Despite strong FY21 results across the board, Baby Bunting Group Ltd [ASX:BBN] share price took a dive. We examine why.

At time of writing, the BBN share price was trading at $5.76, down 3.68%. BBN shares fell as much as 10% in morning trade.

Despite today’s sell-off, Baby Bunting has gained 50% over the last 12 months amid uncertain economic conditions.

Baby Bunting’s FY21 overview

We’ll get to the market’s reaction in a bit, but let’s first look at Baby Bunting’s key results from FY21.

The company reported a Statutory Net Profit After Tax of $17.5 million, which is a climb of 76%.

NPAT was up 34.8% to $26 million compared to the last period, while EBITDA was up 29.2% to $43.5 million.

Just like last year, these results were achieved without any JobKeeper payments or rent relief.

Sales growth, too, also showed some solid numbers.

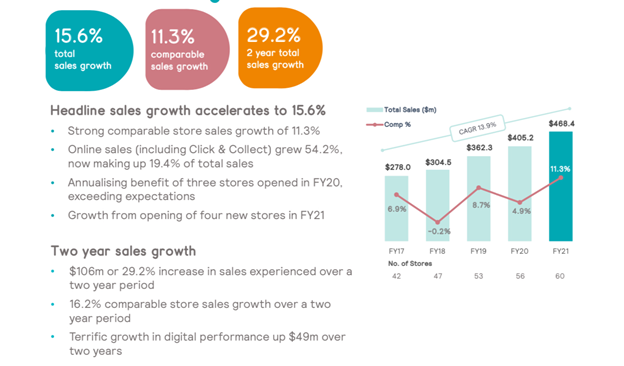

Total sales stood at $468.4 million, which represented growth of 15.6% (pcp).

Comparable sales growth, which included sales from online stores of $90.8 million, was 11.3% for the year.

In the span of two years, BBN’s sales have hiked by 29.2%, or $106 million.

Gross Profit improved by 18.3% prior to the corresponding year, and stood at $173.7 million.

Gross Profit Margin improved by 83 basis points to 37.1%.

This reflects an improvement of 120 basis points in gross margin achieved in the prior year.

Private Label and Exclusive Products sales grew 31.1% to be 41.4% of total sales.

The sales mix means Baby Bunting is on the right track to achieve its long-term target of 50% sales coming from private label and exclusive products.

Baby Bunting was quick to invest heavily in digital commerce platforms as the pandemic shifts consumer behaviour more towards online.

As a result of the investment, BBN’s online sales grew 54.2% to $90.8 million, now comprising 19.4% of total sales.

Click and Collect grew 110% and made up around 57% of all online sales in catchments where Baby Bunting has a store.

It’s essential to talk about the expenses to get a better picture of Baby Buntings fundamentals.

The cost of doing business for BBN was 27.8% of sales for the year. This is an improvement of 14 basis points.

Store expenses were 19.2% of the sales, another improvement of 94 basis points over the year.

The strong results meant the company could give back to its shareholders.

Baby Bunting’s board announced a final fully franked dividend of 8.3 cents per share.

With the FY21 interim dividend standing at 5.8 cents per share, the total dividend attributed to FY21 is 14.1 cents per share.

That’s an increase of 34.1% on FY20 when the full year dividend was 10.5 cents.

Baby Bunting’s CEO & Managing Director Matt Spencer was highly impressed by the results:

‘We have had a tremendous year delivering great growth, both in earnings per share and returns for shareholders.

‘This could not have been achieved without the outstanding efforts of the entire Baby Bunting team.’

Why were BBN share price down?

BBN’s FY21 was clearly strong, showing growth in all key metrics.

So why did the stock suffer selling pressure today?

Markets are forward looking and Baby Bunting’s FY21 results — while strong — were for the year that was.

It is BBN’s FY22 outlook that’s likely got the market spooked.

After all, the company was not confident to provide FY22 guidance.

BBN management said today the pandemic continues to ‘create significant disruption’.

For instance, comparable store sales as at 12 August 2021 were down 6.4% year-to-date.

The company flagged that there’s a risk trading conditions will ‘fluctuate greatly throughout the year.’

That’s why BBN said it was not in a position to offer guidance. The pandemic is clouding visibility.

Now, while the pandemic may be impacting Baby Bunting’s operations, it doesn’t mean other companies are in the same boat.

So, if you are looking for more small-cap stocks having large potential, then I suggest checking out the report by our small-cap analyst, Ryan Clarkson.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here