When it comes to understanding the Aussie economy, you can shelve the complicated Reserve Bank of Australia reports.

They never get it right anyway.

Dump the budget forecasts from the government too.

That’s nothing more than a political fairy tale.

What they use to justify their pay increases…

And you don’t need economic forecasts from the banks either.

While they’re more accurate than anything the government or central bank puts out, they’re often so full of jargon you get lost Googling every second word.

Sometimes the easiest way to understand the health of the Aussie economy, is to look at how people are spending their money…

Your crystal ball to the Aussie economy

The head publisher of Fat Tail Media returns from holidays today.

And I just know today’s article will see me summoned into his office.

The minute my boss sees the words ‘retail’ and ‘shopping’ roll across the screen in the latest Daily Reckoning Australia issue, I get sent an email asking, ‘Have you got a minute?’

We have a chat.

He reminds me that people don’t really care about new bags or shoes or puffer jackets.

In turn, I remind him that the retail sector is the Aussie economy’s crystal ball.

Why?

Because you couldn’t ask for a better barometer of individual prosperity in Australia.

Now, allow me to let you in on a secret.

As an investor, you don’t need to go through complex trade surplus reports…or even wait for the retail trade data to tell you retail sales dropped.

There are clues that can help you pick the trend along the way.

Australia is a consumerist society.

Our gross domestic product (GDP) growth depends on people spending money within the economy. Not iron ore. Not gold. Not natural gas.

The junk you buy at the shops and the services you pay for — so you don’t have to do the job yourself — are the lifeblood of Australia’s growth.

You can actually analyse the health of the Aussie economy yourself, with ease.

The idea is simple.

Track the performance of retail companies.

For example, financial data for retailers like Kmart, Target, and Bunnings — which all belong to the Wesfarmers Ltd [ASX:WES] family — as well as Myer Holdings Ltd [ASX:MYR], JB Hi-Fi Ltd [ASX:JBH], and Harvey Norman Holdings Ltd [ASX:HVN] are all excellent indicators of how Aussies are spending their money.

Watching simple profit increases or decreases indicates which way Aussies are leaning — before months-old GDP, trade surplus, construction, or production data comes out.

The most basic information of all can give you, as an investor, an edge as to how the overall country is going.

Just because something is easy to understand doesn’t mean it should be dismissed.

That’s why I believe all Aussie investors should have a good understanding of Australia’s retail environment.

In other words, use the retail market to understand consumer behaviour. And knowing this gives you an edge in today’s market.

[conversion type=”in_post”]

New year, new data

Last week, the Australian Bureau of Statistics was back in full swing.

Already there’s been a data dump of job vacancies, building approvals, and trade surplus data.

But the data I was most interested in was retail spending for November 2019.

Now last November was a particularly important month for Aussie retailers.

See, for the past few years, some of our retailers have tried to mimic the US by introducing ‘Black Friday’ and ‘Cyber Monday’ in the last week of November.

And for the second half of 2010s, there was limited success.

But November just past was different.

One thing I noticed this time, was that almost all Aussie retailers had Black Friday specials.

And they were good.

Some of the brands I follow were offering discounts of 30–40%. The sort of brands that rarely drop prices more than 20% — even during Boxing Day sales.

Discount retailers like Big W and Target got in on the action too. Even Kmart — which tends to shun sales periods — offered limited products up for Black Friday sales.

And guess what?

People spent money.

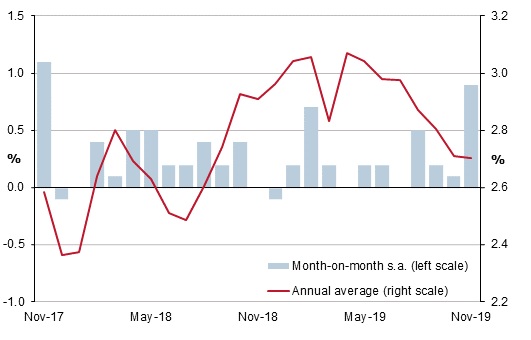

The recent batch of retail sales data from the ABS showed that retail sales increased by 0.9% for November 2019.

Spending on discretionary items was high.

Shoes, clothing, toys, and gaming were all up.

Department stores — the place consumers don’t want to go — saw spending increase by 3%.1,2

Australian retail sales month-on-month change

|

|

|

Source: Focus Economics |

The 0.9% jump was the highest in almost two years.

So much so, that ABC News ran a headline saying there was a ‘rebound’ in consumer spending.3

I noticed another economist over on Twitter talking the higher retail sales up as part of the wealth effect filtering through to Aussies.

He argued that, while delayed, rising house prices meant people were feeling wealthier and willing to spend money once again.

However, both those takes miss the point completely.

The November data wasn’t a rebound, nor was is it about people feeling wealthy.

It was about opportunistic buying while deep discounts were offered at a time when we spend most of our money.

Not only that, but $1 billion was spent with Afterpay. Giving the company their highest month’s turn over ever.4

People weren’t spending from their savings…they were buying goods on a delayed payment basis.

That’s not people feeling wealthier.

To boot, research from ANZ has pointed out this morning that the November sales are probably nothing more than a blip. Noting that credit card use between December 16 and Boxing Day fell compared to previous periods.

There’s a couple of takeaways from this investors should note.

The obvious one is that the November retail sales data is likely a blip, and the higher spending won’t last.

And that will show up in financial earnings later in the year as I suspect more retailers will announce lower profits.

The side story to this is that buy now, pay later services are still growing. People are opting to use this.

By bringing purchases forward, it slows down consumption in later months.

But perhaps the biggest thing to note, is that Aussie retailers are going to continue to mimic the US retail sales calendar. Disrupting our spending habits.

This means holding off on purchases until November for a deep discount…

That’s what I’ll be doing.

|

Until next time, |

|

Shae Russell, |

2 ‘https://www.savings.com.au/savings-accounts/black-friday-drives-november-retail-sales-to-strong-result’

3 ‘https://www.abc.net.au/news/2020-01-10/black-friday-leads-rebound-in-retail-sales-in-november/11857554’

4 ‘https://www.afr.com/policy/economy/retail-sales-surprise-on-strong-side-20200110-p53qbk’