In today’s Money Morning…retail investors surpass hedge funds…‘wacked-out, Fed-fuelled market’ ends…the sell-off asking investors serious questions…stock market’s goalposts have changed: profit back on the menu…and more…

Famed economist John Maynard Keynes reportedly quipped that when the facts change, so does his opinion.

What if Keynes applied the same sentiment to the markets?

Transmuting the spirit of the original message, Keynes may have said something along the lines of: When markets change, so does my investing approach.

How does this relate to the current situation in markets worldwide?

Retail investors surpass hedge funds

The pandemic — and the historic fiscal and monetary stimulus that followed — ushered in an era of optimistic investors short on memories and long on stocks.

As the Financial Times reported in 2021:

‘More than 15m Americans downloaded trading apps during the pandemic, and surveys show many of them are young, first-time buyers. Retail investors have also been hyperactive in Europe, doubling their share of daily trading volume, and in emerging markets from India to the Philippines.’

Bulging with ballooning savings and stimulus cheques, investors poured money into stocks.

And a lot of it (emphasis added):

‘All told, US investors alone poured more than $1tn into equities worldwide in 2021, three times the previous record and more than the prior 20 years combined.

‘After retreating last decade, US households overtook corporations as the main contributors to net demand for equities in 2020. They now own 12 times more stock than hedge funds.’

Those are some staggering numbers that bear repeating.

American investors poured more money into stocks during the pandemic than the prior 20 years combined — now they own 12-times more stock than hedge funds.

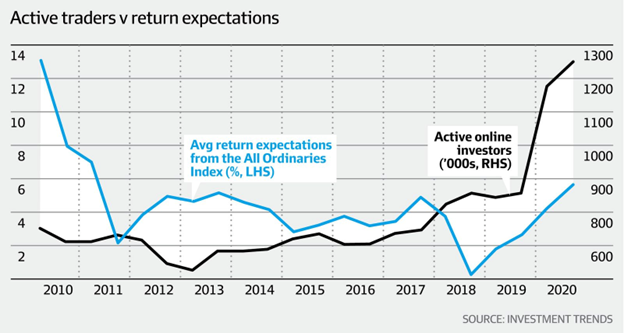

Australia also saw investor numbers rise during the pandemic. Australia reached a record high of 1.25 million investors in March 2021, a 34.8% jump on the prior year:

|

|

|

Source: Australian Financial Review |

But fast forward to now.

The euphoria of the pandemic bull run is subsiding…fast.

So much so that many of the pandemic gains have evaporated.

A recent estimate by investment bank Morgan Stanley found that retail investors who began investing at the start of 2020 ‘have since given back all their profits’.

‘Wacked-out, Fed-fuelled market’ ends

As chief executive Matthew Tuttle at Tuttle Capital told the Australian Financial Review:

‘A lot of these guys started trading right around COVID, so their only investing experience was the wacked-out, Fed-fuelled market.

‘That all changed with the Fed pivot in November, but they didn’t realise that because they have never seen a market that wasn’t supported by the Fed. The results have been horrific.’

When the events changed, investors did not change their approach.

In Tuttle’s words, the results have been horrific.

Consider the ‘meme stocks’ that took 2021 by storm with stellar run-ups in price.

Bloomberg created a basket of these ‘meme stocks’ — a hype index of sorts.

Bloomberg reported that the ‘meme stock’ basket fell to a record low last week:

‘The group of 37 retail trading favorites tracked by Bloomberg extended a four-day slide on Tuesday, wiping out 15% of its value in the past week as global markets fell on concern of a looming recession. The index has shed 63% of its value from a January 2021 high.’

|

|

|

Source: Bloomberg |

Things are likewise grim in the crypto world — boosted by a strong appetite for risk last year.

CNBC reported last week that around 40% of Bitcoin [BTC] owners are in the red.

Data from Glassnode suggests the 40% figure could be even higher when you ‘isolate for the short-term holders who got skin in the game in the last six months when the price of bitcoin peaked at around $69,000.’

The sell-off asking investors serious questions

Fluke or skill?

That’s the question some investors are asking themselves in the sobering silence of the recent sell-off.

Were the gains made during the frenzied pandemic bull run more to do with investors’ acumen or the exuberance of the times?

As a representative voice pondered on Twitter (emphasis added):

‘This pull back should make us all ask ourselves a very serious question. Do we actually know what we’re doing or have we been incredibly lucky the last 5 years in the type of market we’re unlikely to see again for a long time. Only the honest players will survive from here on.’

With the market changing, what should the corresponding change in investors’ approach or attitude be?

A clue can be found in the comments of Dara Khosrowshahi, chief executive of bellwether Silicon Valley stock Uber.

I was alerted to the comments by our Editorial Director Greg Canavan, who pointed out that the market is changing to suit a bear market narrative, not a bull market one.

What worked previously may not work now.

So what did the Uber CEO say?

Last Monday, CNBC got hold of an email from Khosrowshahi to employees where the executive mused on the stock’s recent performance.

Despite Uber recently reporting strong growth in gross bookings and revenue, the company still ended the March quarter with a net loss of US$5.9 billion.

The top-line growth, often enough to send stock prices higher during the pandemic era, wasn’t cutting it in today’s climate.

Uber stock is down 45% year-to-date.

And the Uber CEO is beginning to understand that times are changing. In the email to staff, Khosrowshahi noted that making progress towards profitability was no longer enough.

Profitability now is what matters (emphasis added):

‘It’s clear that the market is experiencing a seismic shift, and we need to react accordingly.

‘We are serving multitrillion-dollar markets, but market size is irrelevant if it doesn’t translate into profit.

‘The goalposts have changed. Now it’s about free cash flow…’

Stock market’s goalposts have changed: profit back on the menu

The Uber CEO’s comments are very interesting and illuminating.

The goalposts have changed: profit is back as a top priority.

You can see that with the downfall of ASX BNPL stocks.

BNPL stocks like Afterpay and Zip rose rapidly on the back of strong growth in users, merchants, and transaction volume.

The widening losses didn’t matter for a long time so long as BNPL firms continued to grow users and market share.

Now, of course, the widening losses are all that matter.

Zip, for instance, is down 85% in the last 12 months.

What can we make of this?

The pendulum is swinging back towards the boring yet sturdy metric of earnings.

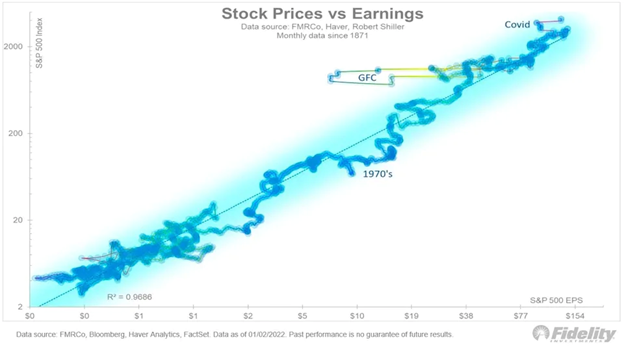

As legendary investor Peter Lynch noted, it’s corporate earnings that drive stock prices in the long term.

A nice illustration of this is captured by the chart below from Jurrien Timmer, director of global macro at Fidelity Investments:

|

|

|

Source: Fidelity Investments |

Stock prices are represented on the y-axis, and earnings are represented on the x-axis, with the data extending back to 1871.

The r-squared figure in this linear regression is 0.9686 — almost 1 — meaning earnings are very good at explaining moves in stock prices.

This is backed up by other research:

‘Researchers have examined the value of earnings and return on equity (ROE) by comparing stock returns that could be earned by a hypothetical investor who has perfect foresight of firms’ earnings, return on equity (ROE), and cash flows for the following year. To assess the importance of earnings, the hypothetical investor is assumed to buy stocks of firms that have earnings increases for the subsequent year and to sell stocks of firms with subsequent earnings decreases. If this strategy is followed consistently, the hypothetical investor would have earned over a 40-year period an average return of 37.5 percent per year.’

In the long run, stock prices follow profits.

Now, the renewed focus on earnings that Uber’s CEO pointed out to staff is an important axis shift.

These axis shifts, however, don’t come along often.

They do offer those who can front-run these shifts opportunities to profit.

Few are better at anticipating such axis shifts than legendary strategist Jim Rickards.

Jim recently partnered with us to construct a portfolio for these turbulent times and leverage what he thinks is a huge upcoming axis shift.

To read about his ideas in greater depth, you can access Jim’s thoughts by clicking here.

Regards,

Kiryll Prakapenka,

For Money Morning