He must be a new reader. Surely, over the years, we must have written things much stupider than that.

The gist of it was that working people get their income from selling their time. So, what really matters is how much they get per hour. In 1948, when the Ford F series began, each hour of his time, at an average wage of 40 cents/hour, bought him 1/3000th of the truck.

Yesterday, when we looked up the median hourly wage in 2023, we got US$11. Today, we get — from the ListFoundation — US$16 and change. The average wage is another thing, it includes the salaries of Wall Street executives and sports stars. It’s more than US$28 per hour. But it is irrelevant. The median actually measures what most people get…so let’s stick with that.

Goin’ Nowhere

At US$16 an hour, a guy can buy — guess what — 1/2,937th of a new Ford F-150. Almost exactly the same as 75 years ago. And while new tech improved the truck, it should have improved the making of it at the same pace. Automated assembly lines, plastics, robots — all should have made the truck cheaper to produce. And it should have made him more productive…and raised his wages, too.

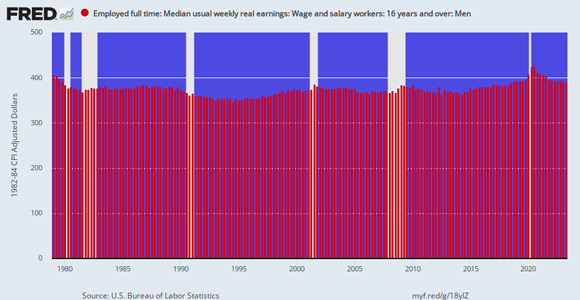

But other studies show the same thing. Wages, adjusted for inflation, have not gone up in more than half a century.

Inflation-Adjusted Weekly Earnings of Full Time Male Workers, 1979 to 2023

|

|

| Source: US Bureau of Labor Statistics |

We also got a response from George Gilder and Gayle Pooley — two of the leading proponents of the ‘time price’ concept (the idea that prices are actually ‘tokenised time’). They agree with our Dear Reader, maintaining that our numbers are all wrong…and that today’s F-150 is far superior to the truck from 1948.

Squishy and Fishy

We don’t really object to either criticism. The numbers are squishy and fishy. As for the truck, we own an old one…and a new one; the new one is definitely much better. Three times better (implied by the increase in price)? Not likely. For local chores and errands, the old truck is just as good as the new one. On the open road, however, the new truck pulls ahead.

We agree, too, with the ‘time price’ idea; it’s a neat way of measuring the rough progress of humanity. Our problem with it is that there is more to the story. It paints the working man as a stick figure…with no flesh, no heart…no jealousy and no sense of betrayal. It fails to take into account what kind of morons we really are — ready to do long division by day and howl at the Moon at night. We measure our progress, not in ‘time prices’, but in comparison to our neighbours, brothers-in-law, and our own parents,

Are we better off?

Thanks to capitalism and traditional fuels (drawing on the Earth’s stored up Sunlight), even the most humble working man in the US can eat fruits and vegetables out of season. He can enjoy entertainments — 24/7 — that Louis XIV couldn’t even imagine. He can see the US in his Chevrolet, coast to coast in a/c comfort, listening to Willie Nelson’s ‘Stardust’ album, for only about US$500 worth of gasoline. Even at the median wage, that’s only four days of work. And the truck doesn’t have to be ‘bought’. It can be financed…month to month. And the gas and snacks can be bought with credit too.

And now, thanks to the wonders of electronic communications, he can watch porn without going to a sleazy theatre in a dodgy part of town…and if he gets too fat, he might even be able to get disability.

There he is…the backbone of the American economy. He builds things. He fixes things. He makes things work. And the money he earns — every penny of it — is recycled into the economy, in sales and profits…to keep the whole shebang in business.

And yet, he is dependent on credit as credit tightens and interest rates go up. His truck is financed. His house is mortgaged. He has very little in savings. Almost no capital. Not much margin for error.

While the rich have gotten richer, he has gone nowhere…and by our calculations, gotten poorer.

‘So what,’ our dear reader wants to know. So what if he depends on credit? So what if he is deep in debt? So what if the elite, including his elected representatives north of Richmond, take him for a moron?

So what?

So…nothing. We’re just trying to figure out what is going on…and guess about where it leads.

Losing

How come all this ‘tech’ and credit didn’t lift him up? More scientists. More capital. More PhDs. Eight trillion in ‘stimulus’ from the Fed. More economists. More technology. More accumulated ‘knowledge’…available on our laptops. We don’t even have to think for ourselves anymore; we have AI. And who hasn’t read Jack Welch’s classic Winning? Jack laid it out for us. All we had to do was to borrow a lot of money, buy businesses, and hire some hotshots to run them.

It sounded so simple. And yet…it didn’t even work for Welch. His empire expanded…and then, overburdened by debt and dysfunction…it contracted. Today, the stock sells for about the same as it did in the mid-90s, nearly 30 years ago.

Jack’s idea seemed new…but there was nothing new about it. Stripped of its trendy jargon, it proved only what we already knew, that credit only works when it is used to increase efficiency and output. Just buying things — whether consumer items or businesses — doesn’t help.

That is obvious in the national accounts too. The Fed, with its spiffy gold-free dollar, could provide credit. Welch, ahead of his time, used it to build a tottery business empire. Consumers used it to buy big screen TVs and granite countertops. The feds used it to pay for, among other things, a 20-year war against nobody-in-particular, for no particular reason.

And now, credit is becoming more expensive…the screw turns…and the credit cycle (getting rid of bad debt) becomes painful, especially for the proletariat that depends on it.

You can pump up an economy — temporarily — with credit. People think it is real ‘money’. They think their wages are rising…their stocks are going up…sales are increasing. Later, they discover that the boom was a fraud. It was a roundtrip to nowhere.

What if the same were true for ‘technology’? What if it were mostly a distraction…a diversion…an idle entertainment? Dot coms…cryptos…the internet…TikTok…AI — the Fed’s EZ credit has juiced them up, one after another. But like Welch’s GE, the feds’ wars, or Wall Street’s buybacks…what if they don’t really add to our wealth…but subtract from it, by absorbing time and resources that might be better used elsewhere?

The new Ford F-150 is said to have 1,000 silicon chips in it. What if none of them takes you where you really want to go?

Stay tuned…

Regards,

|

Bill Bonner,

For The Daily Reckoning Australia