In today’s Money Morning…more than just an energy crisis…a prized base metal…some very deep repercussions…and more…

It’s hard to look at what is going on in Ukraine and not feel a little anxious.

It genuinely looks like we could be on the cusp of war in Europe.

A scary thought to suggest and a scarier one to consider in terms of potential repercussions.

But there is no point in burying our heads in the sand. War isn’t something you can take lightly, no matter what your prerogative or agenda may be.

Even for us, as a financial newsletter, conflict between Russia and the West can’t be ignored. Because even if you don’t think we’ll ever actually see any direct fighting, the economic conflict is already underway. And that is definitely something we can’t afford to ignore…

So without trying to wish war upon the world, let’s talk about some potential possibilities. As well as a few ways investors can prepare for what may be in store for markets.

More than just an energy crisis

Now, the obvious issue that comes to mind concerning Russia is oil and gas.

There has already been plenty of talk about how reliant Western Europe is on Russian pipelines. These are vital channels of energy supply that are necessary to keep the region running.

With the threat of sanctions on the table, Russia may retaliate by cutting off these energy exports. It’s a potential factor that has already helped push the price of oil higher in recent times.

Markets and investors are clearly fearing the worst on this front.

However, what has been far more overlooked is what this conflict may mean for grains. Because what a lot of people may not realise is that Russia is the top wheat exporter in the world.

Ukraine isn’t far behind either, sitting in fifth place. Meaning that if both nations’ exports come to a halt, prices of these key agricultural commodities will likely soar as supply tightens.

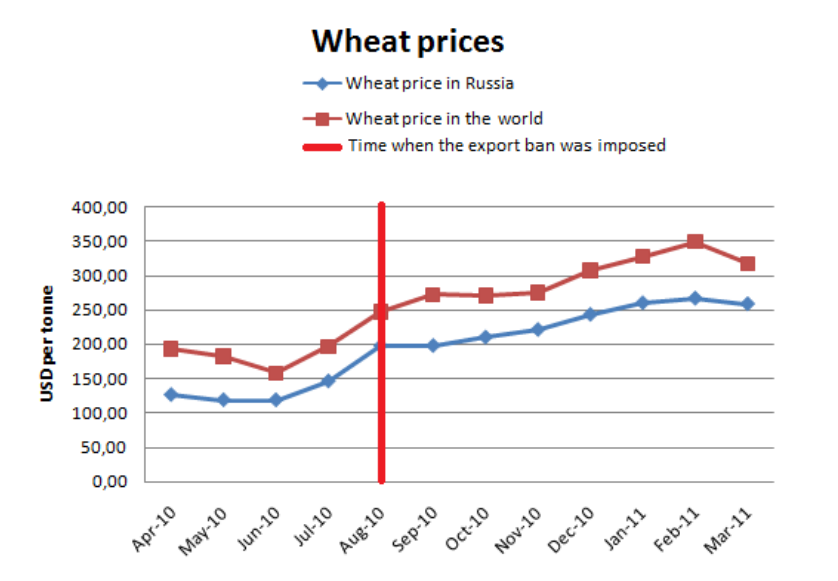

We even have a historical precedent to prove that this outcome is likely. The following chart shows exactly what happened to wheat prices after a Russian export ban back in 2010:

|

|

| Source: Oxfam Research Reports |

For many of the importers of this wheat, mainly across the Middle East, this presents a clear risk. Emerging economies like Egypt and Turkey will have to source new suppliers for this wheat and other key grains.

A possibility that could see some local Australian suppliers stand to benefit.

Just something that you, as an investor, should consider when assessing the market right now.

It certainly isn’t the only one, though…

A prized base metal

Another commodity to consider in all of this uncertainty is nickel.

Just like wheat, Russia is the leading exporter of nickel and nickel products in the world. If that supply disappears due to conflict, it is going to lead to a huge market squeeze.

And again, just like wheat, it is something that could require other exporters to step up. It’s a possibility that could light a fire under the already sizzling nickel production and exploration sector.

This is particularly noteworthy as nickel demand is already rising. It is quickly becoming a prized commodity for battery anode technology, the kind of products that power electric cars and more.

For this reason, it could have some very deep repercussions.

Who knows, it may even force battery producers to turn to new alternatives. Or maybe even look to innovate new potential solutions.

Perhaps it even sets back EV adoption by a few years.

I certainly wouldn’t rule that out as a possibility.

All of which, I must stress again, investors need to consider in the coming weeks and months.

We’re all treading a dangerous line with this potential war. And whatever happens, markets are going to respond one way or the other.

Even for you and me, people who are as far removed from this conflict as humanly possible, that is something that we cannot ignore. For better or worse…and maybe much worse.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.