In today’s Money Morning…Merry Christmas, here’s your 6.8% pay cut…the crime of truth…who gets control over reality?…and much more…

Last week ended with two big stories — one financial, the other not.

While at face value, they’ve nothing to do with each other, in a perverse way, I think they do.

Because they explain the cancer — and conundrum for investors — at the heart of our world right now.

Namely, what is real, and who do you believe?

Let me explain…

Merry Christmas, here’s your 6.8% pay cut

First, the financial news…

The latest inflation numbers came out of the US on Friday, and they showed prices continuing to run red hot.

The November Consumer Price Index (CPI) figure came in at 6.8%.

Taken at face value, this means everything just got 6.8% more expensive. Which, if you turn that on its head, is a bit like a 6.8% pay cut just in time for Christmas.

Some say even this super-high 6.8% figure is baloney, pointing to the fact using pre-1980s measures of inflation, we’re closer to 15%.

You see, they used to use actual prices of real-world items to calculate inflation.

Crazy, I know.

But now — the current CPI calculation uses a more complex methodology called the Cost-of-Living Index (COLI).

As the Bureau of Labor Statistics explains:

‘The composite index weights costs based upon spending patterns identified in households with mid-management income, as measured by government surveys.’

Hmmm, ‘government surveys’ you say…

Whatever the true picture, the commentary around this is even more troubling.

As you know by now, central bankers tried to tell us for months that any rise in inflation would be ‘transitory’.

They’ve now dropped that after reality stubbornly refused to bend to their will.

Even when they could use easily manipulatable government statistics!

Not to be deterred, ECB President Christine Lagarde is now calling it a ‘hump’ — whatever that means.

While her US counterpart Jerome Powell is now admitting he just doesn’t know how persistent it will be.

In short, they don’t know.

Which is fine, except for the consequences their previous position of smug certitude has given us.

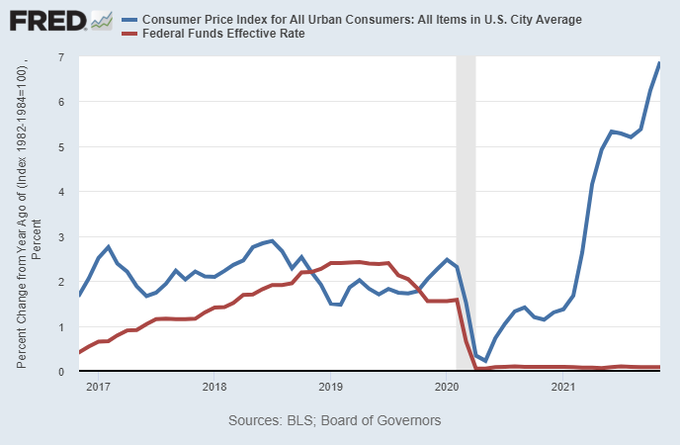

To see their abject failure, you need look no further than this chart:

|

|

| Source: FRED |

This chart shows that inflation (the blue line) is far above short-term interest rates (the red line). In fact, this gap is the biggest it’s been since the 1940s.

That’s important because interest rates are the go-to tool to control inflation. So, basically, by calling inflation wrong, the Fed has kept interest rates far too low for far too long.

Their actions are directly responsible for both the speculative asset price bubble of 2020 and now the consumer price inflation surge of 2021.

Yet, they continue to perpetuate the myth that they should be trusted with our economic system.

You’ve got to admire their sheer chutzpah if nothing else.

Which brings me to the second story…

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

The crime of truth

The other story that ended last week was the worrying development in the Julian Assange case.

A British judge overturned a previous verdict on appeal, and he could now be sent to the US for trial on alleged espionage charges.

Now, I don’t want to get into the legalities or politics of this, but at the deepest level, we have someone being persecuted for the crime of revealing the truth.

Yes, it was an ugly truth, but it was reality.

Are the powers that be that scared of the truth?

Perhaps so…

The consequences of this action are potentially dire.

As American Libertarian Congressman Justin Amash stated:

‘What the U.S. government is doing to Julian Assange puts all journalists at risk and undermines press freedom. He faces prosecution for journalism — for publishing materials exposing war crimes and other horrors in Afghanistan and Iraq. Uphold the 1st Amendment. Free or pardon him.’

It’s good that at least one politician is calling this out, but where are the voices from Australia’s craven political class?

Or are we just happy to be a vassal state?

It seems that a war on journalism has actually been underway for a while in the US.

That other infamous whistle-blower — Edward Snowden — shared a story on his Twitter profile over the weekend about something called ‘Operation Whistlepig’.

He quoted DC Bureau Chief at Yahoo! News, Sharon Weinberger, who said:

‘This morning we published @janawinter‘s article on a secret CBP unit that investigates journalists, members of Congress and other unsuspecting Americans. In 20 yrs of journalism, it’s one of the strangest & most and disturbing stories I’ve encountered.’

You can read that jaw-dropping story here.

So what’s the link I was getting at?

Who gets control over reality?

The idea of the Metaverse is a virtual world you can exist and live in.

It’s getting a lot of chatter right now due to Facebook’s rebranding to Meta.

I don’t know about you, but I don’t fancy being in a world controlled by Mark Zuckerberg! Not if the cringeworthy Meta PR videos are anything to go by.

Though, I do think there will be huge investment opportunities in this concept in 2022 and beyond.

But what I really want to get across today is the fact that our world is already a virtual world of sorts. We’re already in a kind of Metaverse.

I mean, when you think about it, people’s perceptions of reality are always slightly different.

In the investing world, that’s what makes a market.

It’s why I can love an asset like Bitcoin [BTC] while others hate it. Over time, reality tends to decide the fate of everyone’s opinions.

That’s the good thing about investing. There’s a scorecard — your profits or losses — to show you how well you’ve grasped what’s really going on.

But the big danger facing us today is that certain institutions that lie at the heart of our democratic and economic bureaucracy want to control their own scorecard.

They don’t want to be subject to the whims of reality.

They want to shape it. Or hide from it. Or warp it for their own ends.

That’s what the Assange case is about; that’s what the inflation debate is about. Control over the narratives we all live by.

Putting aside the deeper and darker implications of such a world, for investors, it makes life hard.

You have to juggle competing narratives, and their ongoing effect on the psychology of market participants, when you make investing decisions.

You’re not just investing on facts but on investors’ perceptions of what those facts even are.

Maybe Facebook’s Metaverse will bring us back to simpler times!

The big question everyone is asking…

What does all this mean for markets in 2022?

It’s something I’m going to think over for next week’s piece…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.