There’s a great scene in the film The Big Short.

A worried investor is in Michael Burry’s office complaining about the money his fund is losing.

Burry responds to his concern:

‘I may be early, but I’m not wrong.’

‘It’s the same thing, Michael!’ the irate investor replies.

In my opinion, his investors were right to be worried!

Burry is the man who famously bet against the US housing market before the 2007/08 subprime mortgage crisis.

In the end, he was right and made a bundle.

He was ‘short’ — meaning he was betting on values falling — so he made a big profit when the value of supposedly safe mortgage bonds dropped hard.

It was a ballsy trade, and he’s now considered by many as an investing legend.

But the truth is it was a very close-run thing…

You see, Burry had been short since 2004, when he first spotted the huge bubble in subprime bonds.

It would be three years before he would profit from the trade.

Here’s the thing…

To stay short, he had to pay a monthly premium — a bit like you do with an insurance policy.

This meant his fund was bleeding money, month after month, as the housing market continued to bubble along, and the bonds held their values with it.

Being ‘early’ is as good as being ‘wrong’ a lot of the time, and there was a real risk Burry would have run out of investor funds before the trade paid off.

It’s a brutal truth about investing.

If you don’t get your timing right, you can lose money, even when your investing thesis turns out to be correct.

This brings me to the path markets might take in 2023…

It’s all just theatre

Before I brazenly make predictions for 2023, let me first admit I’ve got a few things wrong in 2022.

So, take any predictions for what they are — best guesses.

Earlier this year, I was of the view a Fed pivot — a halting of interest rate rises — would come quicker than it has.

But so far, that seems to have been the wrong call.

Central bankers worldwide continue to raise rates even as various economic metrics seem to be signalling an imminent recession.

Both the US Federal Reserve and the European Central Bank raised rates last week and put out commentary saying more rises were to come.

Whether the economy will let them do that or not remains the big question.

As fund manager Michael Leibowitz pointed out last week, the yield curve is warning it won’t. It’s at its most negative since 1982.

Leibowitz wrote:

‘The yield curve is a financial foghorn of sorts. Currently, it is bellowing that something is drastically wrong…

‘…yield curve foghorns are often unheeded by investors as they blow well before danger is apparent. As such many investors are unprepared when problems arise.’

Without getting into the complexity of yield curves, understand it’s the bond market’s way of saying central bankers will be cutting rates — not raising them — at some point in the future.

This usually happens because of economic calamity!

But so far, central bankers refuse to give an inch on this possibility.

The big risk, in my mind, is that central bankers put their heads in the sand too long and keep raising rates regardless.

Or maybe they know it’ll cause a big downturn, but it’s what they want?

After all, they like to be seen as having total control.

It seems that a genuine economic shock like a global pandemic isn’t allowed to cause economic collapse, but the whims of some central bankers are.

How ridiculous!

As analyst Dylan LeClair put it on Twitter:

‘Every FOMC meeting where global currencies, bonds, equities and commodities move in tandem based on the words of an old man, I can’t help to think about how laughably sad the entire damn system is.

‘It’s all just an elaborate dance for liquidity.

‘That’s the entire game. I comprehend the game and the rules by how its played. But that doesn’t make it any less of a joke.’

Forget everything else, it seems liquidity is the only game in town.

My colleague, Greg Canavan, has a good grasp of this.

In a presentation to our editorial team last week, he showed how markets react to liquidity — when central banks both inject and pull money from the system at will — more than anything else.

Check out the correlations on this chart:

| |

| Source: Fidelity |

Look how closely the black line (stock market values) follows the orange line (liquidity measure).

The cold truth of our economic system is that it’s one giant theatrical performance…

A game where everyone pretends there’s such a thing as fundamental value, but it’s really all just monetary manipulation.

And that money is controlled by a cabal of vested interests.

This is the number one reason I’m an advocate for Bitcoin [BTC]. Bitcoin can’t be controlled like fiat can. And it’s why the financial establishment and political elite hate it so much.

But I’ll spare you the bitcoin lecture today.

Because, like it or not, we’re in this game for now.

So how should you play it in 2023?

Down first…

In his presentation, Greg was of the view that central bankers would tighten too much…

Earnings would fall sharply, and we’d likely see a spate of downgrades in the first quarter or two of 2023.

As he pointed out in this chart so far, unlike bond markets, equity markets aren’t pricing this possibility in:

| |

| Source: Greg Canavan |

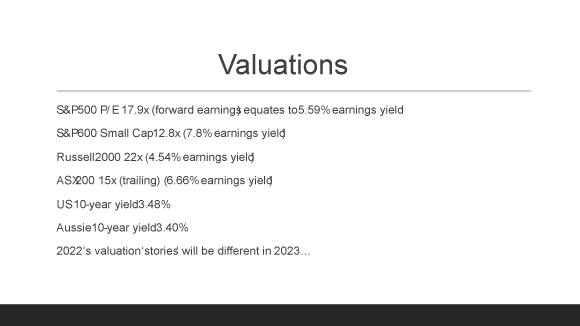

From the above, the PE ratio (price-to-earnings ratio) shows large-cap stocks are still valued fairly high.

The PE ratio is simply a measure of the company’s value divided by its earnings. The simple way of looking at it is that the higher the ratio, the more expensive the price you’re paying.

A PE of 15–18 certainly isn’t cheap.

And I should point out, the measure above is an estimate of future earnings (not past earnings), so it seems stock markets aren’t pricing in any drastic falls in earnings next year yet.

So, if both Greg and the bond markets are right, as earnings are revised lower next year, this PE ratio will blow out, causing investors to sell the ‘expensive’ stocks.

Of note to me was that statistic on small-cap and tech stocks.

As you can see, the PE ratio for small-cap stocks is already a lot lower. Conversely, that means they’re valued a lot more attractively right now.

Not that a broader economic decline won’t hit them too.

It will.

But I’ll make the point, the value you might find in the small-cap space may start to get very attractive on any broad-based falls.

And if you invest in this space, my advice would be to use the next few months to build a hit list of quality small caps you want to pick up on any panic selling in early 2023.

A word of caution, though…

Small-cap stocks without earnings, cash flow, or strong balance sheets can fall a lot further than you might think in bad markets.

The reason for this is that the share prices have to fall to a level where the company can raise funds from investors.

And when sentiment is negative, such funding is hard to find unless the deal is super attractive (i.e. cheap!).

Now, the good news.

If the first half of next year might be rocky, the second half could be spectacular…

…then up!

Here’s where the optimism could return.

It’s likely that a real stock market shock and corresponding economic collapse will result in that hoped-for Fed pivot finally coming.

If by then inflation is under control — and there’s already strong signs it is — central bankers will do what they’ve always done.

Turn on the liquidity taps to juice the economy back up.

Remember, as I pointed out above, liquidity is the market!

When that comes back, we can go from risk-off to risk-on fairly fast.

Personally, I think there will be stunning opportunities in copper, battery metals, technology, fintech, artificial intelligence, biotech, and many more future-driven industries at some point in 2023.

As I pointed out in my last two updates, exponential change is the new norm for many industries due to the pace of technological advancement.

If, like me, you believe that, then broad downturns based on nothing more than monetary games are prime opportunities to load up.

You just need to make sure you’ve the money and ideas ready for when the time comes to take the plunge.

That might not be now, but it will likely be sometime in early 2023, in my opinion.

But I’m ever heedful of the lesson of Michael Burry.

If you’re too early, you’re as good as wrong. There’s nothing worse than sitting in a great company at too high a price.

It can take years to recover, and even if you are eventually right, the emotional strain can be too much for many to hang on.

It’s not easy, of course, but the cheaper you can get into a great company, the better. And I think that’s the kind of market we’re moving towards. There will be value for those that can spot it.

That’s why timing your entries will be a crucial part of your 2023 investing plan, in my opinion.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.