There’s a very funny episode of the classic South Park series that aired just before the 2004 US election between George W Bush and John Kerry.

In the episode, Kyle tries to convince everyone that his candidate, a giant douche, is better than Cartman’s nominee, a turd sandwich.

Although a bit crude, like all good satire it was funny because it had a ring of truth to it.

I don’t know about you, but politics to me these days feels a lot like choosing the least worst of two bad choices.

Maybe not between a giant douche or a turd sandwich but not too much better!

But like it or not, as investors, the political situation will have some bearing on what happens in investment markets.

After our own, the US political scene is probably the most important for Aussie investors.

So, what does this year’s US election in less than two months mean for your investment strategy?

Let’s have a look…

Ready for anything

First up, it’s worth pointing out that long term these elections turn out to have less effect on markets than you might think.

Though it’s politically convenient these days to try and persuade the electorate that your opponent will spell doom for markets, history suggests it never does.

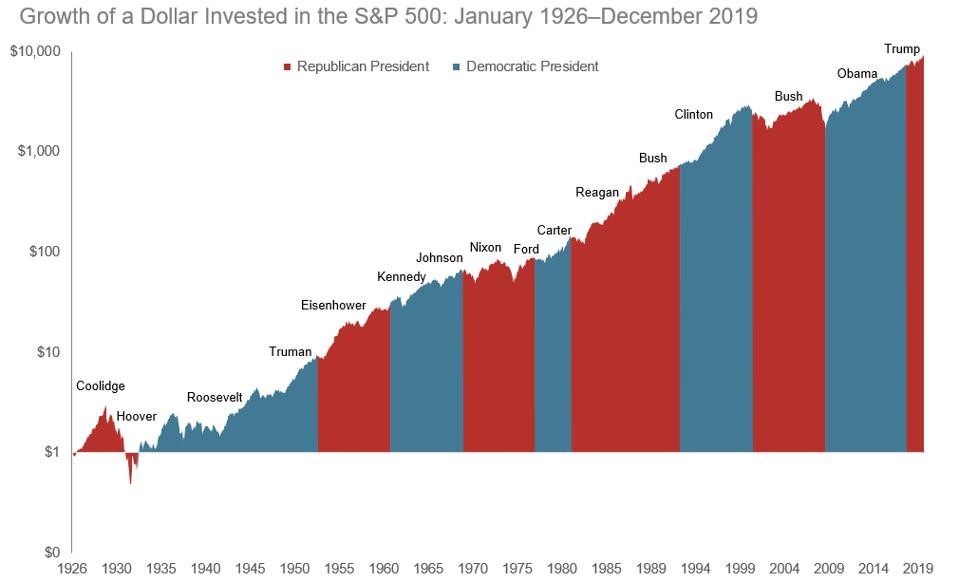

Check out this chart:

|

|

|

Source: Forbes |

As you can see in the long term, Republican or Democrat, the market seems to continue its merry way upwards.

But shorter term, the effects are a bit more real.

The number one of which is increased volatility. Historically, volatility in the stock market is elevated in the months leading up to the election.

Which makes sense.

Markets hate uncertainty, and the hyper-partisan politics of today create more uncertainty than ever.

Also interesting is the fact that US stocks tend to perform better during an election year compared to the year after.

Though interestingly, the returns on international stocks tend to do better the year after a US election.

That’s the broad theme, but what can you expect specifically? What happens in markets if Trump gets re-elected, or if Joe Biden becomes president?

Here are four scenarios that could play out…

From blue wave to red dawn

Broadly speaking there are four possible scenarios to prepare for as an investor.

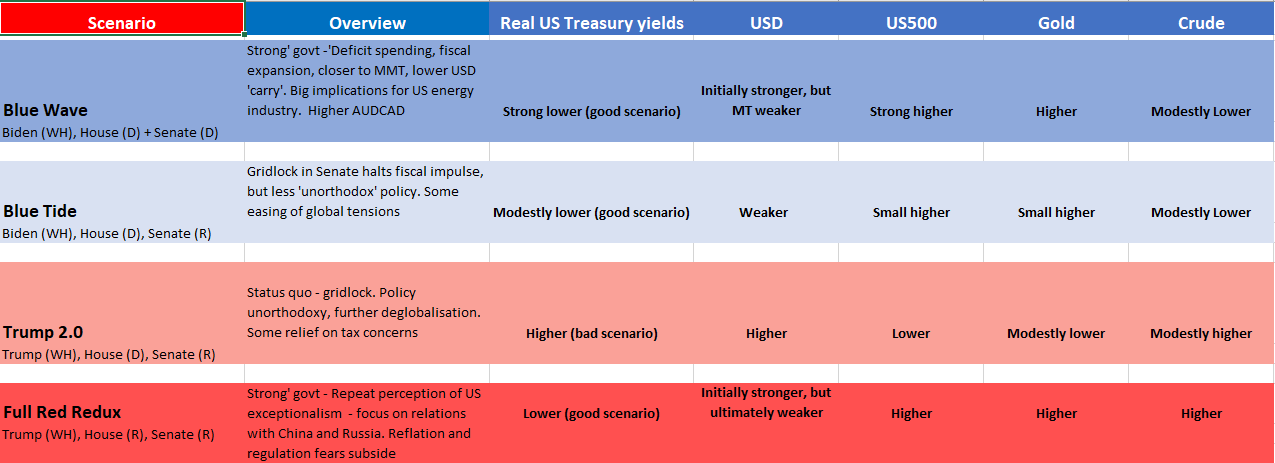

This graphic put together by Head of Research at Pepperstone, Chris Weston, explains it very well:

|

|

|

Source: Twitter @ChrisWeston_PS |

According to Weston, if Biden wins comfortably and the Dems control both the House and Senate, we can expect a lot of government spending.

I’d agree with that.

If that happens, that should be good for markets, especially commodity prices, but also for gold as further confidence is lost in the US dollar as a sustainable store of value.

At the other extreme is the prospect of a Trump landslide.

Again, that could be good for markets and gold, but also oil.

I think that conclusion has just been reached by Trump’s propensity to pick winners, and in energy he prefers fossil fuels to tech.

The middle outcomes are the more uncertain ones for the economy.

Gridlock in the Senate and political gamesmanship from either side could stop any government from functioning as we try to exit the COVID crisis.

As it stands the odds-on result (40%), according to Moody’s Analytics, is for a Biden victory with the House and Senate divided.

The least likely outcome is the red sweep at just 5%.

But this is the important point today…

Regardless of who wins, there’ll always be investment opportunities for those who keep their heads.

Good investing,

|

Ryan Dinse,

Editor, Money Morning