At time of writing, the share price of Afterpay Ltd [ASX:APT] is down 1.76%, to $71.04.

You might be asking, why is the APT share price down?

It could be as simple as a capital raise and the sale of $250 million worth of shares by co-founders Anthony Eisen and Nick Molnar.

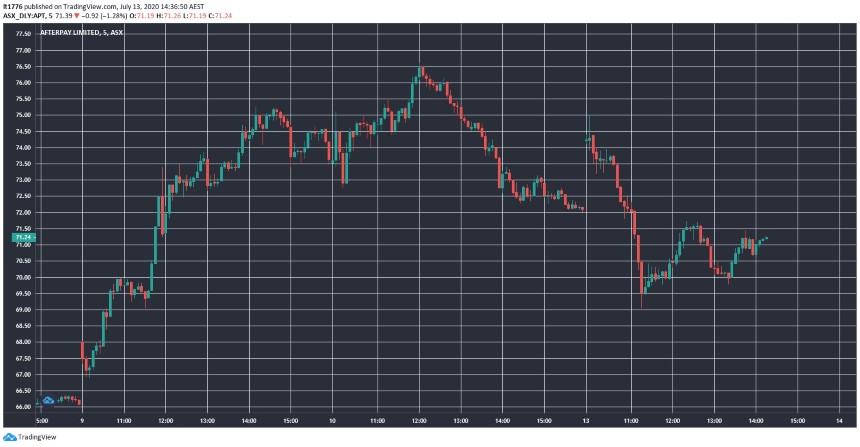

You can see how trading played out since 9 July:

Source: tradingview.com

We take a look at how you could go about valuing a company that still isn’t profitable.

Analysts don’t know what to make of the APT share price

There are widely fluctuating price targets for the APT share price.

UBS, for instance, thought it should be $27 in June.

Bell Potter has it at $81.25.

And today, the AFR reported that Goldman Sachs lifted its target to $70.15 from $25.75.

So, based on this, the current price of APT shares would be potentially ‘fairly valued’.

Why such wild discrepancies amongst analyst assessments though?

I think it comes down to three primary factors:

- Growth

- Competition

- Ability to monetise user base

Now on the growth front, the recent capital raise was pitched to expand its reach in existing and new markets.

This could mean Europe and Southeast Asia.

As for competition, there are now a host of buy now, pay later (BNPL) stocks out there, many going for the holy grail of US retail.

For instance, there is Sezzle Inc [ASX:SZL], whose share price went through the roof on a recent trading update.

With so many huge winners in the BNPL space, it’s within reason to say we are approaching bubble-level growth.

It’s not quite the same as the Dutch tulip craze, but at some point, reality may set in.

Finally, Afterpay’s user base could hit 47.8 million by 2030, according to Goldman Sachs.

That would represent nearly a fivefold growth on current numbers.

The thing is…they still aren’t profitable.

Which brings us to a crucial point.

Price to sales — a key figure to watch

The APT price to sales ratio stands at just over 78.

Even if this were P/E, that would be at the high end of the tech stock spectrum.

This is the real story, not the director sell-down, I believe.

For example, there was a significant amount of handwringing in one particular article in the AFR today.

To quote the author on the change in policy on director sales:

‘As if anticipating this insufficiently bendable hurdle, Afterpay’s board released a new securities trading policy … last Monday, the day before the capital raising! The new policy invalidates trading restrictions in any “other circumstances pre-approved by the board in its discretion, subject to compliance with insider trading rules”. Why even have a policy? This clause might as well read: “Whatever Anthony Eisen wants, whenever he wants it.’

The hoopla surrounding the sale of shares by directors is a smokescreen though.

The longer-term story is about how the price to sales ratio can come down as the company moves towards profitability.

To do this, macroeconomic factors will likely need to play a role.

Even if payments are interest-free, you still need to be able to pay them.

And to do that, you need income, i.e. a job.

Jobs are drying up globally and e-commerce merchant sales may only get you so far.

Goldman Sachs indicates that on an EV/sales basis by FY2022, APT shares may trade on a multiple of 25.

Which means APT shares may go for $104 a share by then.

If this is the true value of APT shares, you can therefore see how its share price growth in the coming years could be more modest.

A price target means nothing if you don’t put a time frame on it.

I’d be tempted to agree with Goldman Sachs on the more muted growth through to 2022.

APT is a powerful touchpoint with the younger generation and monetising this relationship will be key going forward.

Their progress on this front could show up as a more sensible price to sales ratio.

Regards,

Lachlann Tierney,

For Money Morning

PS: Four Innovative Aussie Stocks that Could Shoot Up during and after Lockdown.

Comments