‘Life turns on a dime. Sometimes towards us, but more often it spins away, flirting and flashing as it goes: so long, honey, it was good while it lasted, wasn’t it?’

Stephen King

Headlines are looking dire out there.

Pound sterling collapses…the stock market is cratering…energy crisis…inflation…drums of war…risks of contagion…investors losing faith…you name it.

We are at a moment of extreme fear — sentiment is at lows. Which begs the question: Is this as bad as it gets? At least for now?

Of course, no one can answer that question. No one has a crystal ball.

But (barring some major catastrophe), I’m inclined to think that things may start looking better in regard to inflation, at least in the short term, glass full and all.

Don’t get me wrong, it’s likely there’ll still be plenty of volatility ahead. There’s no denying we are walking on thin ice.

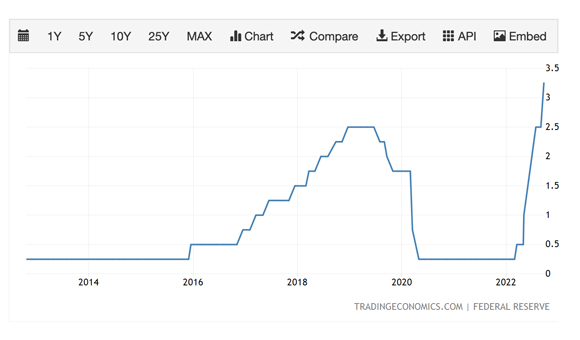

Markets are reacting to an aggressive Fed that’s trying to keep inflation at bay. Last week the Fed raised rates by another 75 basis points and forecasts rates will end the year higher than expected at 4.4%.

One thing to consider is that inflation is a lagging indicator. Much of what the Fed is commenting on is based on data that looks backwards.

The Fed has also been tightening fast this year, way faster than it did in 2018, as you can see below:

|

|

| Source: Trading Economics |

The big risk is that they trigger a recession. But these rate hikes and their effects are still flowing through the economy.

The other thing to consider is energy prices. High energy prices have been driving much of the inflation we’ve seen.

Oil prices, for example, spiked after Russia invaded Ukraine, but oil prices have been falling and are now just under US$80 a barrel.

Fears of a recession and a stronger US dollar are hitting demand.

The US has also been releasing oil from its strategic reserves, which has bumped up supply. Supply is still looking tight, though.

Plenty of what happens with prices will depend on what OPEC+ does next. If they tighten supply to counter falling prices, oil could go higher.

In short, things are looking complicated out there at the moment. So, where to look when things get tough?

Follow the money

One way is to look at where money is flowing — trends that have wind beneath their wings and will play out over the long term for years to come.

One such trend is the energy transition. To me, this is still one of the most exciting corners of it all…one where money keeps pouring in.

In 2022, clean energy investment has continued to accelerate and is expected to hit US$1.4 trillion.

What’s more, most major economies, such as China, the European Union, and the US, are investing big in it.

The US, for instance, has just passed the Inflation Reduction Act. The Act pledges US$369 billion into climate investments over the next 10 years in areas such as solar, electric vehicles (EVs), and batteries.

In particular, the Act should boost EV uptake in the US along with battery demand.

In fact, even with all the doom and gloom out there this year, EV sales have continued to grow.

Over the first half of the year, 4.3 million new EVs were sold, a 62% increase from the first half in 2021. And EV-Volumes expects EV sales will hit 10.6 million units, a 57% growth over 2021.

This has kept boosting battery metals like lithium.

Lithium is still going strong

Lithium prices just reached an all-time high this month, 501,500 yuan a tonne. All in all, lithium prices have been up 122% since the beginning of the year, according to Benchmark Minerals.

And these high lithium prices are feeding into some companies.

While higher interest rates have been hitting the stock market, one stock bucking the trend has been Pilbara Minerals [ASX:PLS].

Pilbara’s share price is up 34% just in the past month.

Pilbara’s battery metals exchange (BMX) auctions continue to show there’s still plenty of demand for lithium.

Last week, Pilbara conducted its latest BMX auction, hitting another record price of US$7,708 per tonne of spodumene.

It’s pretty incredible considering that in July last year, Pilbara was fetching US$1,250 per metric tonne.

Of course, Pilbara isn’t the only one. Allkem’s [ASX:AKE] share price is up 4%, and IGO [ASX:IGO] increased 10% in the past month, to name a few.

Don’t get me wrong, I’m not recommending you buy these stocks, but just showing that it’s not all bad out there and that there’s still plenty of opportunity.

All the best,

|

Selva Freigedo,

For Money Morning

Selva is also the Editor of New Energy Investor, a newsletter that looks for opportunities in the energy transition. For information on how to subscribe, click here.