Major coal mining producer Whitehaven Coal [ASX:WHC] declared strong sales for its 2022 December quarter with its Narrabri mine delivering a record half-year financial result, despite bad weather taking a toll on operations.

Whitehaven expects its earnings for the first half of 2023 to reach four times that of last year’s, with coal prices recently soaring to record highs.

WHC shares rose 5.5% this morning, taking it to $9.43.

The company’s share value rallied 210% over the last full year but has been flat so far for 2023:

www.TradingView.com

Whitehaven coal fuelled by strong sales results

The coal mining giant alerted the public to record earnings for the first half of 2023, crediting its Narrabri mine, which led production to strong sales in Q2 FY23.

This result was said to have been achieved despite bad weather affecting its open-cut operations.

WTC also highlighted that coal prices averaged $527 per tonne in the December quarter, though down from $581 in the September period, this took the average for the first half to a record $552 for the first half.

The financials:

Whitehaven revealed it had generated $1 billion in cash in the December quarter, with an expected $2.5 billion in the first half of the year.

The company expects to report EBTIDA of around $2.6 billion for the half year in February, in comparison with the $0.6 billion in H1 2022.

Whitehaven reported a net cash position of $2.5 billion as at 31 December 2022.

During the December quarter, 40.1 million shares were bought back for $367 million. Since commencing the share buyback program in March 2022, a total of 143.4 million shares have been bought back for $955 million.

Operations:

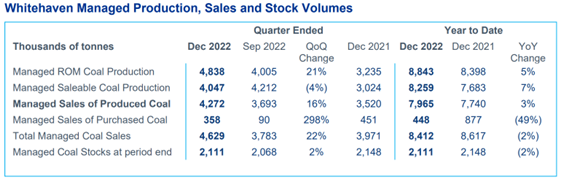

The quarter’s managed run-of-mine (ROM) production totalled 4.8Mt, which was up 21% on the September quarter.

Total equity sales reached 3.4Mt of coal, up 16% on the September quarter and managed sales of 4.3Mt coal, up 16% on the September quarter, and 8.0Mt for the half year (up 3% on the prior period).

WHC expects to see continued thermal coal prices being well supported throughout CY23.

‘“We continue to see strong demand for high CV coal and tight supply, particularly with the sanctions / bans on Russian coal to Europe, Japan and some segments in Taiwan,” the company said.

‘In metallurgical markets, while pricing is relatively strong compared to historical levels, we expect further volatility due to ongoing global economic pressures.’

A word from the CEO:

CEO Paul Flynn commented:

‘During the December quarter, we maintained strong operational performance at our Narrabri underground mine which helped offset the impact of continued wet weather on volumes from our open cut mines.

‘Strong ongoing demand for high CV coal, coupled with supply constraints, underpinned high prices, a solid December quarter and an exceptional first half result.

‘The Company is performing well and delivering strong returns for our shareholders including buying back $593 million of shares in the first half of FY23.

‘Energy security remains a key imperative for our customers throughout Asia, and we are continuing to supply high quality coal through the energy transition for the benefit of all stakeholders.’

Source: WHC

Australia’s next commodity boom

Our resource expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

James is convinced the gears are in motion for another multi-year boom in commodities…a boom where Australia and its companies stand to benefit.

The next big mining boom is predicted to happen in the next few years…the question is, are you ready for it?

You can access a recent report by James on that exact topic AND an exclusive video on his personalised ‘attack plan’ right here.

If that isn’t enough to sate your curiosity, watch this recent interview with James and Greg at ausbiz from the end of last year.

Regards,

Mahlia Stewart

For The Daily Reckoning