Nassim Taleb has got a lot to answer for…

The author of the 2007 best-selling book The Black Swan: The Impact of the Highly Improbable sowed the seed in millions of investors’ minds that you could clean up when catastrophic events occur out of the blue.

The book was a doomsayer’s dream!

I mean, not only could you feel bearish all the time – which strangely enough is a very appealing emotion for a lot of investors – but you could also get rich when the ‘black swan’ finally hit.

The only catch?

For the chance to land the big one, you needed to be willing to lose a little a lot of time.

Most investors are conditioned the other way. They would rather be making money most of the time.

But Taleb argued one market crash – one black swan – was enough to wipe out years of winning.

So, his strategy was to take the other side of that bet.

As he noted:

‘We cannot blow up; we can only bleed to death.’

But as it happens, Taleb’s timing with his book launch was impeccable!

Soon after the book’s release, the GFC hit out of nowhere.

As most people saw their wealth smashed, a small band of misfits made bank.

Hedge fund managers like Michael Burry of Big Short fame, emerged as the ‘heroes’ who bet on the black swan and won big time.

Like Taleb they were wrong for years. But when they were eventually proven right, they made a motza.

It was heady stuff…

And I’ll admit, as a competitive financial advisor at the time, I was excited at the possibility of creating strategies to win big by betting against the hubris of my colleagues who thought they knew it all.

The problem?

As I found out, not all black swans are crashes DOWN.

Right now there’s much economic angst around.

Rampant inflation, soaring debt, market volatility, recession fears, crashing commodity prices, and even global war are all topics on the market’s mind.

And yet, as it stands, stock markets and property are at or near all-time highs!

So have the doomsayers got it wrong?

Or have they actually got it right?

But the black swan event they’re not expecting is a crash UPWARDS?

Let me explain what I mean…

An era of monetary destruction

In 2008, the term quantitative easing (or QE) entered the investor lexicon.

The complex name hid a simple idea – central banks would increase the supply of money and reduce interest rates by buying assets with newly created bank reserves.

It’s essentially a form of money printing.

But it wasn’t just a point-in-time bailout.

No, it was a new normal…

As Deutsche Bank wrote in a 2018 report entitled – ‘GFC 10 years on’ (my emphasis):

‘Central banks have played a big role in facilitating the post-GFC workout. The real adjusted cumulative size of the balance sheets of the Fed, ECB, BoJ and BoE is nearly three times as large it was ten years ago.

‘There has been no precedent for such activity across so many central banks in history.’

Over the next decade, this particular form of money printing (QE) mostly found its way into asset prices.

Stocks, bonds, property…even Bitcoin have all benefitted from a decade of easy money.

Then, when the Covid-crash of 2020 struck, markets fell sharply at first.

But not for long…

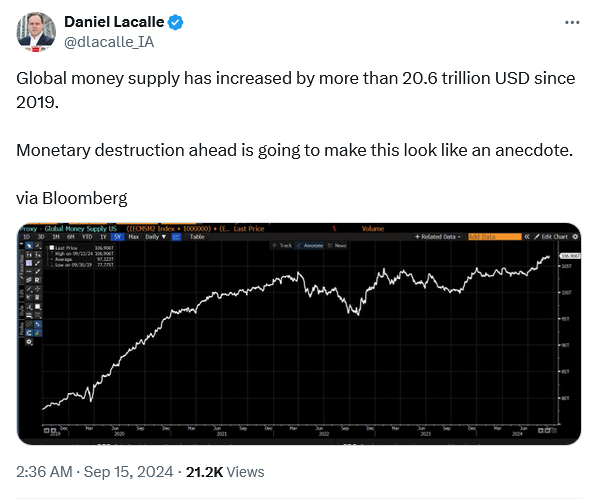

The money printer came on with a vengeance, as this tweet from Chief Economist Daniel Lacalle points out:

| |

| Source: X.com |

In this era of ‘monetary destruction’ stocks went berserk.

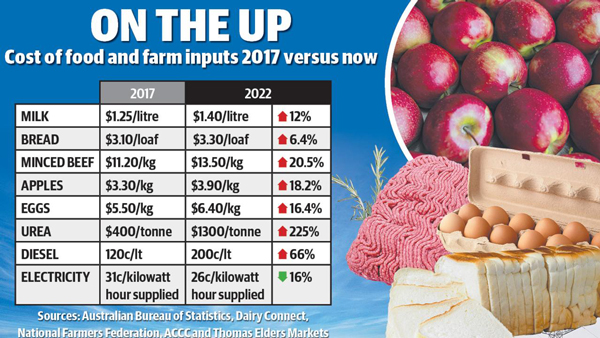

In addition to the never-ending QE, government handouts – remember when people were paid to sit at home! – added to the money supply.

This cold, hard cash straight into everyone’s pockets had a predictable effect.

It took a year or two but this form of money printing inevitably led to the sustained period of price inflation we’re seeing today.

| |

| Source: Herald Sun |

The key point…

In both times of crisis, the reaction from central authorities is always the same – print more money.

But ‘free’ money isn’t a consequence-free act.

It’s an intentional debasement of the currency you use. And it completely destroys any store of value that money is supposed to have.

The effects of this post-GFC world are insidious and far-reaching.

For example, check out the average wage of a Greek worker since 2008:

| |

| Source: Michael Arouet |

That’s a 25% fall in real wages over the past 16 years!

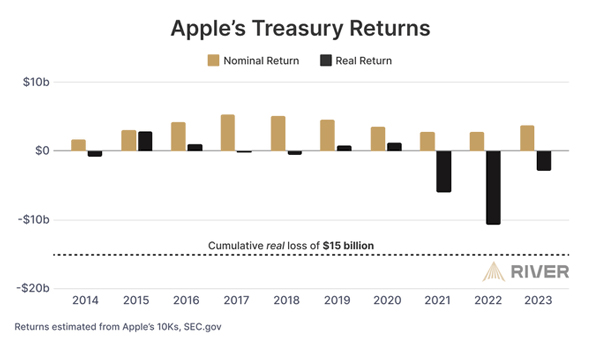

Even big corporations aren’t exempt from the fallout of continual monetary debasement.

Check out this chart of Apple’s cash holdings over the past decade:

| |

| Source: River |

See those three big black bars at the end?

That’s US$15 billion in lost ‘purchasing power’.

Now, Apple can take the hit, given the immense profitability of its underlying business.

But you, me, and every other investor in the world probably don’t have that luxury.

We can’t afford to see our future purchasing power smashed, so we can’t keep our money in cash for any sustained period of time.

Where can you put it, then?

The investor’s dilemma

How to store your wealth in an asset that can’t be debased over time…this is the investor’s dilemma.

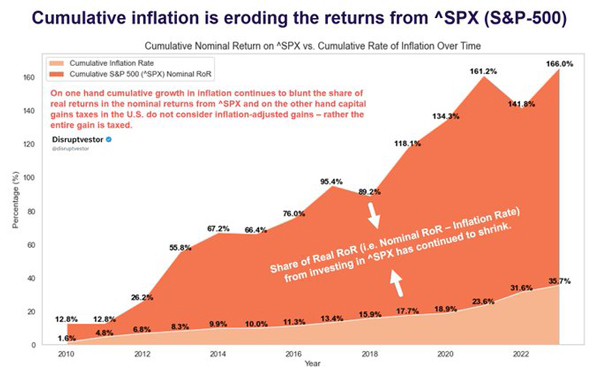

Stocks are, of course, one place.

But as this chart shows, the real return from owning them is falling even as they hover near all-time highs:

| |

| Source: Federal Reserve |

Some would argue CPI (inflation) isn’t even the correct benchmark given various inconsistencies in CPI calculations over time.

What you should measure it against instead is the growth in money supply because that’s the denominator everything else is priced in.

With that in mind, check out this chart:

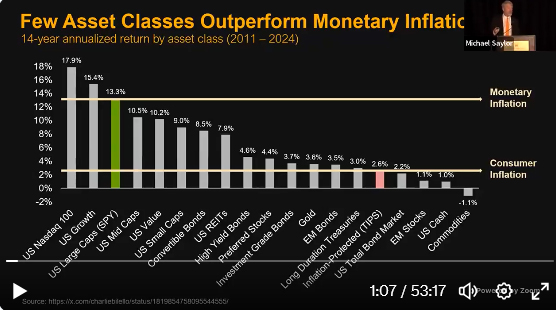

| |

| Source: Michael Saylor |

This slide was presented by Michael Saylor at the recent H.C. Wainwright Annual Global Investment Conference.

It shows that only three asset classes have kept up with monetary inflation (the growth in money supply) since 2011.

Large tech stocks, high growth stocks and large cap US stocks (just!) were the only places where you could protect your wealth over the past 13 years.

Every other asset class went backwards compared to the money supply growth.

When people say tech stocks are overvalued, I think they’re missing the fact that about 50% of investors aren’t necessarily investing on fundamentals alone.

They’re using it as a way to preserve their wealth and they use passive ETFs to do this.

Much the same could be said about Australian property.

Here’s the thing….

Inflate or die…or maybe buy pianos?

The money supply is only going to continue to grow.

As publisher Bill Bonner put it in a recent essay called ‘Inflate or Die’:

‘The idea is to inflate away the value of the US dollar… but also to trap foreigners in the depreciating currency.

‘It’s either inflate… or die. The US economy may be a grotesque zombie with debt growing three times as fast as GDP. But neither political party has the courage to drive a stake through its heart. So, inflation it will be.’

Currency debasement is the end game.

It always is when sovereign debts pass the point of no return.

That means as things crash in real terms, the price of everything in nominal terms might crash UPWARDS!

We’ve seen this before…

When the German economy experienced a catastrophic era of hyperinflation in the 1920s, the value of its currency also fell.

As George J.W. Goodman wrote in Paper Money:

‘The nervous citizens of the Ruhr were already getting their money out of the currency and into real goods — diamonds, works of art, safe real estate.

‘Now ordinary Germans began to get out of Marks and into real goods.

‘Pianos, wrote the British historian Adam Fergusson, were bought even by unmusical families.’

And as Jeff Booth wrote in his recent book The Price of Tomorrow:

‘When you have abundance in money you have scarcity in everything else.’

That’s always been the rationale for investing in gold, too.

Not coincidentally, gold is hitting new all-time highs as people start waking up to the fact that money printing will never stop.

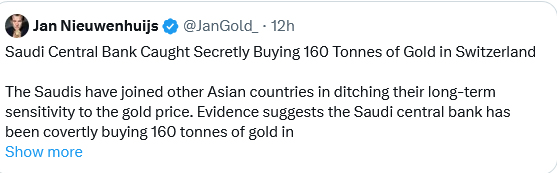

On that note, I saw an interesting tweet last week:

| |

| Source: X.com |

When the oil-rich Saudis start buying hard assets, that should pique your interest.

My personal ‘safe-haven’?

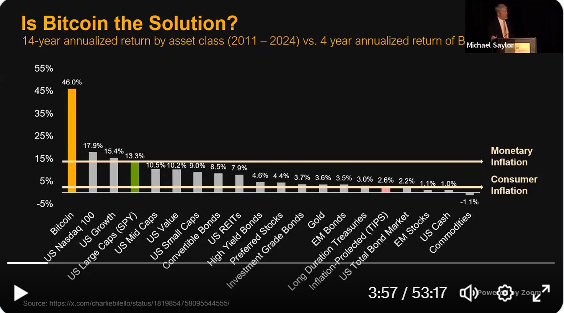

Check out a different version of the chart I showed before:

| |

| Source: Michael Saylor |

This chart shows the annualised returns of various asset classes over the past 14 years, but it also includes one more asset this time.

Yep, standing all on its own in the number one spot is Bitcoin [BTC].

It’s smashed all other contenders in protecting your purchasing power over time.

Though that has come with some stiff bouts of volatility, of course!

However you protect yourself, you’ve got to start thinking about this.

Because things might start to spiral out of control, even as markets continue to rise!

In the coming weeks, I’ll be running a presentation on how you can formulate a strategy to protect yourself in this era of currency debasement.

Look out for that…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments