In today’s Money Morning…What’s going on? Is the war over?…gold is also correcting after a strong run…where we can find opportunities…and more…

|

In today’s Insider, I’m going to give you a sneak peek of where we think this year’s biggest opportunities are brewing. To really see and understand this opportunity, you have to have a willingness to block out some of the noise and look where others aren’t right now.

More on that in a moment. But first, let me create a little noise of my own and bring you up to speed on the latest big moves across global markets.

Asset prices are like a chaotic tidal ocean right now. Capital is rushing back and forth, and in and out…it doesn’t know where to go. Overnight, gold and oil continued their sharp falls while stocks rallied sharply, reversing previous sharp falls.

For a while there, gold and oil were THE trades.

But now, the tide is rushing out again. Oil is back below US$100 a barrel and gold is trading close to US$1,900 an ounce.

What’s going on? Is the war over?

No. But there are a couple of reasons for the falls. In the case of oil, one is that investors realise that the cure for high prices is high prices. From the lows of December 2021 to the recent high, the price of oil doubled.

That’s a price shock that will lead to demand destruction, as consumers change their behaviour.

This, along with Chinese authorities imposing restrictions on its citizens’ movements due to COVID, provided enough of a reason for profit-taking to smack the price down.

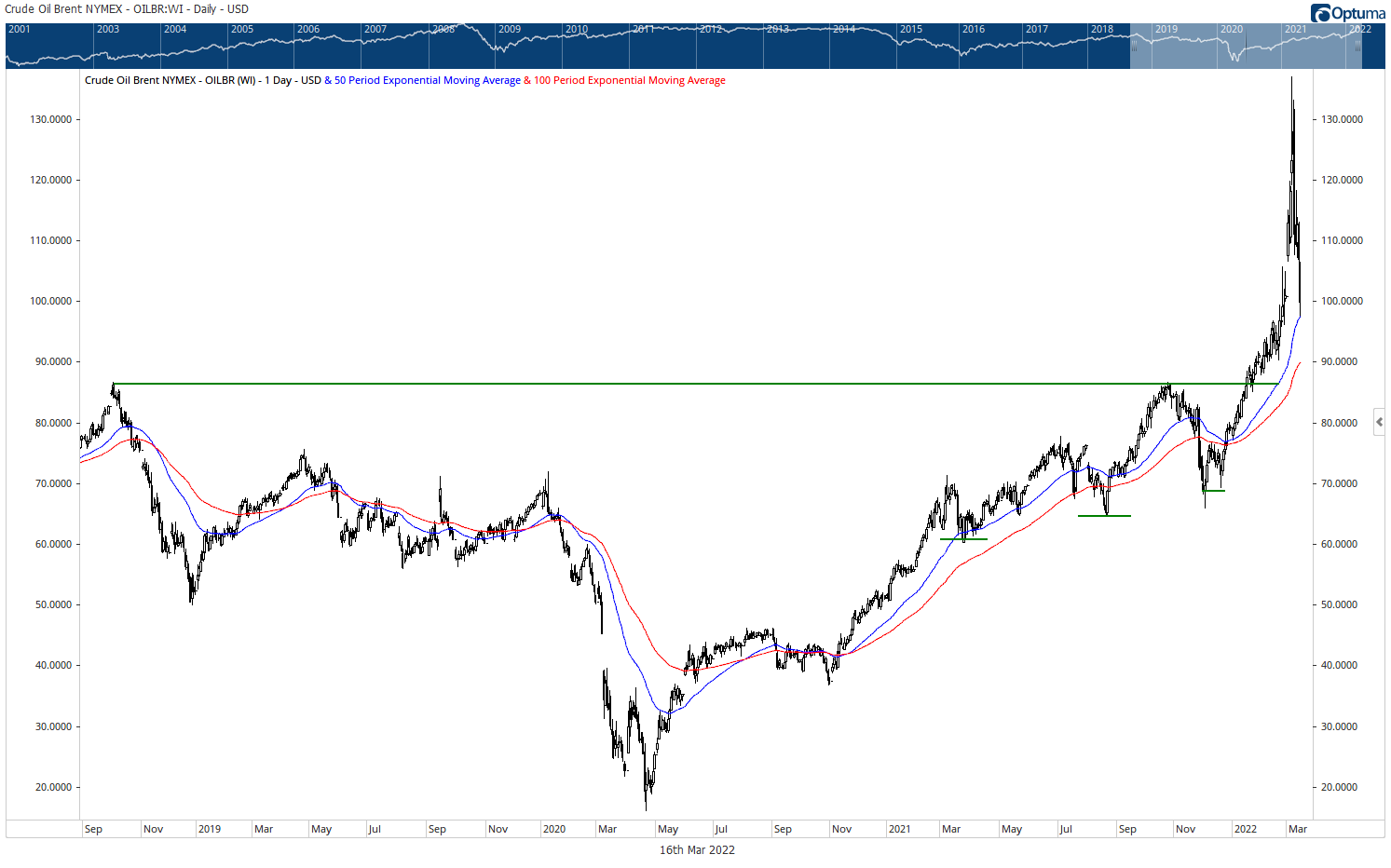

But if you look at the longer-term chart of Brent crude below, oil remains in a healthy position.

The breakout from the 2018 and 2021 highs is around $US86 a barrel. The price is currently well above here, at around US$99 a barrel. (It bounced off the 50-day moving average overnight.)

|

|

| Source: Optuma |

I would guess that oil is now in for a decent period of consolidation. A long-term price in the US$90–100 a barrel region would be both good for oil stocks and manageable for the global economy.

Gold is also correcting after a strong run. Before you think it’s time to get out, though, take a look at the chart below:

|

|

| Source: Optuma |

After a strong breakout, gold is now giving back some of those gains. But the moving averages have turned up and the gold price remains well above them. So the yellow metal still looks bullish to me. And the fact the gold stocks didn’t move sharply higher with the gold price suggests we’re in the early stages of a stealth bull market.

As much as I’m bullish on gold longer term, there is another corner of the market that I think offers an even bigger opportunity this year.

From an index perspective, the Aussie market has held up very well this year. While the Nasdaq is down more than 20% from its highs and the S&P 500 is down around 13%, the ASX 200 is only down around 7% from its August 2021 high.

Obviously, our heavy weighting to commodities helps.

But we’ve also got a central bank that’s not in a rush to raise rates, unlike their central bank counterparts overseas.

Which is weird. The commodity price spike will provide Australia with a big boost to national incomes. In the (distant) past, the RBA has tightened monetary policy in this situation. But now they’re taking a wait-and-see approach. They’re erring on the side of easy money.

No wonder the broader market is holding up!

But as the old saying goes, it’s a market of stocks, not a stock market. And underneath the hood of the benchmark index, there has been plenty of pain inflicted in individual stocks.

Zip Co is down more than 80% over the past 12 months…

PointsBet is down 75%…

Kogan.com, PolyNovo, and Appen are all down more than 60%.

That’s just over the past 12 months. The falls from the highs are in many cases a lot worse.

And I’ve only shown you a handful of stocks in the visible All Ordinaries Index. There are many, many companies outside of the All Ords that have already been hit hard and you don’t even know about them.

You see, what happens in bear markets or times of stress is that capital gravitates towards ‘safety’. Size and liquidity come at a premium, and tiny illiquid stocks get left behind.

Now, if you’re in these stocks, it can be a disaster. Prices can fall considerably without fundamentals or the earnings picture changing.

But if you’re looking at these stocks for opportunities AFTER the falls, the potential returns can be life-changing.

Especially if you have a proven trading system for identifying when the bottom is in, and the momentum is shifting back to the upside.

You can find one such system with the stock picking team behind Australian Small-Cap Investigator, by the way.

Or you can switch gears entirely…to the crypto market.

You may or may not know that I also work on a one-of-its-kind letter alongside Ryan Dinse called New Money Investor.

Just as it’s a pivotal time for commodities, stocks, and gold (the traditional sound money), it’s also a pivotal time for digital sound money.

To some people, it’s the single biggest financial revolution in centuries.

To others, it’s a scam — fit only for drug dealers, criminals, and speculators.

And, of course, there are plenty of people who just don’t quite know what to make of it all.

Whatever your views on Bitcoin [BTC] and the wider crypto markets, it’s clear that you need to — at the very least — have a grasp on how it all works.

Increasing numbers of people are making it a part of their long-term plans.

According to the Australian Taxation Office, more than 800,000 Aussies have used digital assets like cryptos since 2018.

And there are countless companies and major institutions racing to adopt crypto technology, including Tesla, Goldman Sachs, Visa, Mastercard, and at least 30 different central banks.

That might be scary…exciting…or a little of both.

But there’s no doubt you need to get to grips with how the world of ‘new money’ works.

It’s not going anywhere.

And that’s why we recently put together a four-part New Money Masterclass — the first episode of which you can view for free right here.

In it, Ryan will explain why there’s never been a better time to finally dive into the world of cryptos.

And he’ll name the number one move he recommends you make today if you want to capitalise on the new money revolution.

It’s not just buying bitcoin or Ethereum [ETH]…in fact, I think you’ll be surprised by what he’s recommending.

Regards,

|

Greg Canavan,

Editorial Director, Money Morning