Australian coal producer Whitehaven Coal [ASX:WHC] has revealed that in the first half of FY2023, its profits have soared to $3.8 billion on higher average coal prices.

The coal miner generated $2.5 billion in cash from its mining operations — way up from its previous count of $567.4 million earned the year before.

The WHC share price was drifting upwards on Thursday morning by 3.5%, valued at $8.19 a share.

Over the last year, the coal miner’s share has increased a whopping 167%, and yet so far in the new calendar year, it has not been doing as strongly, trading at a 13% deficit.

Source: tradingview.com

Whitehaven Coal hits record revenue and higher profit

Whitehaven experienced a record half year for net profit after tax (NPAT), which reached $1.8 billion for the six months ending 31 December 2022.

EBITDA (earnings before interest tax, depreciation, and amortisation) came to $2.7 billion. This is quite an increase compared to the first half of 2022, where EBITDA totalled $6 million.

WHC claimed record revenue of $3.8 billion in 1H FY23, up from $1.4 billion 1H FY22, largely supported by a higher average coal price in the first half — $552 a tonne as opposed to $202 a tonne the year before.

Operational cash generation came to a total of $2.5 billion compared with $567.4 million at the same time last year.

The company’s run-of-mine (ROM) production hit 8.8 million tonnes, compared with 8.4 million in 1H 2022.

Paul Flynn, WHC’s CEO, commented on both the company’s results:

‘In the first half of FY23, global energy shortages continued to underpin strong pricing. Weather related production constraints in New South Wales contributed to tight supply.

‘Prices for high quality, high-CV coal held at very high levels during the half year and our customers remain focused on energy security as a key priority.

‘With Whitehaven’s half year NPAT of $1.8 billion, and strong operating cash flows, we are retaining cash on our balance sheet for future optionality. At the same time, we are returning surplus capital to shareholders through fully franked dividends and share buy-backs.’

Whitehaven is set to pay an interim dividend of 32 cents a share, fully franked, up from 8 cents in the prior half-year.

WHC coal market forecast

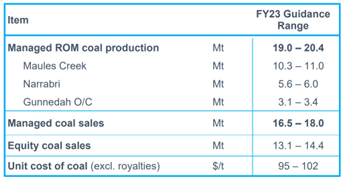

For the full financial year, Whitehaven forecasts ROM coal production of 19Mt to 20.4Mt compared with 2022’s 20Mt.

WHC also predicts coal to cost $95–102 per tonne ($84/t in 2022), and its total CapEx to hit $287 million to $360 million, significantly up from 2022’s $154 million.

Mr Flynn says demand for seaborne and thermal coal remains strong, and despite some cyclical price softening, he believes high-CV coal prices will perform well throughout the year.

WHC stated:

‘We continue to expect the rebalancing of global energy demand and supply to take several years and we observe that markets appear to demonstrate impacts of disruption as a consequence of decarbonisation efforts in the developed world.

‘Throughout the coming multi-decade energy transition reliable baseload fuels will continue to be required. Industry analysts expect demand for coal to remain strong and particularly for high-CV coal that Whitehaven produces with its higher energy content and lower emissions profile relative to other coal products.’

Source: WHC

Australia’s next commodity boom

Speaking of the energy market, our resources expert thinks the Australian resources sector is set to enter a new era based on the world’s transition to carbon-emission-free energy.

It could be an era that paves the way for commodity corporations to make big gains, just like Fortescue Metals when it struck gold — well, iron — the last time around.

James Cooper, trained geologist turned commodities expert, is convinced ‘the gears are in motion for another multi-year boom in commodities’… and the best part is that Australia and its stocks are in a prime position to reap great benefits.

You can access a recent report by James on exactly that topic, AND access an exclusive video on his personalised ‘attack plan’ — right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning