I sometimes like to surprise our editorial director Greg Canavan with a random quote to start Fat Tail Investment Research’s new podcast What’s Not Priced In.

This week, the quote came from a 1976 article (an oldie but a goodie) in the Financial Analysts Journal by then-editor Jack Treynor.

Here is Treynor’s ageless wisdom:

‘There are two kinds of investment ideas. Those whose implications are straightforward and obvious, take relatively little special expertise to evaluate, and consequently travel quickly (like hot stocks). And then there are those ideas that require reflection, judgment, special expertise, etc., for their evaluation, and consequently travel slowly.

‘Pursuit of the second kind of idea — rather than the obvious, hence quickly discounted — is the only meaningful definition for long-term investing.’

I found Treynor’s idea of categorising investment implications by speed of uptake to be very insightful.

Implications that travel quickly are discounted quickly — that is, priced in by the market with haste.

Like Treynor said, usually, the quickest travelling ideas are associated with hot stocks, popular press stocks, and ‘meme’ stocks.

A good example of this is lithium hopeful Lake Resources [ASX:LKE]. The stock was one of the best-performing stocks on the All Ordinaries [INDEXASX:XAO] in 2021.

But the thesis for LKE — that electric vehicles (EVs) are the future and lithium supply is constrained — was somewhat ‘straightforward and obvious, [took] relatively little expertise to evaluate, and consequently travel[led] quickly.’

The investment idea behind LKE was relatively obvious — and was ‘quickly discounted’.

Since hitting an all-time high in April 2022, LKE is down nearly 90%.

Treynor’s quote encapsulates the spirit of What’s Not Priced In. Judging from his reaction when I read out the quote, Greg seemed to agree.

But you be the judge! Here’s the latest episode

Aussie market correction and signs of slowdown in business conditions

Yesterday, the ASX 200 fell a whole 1.6%. No sector was spared, especially not the tech sector.

As I’m writing this piece nearing midday, the benchmark index is down a further 1%.

With the Aussie market correcting, are investors twigging on to the lagging impact of rising rates?

Not quite yet, according to Greg. Or, at least, not to the extent that they should.

Earlier this month, NAB released its monthly business survey.

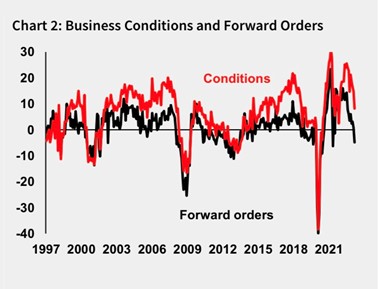

It revealed that forward orders — which led business conditions by a few months — ‘fell sharply and if sustained will likely see a further sharp slowing in demand’.

Source: NAB

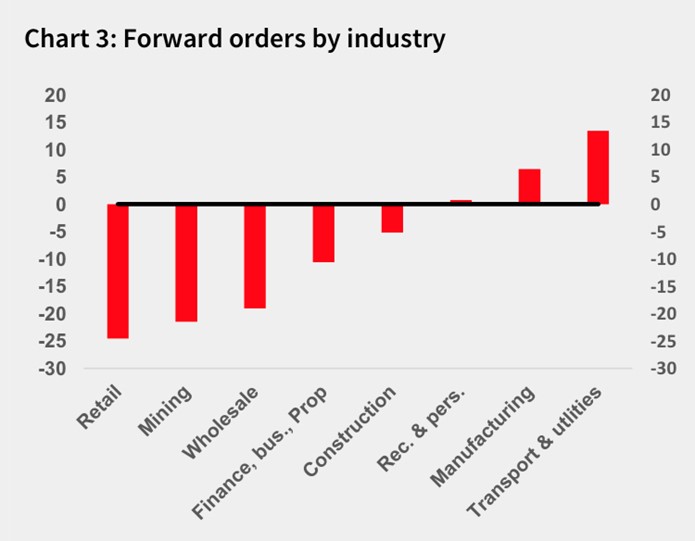

The worsening conditions were most pronounced in, you guessed it, the consumer sector, ‘where forward orders in both retail and wholesale fell sharply and are now the weakest of all industries’.

Corroborating the assessment from forward orders was the huge profit downgrade from retailer Best & Less Group Holdings [ASX:BST] this week.

UBS then downgraded its outlook for retail stocks.

But other firms issued downgrades, too. Like IDP Education [ASX:IEL], REX Express Holdings [ASX:REX], and Fletcher Building [ASX:FBU].

Source: NAB

NAB concluded its latest business survey report with this corker:

‘Historically, there have been very few periods of negative orders outside of downturns in the economy.’

Clearly, the Reserve Bank’s rapid hiking cycle is starting to hurt. So, is the RBA — and other central banks like the US Fed — done raising rates?

Anecdotally, this contrarian magazine cover could suggest so:

Source: The Economist

As we like to say on the podcast, if it’s in the press, it’s likely in the price.

Nothing strange about markets withstanding rate cycles

Speaking of interest rates, Greg had a great section during the podcast on why the stock market can be seemingly impervious to rapid interest rate hikes.

History serves as a guide.

Here’s economist David Rosenberg:

‘So, the point is this: there is nothing strange about the stock market withstanding the Fed tightening cycle: it happens almost all the time. All the bad stuff happens AFTER the last hike as all the lags from the prior tightening cycle kick into the economy and earnings…and we have yet to see that chapter written.’

Source: Optuma

So when will the next chapter be written? And how will it look like?

Watch the full episode to find out!

Regards,

Kiryll Prakapenka