The Splitit Ltd [ASX:SPT] is partnering with UnionPay, a network of more than nine billion cards. We analyse what this can mean for Splitit’s growth.

On Tuesday, two buy now, pay later players released ASX updates.

One stock closed up 8.3%, the other closed up 17%.

The first stock was Splitit and the second was Zip Co Ltd [ASX:Z1P].

The double-digit jump came after Zip announced its March quarter results, which showed Zip’s US subsidiary Quadpay adding 674,000 customers during the quarter.

Quadpay’s US customers now total 3.8 million, with Zip’s revenue rising $54.4 million or 188% year-on-year.

Zip continued to dominate the news this week after revealing today that it has successfully priced $400 million zero coupon senior unsecured convertible notes due 2028.

The initial conversion price of notes at $12.39 per share represents a conversion premium of 35% over the reference share price.

Zip’s big announcements threatened to overshadow the news that Splitit has partnered with a major bank card services provider in a bid to expand into the large Asia Pacific shopper base.

In some ways, Splitit may be considered the little sibling of Afterpay Ltd [ASX:APT] and Zip.

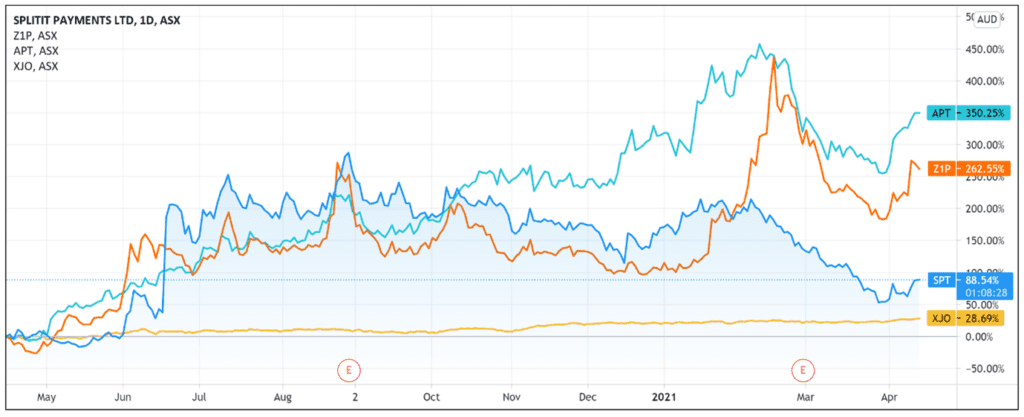

Over the last 12 months, Afterpay and Zip have left Splitit behind, with APT shares up 350% and Zip shares up 270%.

In the same time period, the SPT share price is up 75%.

But can the UnionPay partnership propel Splitit into the same ranks as its bigger BNPL rivals?

Splitit partners with UnionPay

On Tuesday, the BNPL provider announced a partnership with UnionPay International, part of China UnionPay, a major card scheme in mainland China.

The deal will see UnionPay International integrating Splitit to make it available to its network.

UnionPay card holders can then accept to utilise Splitit’s instalment payments option.

The BNPL provider noted that all UnionPay credit card holders could use Splitit’s interest-free and fee-free instalment payment option at any merchant offering Splitit from June FY21.

According to Splitit CEO Brad Paterson, the partnership is ‘another significant milestone in Splitit’s Asia Pacific expansion strategy to boost consumer adoption and merchant acceptance.’

SPT reported that the UnionPay global acceptance network extends across 180 countries and regions, covering 55 million merchants.

Splitit also stated that more than nine billion UnionPay cards (debit and credit) are issued in 68 countries, with 150 million of those cards issued outside mainland China.

Splitit share price outlook

While Afterpay and Zip are chasing the large market in the US, a pivot to Asia could be a shrewd strategy for SPT.

Certainly, that is what IOUpay Ltd [ASX:IOU] is doing with its focus on the Southeast Asia market, particularly Malaysia.

China is a huge market and can present Splitit with a major opportunity.

SPT CEO Brad Paterson stated that the partnership will lead to ‘increased relevance to more cardholders and merchants’ and will, in turn, ‘accelerate our merchant sales volume.’

But there are big caveats.

Major e-commerce and online payment platforms in China already have options for deferred payment.

But in contrast to the likes of the US and Australia, most of China’s retail giants developed their own payment instalment products.

According to a recent report by 58 Finance in June of 2020, the credit arms of major Chinese e-commerce players like Alipay Huabei, JD Baitiao, and Suning Renyifu had the ‘highest penetration (79 percent) with Chinese payment instalment consumers during the first half of 2020.’

And finally, Splitit itself noted that the ‘economic materiality of the agreement … is unknown due to the contingent nature of results that may be generated.’

Currently, SPT considers that the UnionPay partnership is ‘unlikely to yield a short-term economic benefit for Splitit.’

If you’re interested in the changing payments landscape and wondering if there are other fintech investing opportunities apart from the saturated BNPL space, then definitely read our free report on three innovative Aussie fintech stocks with exciting growth potential.

Download the free report here.

Regards,

Lachlann Tierney,

For Money Morning