At time of writing, the share prices of Sezzle Inc [ASX:SZL] and Openpay Group Ltd [ASX:OPY] are both down more than 12% and 5% respectively.

This leaves the SZL share price trading at $8.79 and the OPY share price trading at $2.73.

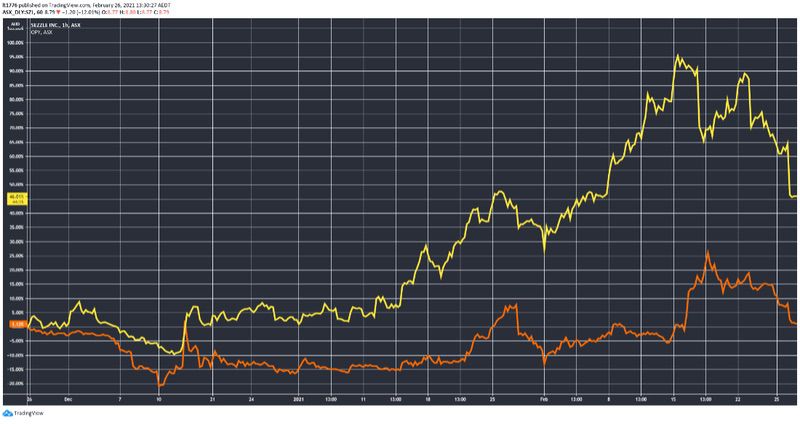

As you can see in a three-month window, the SZL share price ran up harder than the OPY share price, but both have a rather nasty looking dive playing out at the moment:

Source: tradingview.com

Is this the beginning of the end? We look at the most recent results for SZL and OPY, and the outlook for both BNPL stocks.

Results could be taken differently if bond yields didn’t cause a sea of red today

You can see the highlights from SZL’s results below:

‘● 2020 UMS and Total Income rose 250.8% and 272.1% YoY, respectively.

- Merchant Fees (80.9% of Total Income) for 2020 increased 266.9% YoY.

- Active Consumers and Active Merchants reached 2.2M and 26.7K, respectively, as of 31 December 2020, representing YoY increases of 143.9% and 166.6%, respectively.

- Net Transaction Margin (NTM) was US$12.4M in 2020 (1.4% of UMS) compared to US$0.6M in 2019 (0.2% of UMS).

- Strong positive trends continued in January 2021 with Active Consumers reaching 2.4M (up 5.7% MoM), Active Merchants rising to 29.2K (9.5% MoM), and UMS of US$117.8M, representing a record month and 65.1% above the average monthly pace for 2020.’

To go with SZL’s $250 million receivables agreement with Goldman Sachs.

And OPY’s results below as well:

‘• Active Plans of 1,447k up 213% relative to pcp1

- Active Customers of 461k up 123% relative to pcp, with 78% of new plans generated from Repeat Customers and 49% of Active Customers with more than one plan

- Active Merchants of 2,766 up 46% relative to pcp; percentage of Active Merchants per vertical strongest in key verticals of Automotive and Healthcare at 43% and 37%, respectively

- Total Transaction Value (TTV): strongest half on record, up 96% in H1 FY21 vs pcp, to $165m; revenue of $13.4m, up 63% relative to pcp

- Solid path to profitability, with gross revenue yield of 8.1% (H1 FY20: 9.8%); net transaction margin of 1.4% (H1 FY20: 4.0%), and net bad debt ratio of 2.0% (H1 FY20: 2.2%)

- Openpay remains well funded with a strong mix of available cash and debt for a total funding runway of $173m to support expected portfolio growth

- Cost of funding reduced by ~50 bps in H1 FY21, driven by optimisation of the portfolio’s funding mix’

Normally this would be cause for enthusiasm from investors.

But today it’s a bit of a different picture, with US tech stocks selling off bleeding through to the OPY and SZL share price action.

The culprit?

Well, it’s complicated, but here it is in a nutshell.

Higher inflation expectations driven by recovering economies and vaccine rollouts are driving bond yields higher, meaning the value of future earnings decreases, in turn hurting tech stocks.

The same stocks that propped up indices in the market recovery.

It’s something that’s been on the cards for a while, and just as bad news isn’t always good news, good news isn’t always bad news.

It’s a complex situation but here’s what I think of the two stocks.

Outlook for SZL and OPY share prices

If you look at the chart, the two BNPL stocks move in lockstep almost.

The same macro factors affect their share price performance.

And I think we may be getting closer to a situation where the BNPL market is saturated — something I discuss in detail in the video below on most recent BNPL entrant, Credit Intelligence Ltd [ASX:CI1]:

And if you want more BNPL commentary, you can also watch this video:

If reading is more your thing, then be sure to check out this small-cap fintechs report too.

If you are looking for alternatives to BNPL stocks that have already bolted, it’s a must read.

Regards,

Lachlann Tierney,

For Money Morning