In August 1985, the first Back to the Future movie was released.

Marty McFly (played by Michael J Fox) travelled back and forth through time in a purpose-built DeLorean time machine — a pretty cool way to see the past and future.

When Back to the Future appeared on the big screen, the Dow was around 1,300 points.

Little did we know what the future (or, more to the point, central bankers) had in store for asset prices.

And to be fair, without the benefit of the magical DeLorean, how could we possibly have known?

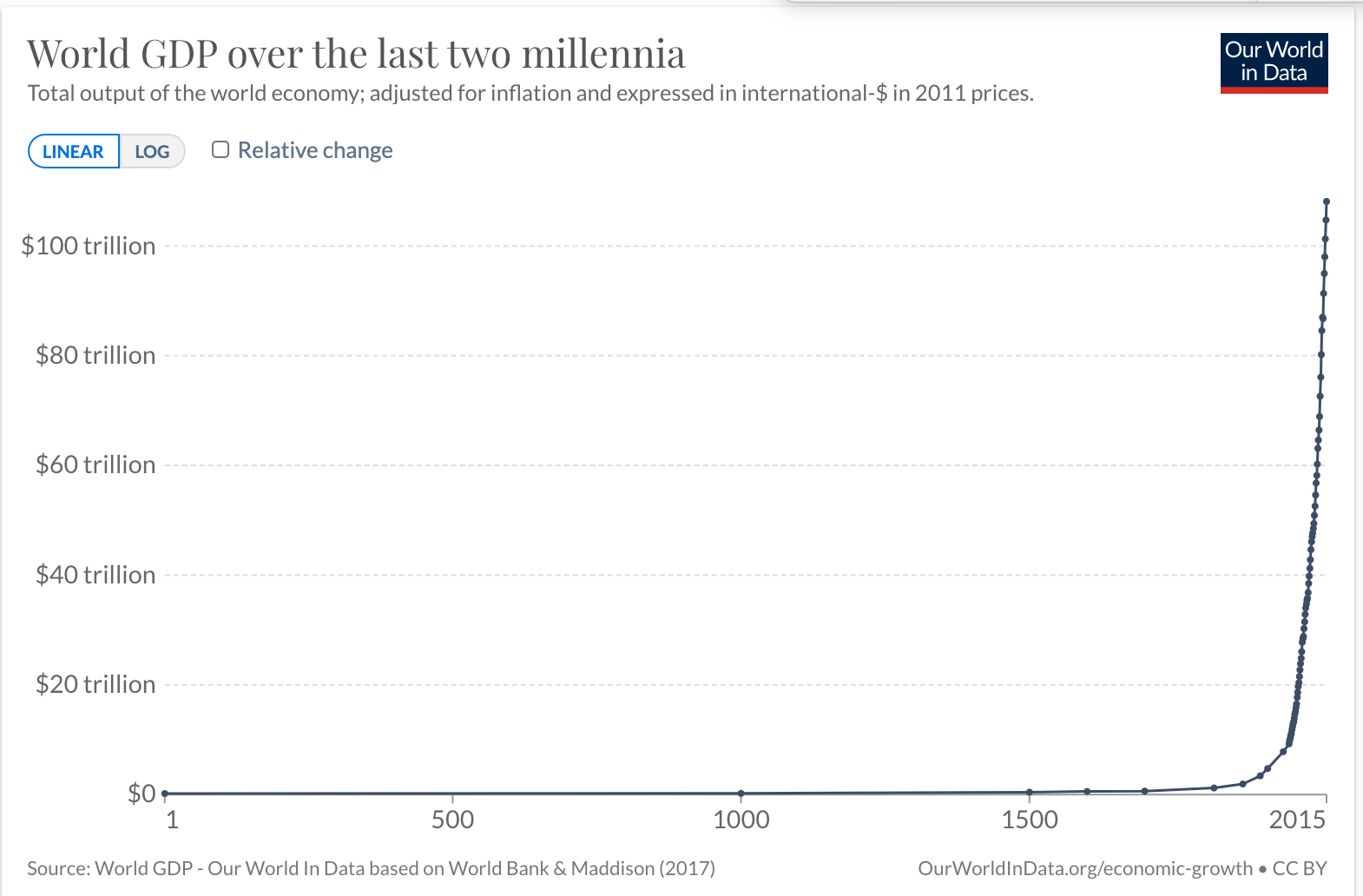

In the 2,000-year history of economic progress, the concept of exponential growth was a relatively new phenomenon.

|

|

| Source: Our World in Data |

Going back in time, we see the seeds of change were sown with the first Industrial Revolution (1750 to 1830).

The pace of change and progress picked up considerably with the second Industrial Revolution.

Mechanisation. Sanitation. Medication. Population. These ‘game changers’ propelled society forward.

All these factors contributed to increasing living standards in the developed world.

Life expectancies, incomes, and household net worth all rose during a purple patch of economic growth.

The equation for economic growth is straightforward — increased workforce and/or increased productivity.

Women entering the workforce.

Machines replacing manual labour.

A near quadrupling in global population (creating demand).

Doubling in life expectancies.

These one-off factors all contribute to increasing the economic pie.

More people producing more goods and services more efficiently for more consumers (who had more years to live)…this combination of ‘mores’ was the recipe for economic success.

However, these one-offs have gone stale.

According to Live Science:

‘Many scientists think Earth has a maximum carrying capacity of 9 billion to 10 billion people.’

The current population is estimated to be 7.5 billion. Not much upside left there.

Population growth — as an annual percentage — is slowing and could conceivably go into reverse.

Productivity gains are proving harder to come by. Technology is marginally increasing productivity. However, these gains come with an offsetting ‘un and underemployment’ cost.

Women cannot reenter the workforce again.

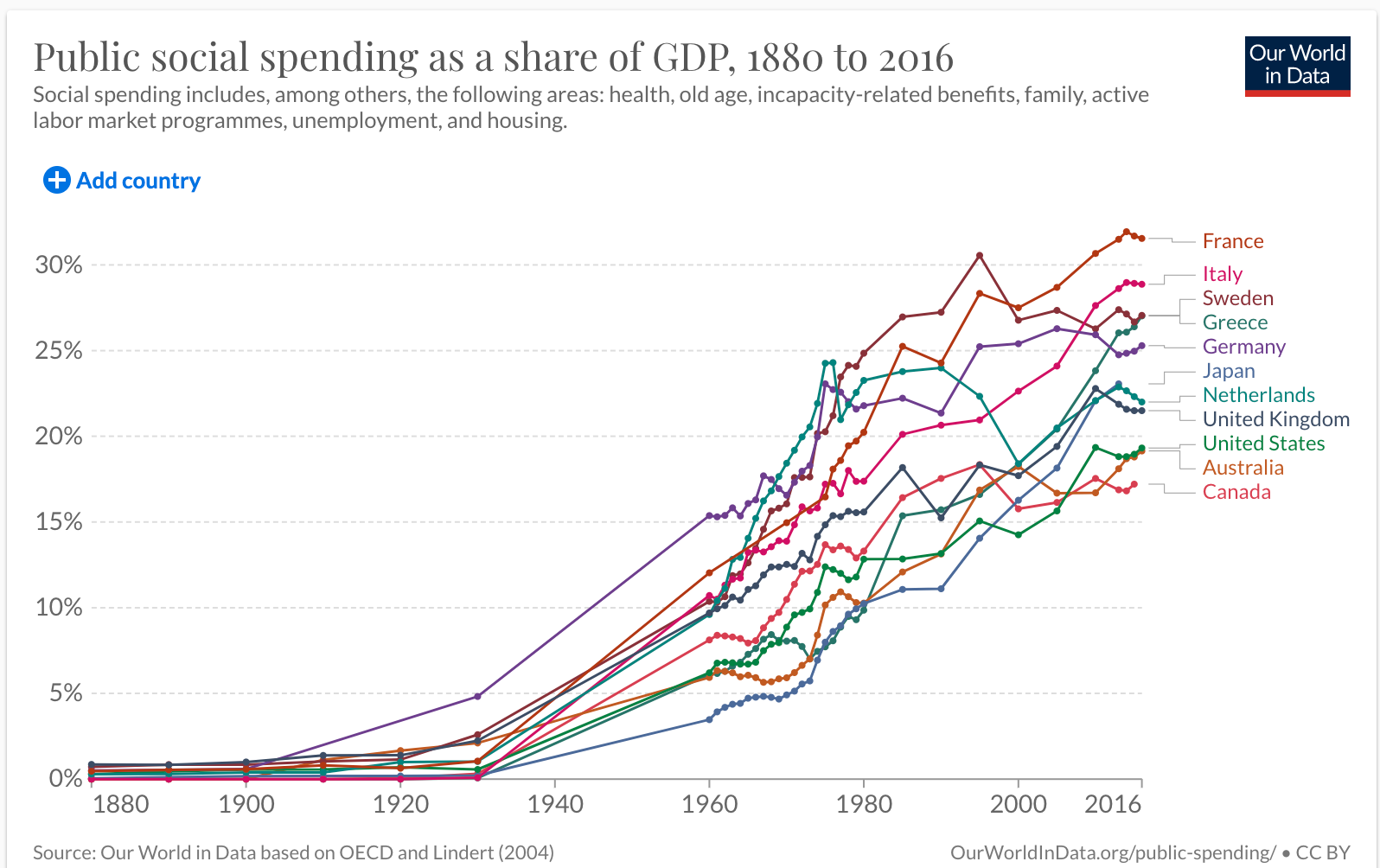

With the cost of social spending (as a percentage of GDP) steadily rising, a further increase in life expectancy is going to place further strain on Western government budgets.

|

|

| Source: Our World in Data |

Logic tells us any change in the ingredients that baked the exponential economic pie should deliver a different outcome.

However, most people are making plans based on the premise of ‘what has been will continue to be so’.

Our decisions are influenced by decades of conditioning…especially the period since 1985.

However, this was a unique moment in time…one that was made even more exceptional by blatant central bank intervention in market operations.

Folks, we have borrowed from the future to finance today’s flight of fantasy.

Have you considered that after the next significant market crash we might possibly be on the cusp of another revolution and not just a period of fine-tuning?

A glimpse into the future

Let’s hop into Marty McFly’s DeLorean for a quick glimpse at the future.

Advance warning: the DeLorean’s demister is not working all that well.

Therefore, the best we can do is look through the haze and piece together the story with a mix of facts and guesswork.

The folly with looking into the future was laid bare in the 1970s and ‘80s.

Remember how the video recorder was going to be the death of movie theatres? Not so.

Back then, technology was being hailed as our saviour.

A future with more leisure time awaited. Wrong.

People are connected 24/7 and responses are expected 24/7.

Stress management is big business.

The facts (or at least what we think the facts) are:

- Automation/robotics/artificial intelligence is here to stay. As we’ve seen with mobile phones, as the cost of automation decreases, the functionality and capability will improve and increase.

- Labour costs in large parts of Asia and Africa are a fraction of the developed world. In a competitive world, capital will migrate to these areas to maintain a decent return on investment.

- In the 19th and 20th century, innovation mainly originated from the developed world. Today, innovation can come from anyone with internet access…millions of people will be looking at ways to do things better, faster, differently, or introduce goods and services we never knew we needed.

Therefore, the pace of developing a ‘new normal’ economy could be much quicker than any of us can imagine.

The Western world’s perceived entitlement to a first-world lifestyle is most at risk from these powerful forces of creative destruction. Resting on our laurels and a sense of entitlement make us vulnerable to rapid change.

The exponential growth of the 20th century has left us with a legacy of debt, demographics, and deficits.

These are significant handicaps that, in all probability, can only be resolved by market forces.

Politically, the willpower is not there to change society’s debt dependency and entitlement mentality. These ‘beliefs’ are too deeply ingrained.

Squinting through the fog from our DeLorean, it looks like shock treatment over a sustained period of time is the most probable outcome. Not too dissimilar to what the citizens of past fallen empires endured.

If something can’t go on, then it won’t.

If this outlook is somewhat accurate, then first and foremost, it would be prudent to err on the conservative side with our capital…more cash, less equity, and no debt.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

Deflation, not inflation, is in our future

The destructive forces of a market solution — bankruptcies reducing debt loads, capital values being reduced significantly, pension fund insolvencies — are deflationary forces…we saw that in the immediate aftermath of the GFC.

The creative destruction from automation and competition from lower labour-cost countries are also deflationary influences.

The combination of market destruction and creative destruction are likely to herald in a period of persistent deflation, like Japan has experienced since 1990.

This is the equal and opposite of what we experienced in the 20th century…when the powerful drivers of economic growth produced inflationary pressures.

If the 20th century was a period of ‘more’, then the 21st century is shaping up to be one of ‘less’.

Less economic growth (due to a massive debt overhang).

Less debt accumulation (this will happen after a full-blown debt crisis).

Less population growth…especially with declining birth rates in the Western world.

Less employment opportunities (more automation).

I know this thinking is at odds with the current inflation narrative.

However, a major reversal in personal fortunes (due to a significant market event) could herald in period of private sector austerity…something we haven’t seen since the 1950s.

In an inflationary environment, capital gain is the preferred investment strategy…asset prices rise with inflated values.

With deflation, the opposite holds true. Income is highly prized. Any capital gain should be treated as an added bonus.

My DeLorean view of the future is one of enormous change that few have even considered, let alone prepared for.

With adversity comes opportunity.

In my opinion, erring on the side of caution — less exposure to overvalued and overhyped markets and less debt — is the best way to survive and eventually thrive from a future that’s going to be vastly different to our recent past.

Thank you

The immediate future has far more clarity.

The next few days are going to be a special time to be with those we love. These are the people whose presence in our lives makes us rich in what truly matters. Enjoy.

Thank you for all your support and feedback in 2021.

From my family to yours, I wish you a very happy and safe Christmas and sincerely hope 2022 is a year filled with an abundance of good health, quality relationships, intelligent conversations, exciting opportunities, and financial well-being.

Until 2022.

Best wishes,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.