Flooding has hampered production at Whitehaven Coal [ASX:WHC] open-cut mines, forcing the coal producer to lower its FY23 guidance.

WHC has ‘moderated its expectation’ for FY23 run-of-mine (ROM) coal production at its open-cut operations.

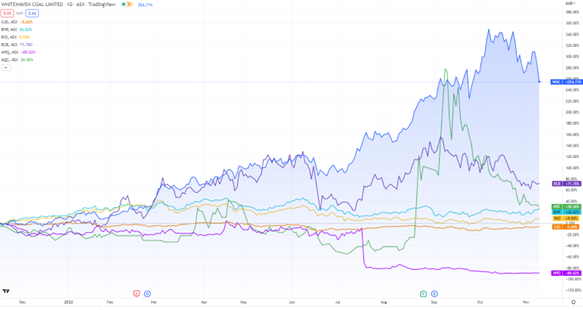

WHC shares were down 8% late on Wednesday and 20% over the past month.

Source: Trading View

Whitehaven downgrades guidance due to flooding woes

On Wednesday, Whitehaven Coal lowered its FY23 production guidance due to wet weather and flooding hitting its open mine operations.

Whitehaven previously reported lower-than-anticipated ROM production in September at all three open-cut mines.

It wasn’t just the mines that were impacted; the bad weather also affected accessible trade pathways and haulage roads during that time.

The adverse weather has persisted since, forcing the FY23 downgrade. Whitehaven reported:

‘Whitehaven has not experienced on-site flooding and has maintained a level of production continuity by transporting people to sites via helicopter to overcome flood-related access issues. While mine sequencing plans provide opportunities to lift volumes throughout the year, recent rain and flooding events continue to drag on ROM production, predominantly at Maules Creek and Tarrawonga open cut mines’.

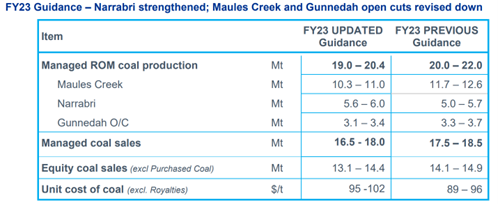

While its open-cut mines at Maules Creek and Gunnedah were adversely affected, operations at Narrabri surprised to the upside, leading Whitehaven to upgrade guidance at Narrabri:

Source: WHC

La Niña wreaks havoc for miners as inflation bites down

The weather phenomenon has not only affected Whitehaven but paints an unkind picture for other Australian miners already faced with the stinging bite of inflation and labour shortages.

In October, gold miner Newcrest experienced a water shortage at its Lihir operations in Papua New Guinea. The company blamed ‘dry conditions’ associated with La Niña’s pacific pattern as excess rainfall was diverted to NSW and Victoria.

Suncorp has already reported around $530 million in flood-related damage in NSW and Victoria between July and October.

Meanwhile, in Queensland, coal-fired energy power stations like Callide are already concerned about possible power disruptions in what could be shaping up as a very soggy summer with La Niña lingering in the southern pacific region.

On the other hand, and coming back to WHC’s situation, coal prices are reaching incredible highs.

On 4 November, NSW thermal coal was worth $556.91 a tonne, which should be helping the coal miner keep on track for some profit, even as the environmental and market conditions present some obstacles.

A crude awakening for the world

Whitehaven’s share price surge in the last 12–16 months has highlighted the energy crisis engulfing the world as supply of renewables and fossil fuels alike hasn’t kept pace with demand.

Few things are as important to our modern daily lives as energy.

It powers our lifestyle.

But the recent ruptures in the energy market — stoked by the flooding, undersupply, rising inflation, and Russia’s invasion of Ukraine — have threatened global energy security.

As the world fractures, most stand to lose.

So, what world are we in?

And what does it mean for the energy sector?

Our Editorial Director, Greg Canavan, has just released a comprehensive new report on the entire energy industry.

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia