninth with 8.4%.

Nickel and copper developer Chalice Mining [ASX:CHN] is 12th with 6.6%.

Core and Syrah don’t just have a high short interest in common. They’ve both paused production due to unfavourable prices.

In Syrah’s case, it paused much earlier. In July, Syrah suspended operations in its Mozambique mine. It will restart only when bids reach an economical level.

Syrah is still waiting.

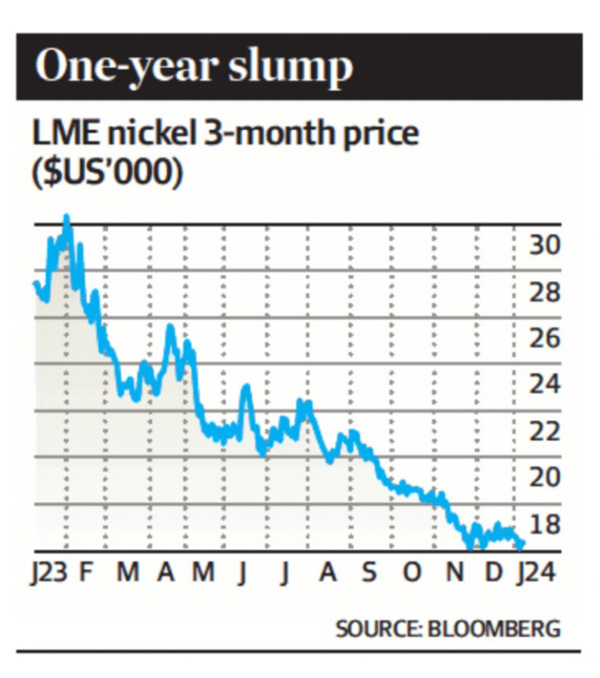

And take nickel.

On Wednesday, our mining giant BHP released its December quarter update. Its nickel division disappointed.

In BHP’s own — jargoned — words:

‘The nickel industry is undergoing a number of structural challenges and is at a cyclical low in realised pricing. Nickel West is not immune to these challenges. Operations are being actively optimised, and options are being evaluated to mitigate the impacts of the sharp fall in nickel prices. Given the market conditions, a carrying value assessment of the Group’s nickel assets is ongoing.’

| |

| Source: Australian Financial Review |

What’s interesting about nickel is its association with the energy transition at all.

Our small-caps expert Callum Newman put it best last week:

‘Most nickel demand comes from the stainless steel sector. I’m pretty sure it’s as high as 98% of market share.

‘The battery component, while important, is tiny. It seemed to me 99% of people missed this important observation — or at least in the articles I saw.

‘You were taking a big risk – if you knew it – buying a nickel miner based off future electric car demand.’

In markets, it pays to pay attention.

So can energy transition stocks rebound?

James wrote yesterday that 2023 was a ‘bloodbath’ for green energy transition mining stocks. But he doesn’t see a quick turnaround in 2024 just yet.

He did point to a reason why they might.

And it’s not a reason I expected: falling interest rates.

This is James’s thinking, elaborated upon on the pod:

He recently wrote:

‘Obviously, rising rates diminished the public’s appetite for extravagant renewable mega-projects.

‘[In] a high-cost environment, traditional energies reign. So why could 2024 see a major pivot BACK to ‘green’ metals?

‘The idea of capital-intensive green energy projects becomes a difficult pill to swallow in an economy struggling against the rising cost of living.

‘But, with rate cuts looming, could the narrative from 2023 make a dramatic U-turn? In other words, will investment flood out of the brown commodities back towards the green?

‘It’s certainly possible.’

Investment may have flooded out of green commodities in 2023. But it’s certainly flooding into uranium right now.

Uranium stocks rising

Battery metals are not doing so well.

But one material associated with a greener future is. Uranium.

Uranium is at a 16-year high, with uranium futures breaching US$100 a pound this week. For context, in 2007, the price of uranium peaked at an all-time high of about US$150 a pound.

All five of the top-performing stocks to start 2024 on the All Ords are uranium stocks.

But the rally raises questions. Questions I put to James. Among them:

- Will we see uranium prices surpass all-time high in 2024?

- Will more supply come online with prices becoming more attractive? How elastic is uranium supply?

- Is the rally sustainable?

- Or will uranium emulate lithium’s boom and bust cycle?

And James had great answers for each.

I’m a hack, I know. But watch the episode to hear James’s answers.

Enjoy the episode!

Regards,

|

Kiryll Prakapenka,

Analyst and host of What’s Not Priced In

Kiryll Prakapenka is a research analyst with a passion and focus on investigating the big trends in the investment market. Kiryll brings sound analytical skills to his work, courtesy of his Philosophy degree from the University of Melbourne. A student of legendary investors and their strategies, Kiryll likes to synthesise macroeconomic narratives with a keen understanding of the fundamentals behind companies. He’s the host of our weekly podcast What’s Not Priced In, where he and a new guest figure out the story (and risks and opportunities) the market is missing to give you an advantage. Follow via your preferred channel and check it out!

Comments