The price of Bitcoin [BTC] rose above the US$10,000 level over the weekend.

Which means it’s up 40% for the year.

And it’s only February…

So far, the mainstream is staying quiet about the whole thing.

I haven’t heard a peep yet.

My take is they’ll remain sceptical of bitcoin and cryptos until the next wave of euphoria hits. Because they don’t really get the enormity of what crypto represents.

They still think it’s ‘funny internet money’.

And when the price rises enough, that’s all they’ll talk about.

But it’s a lot more than that, as I’ll explain shortly…

We’ve written a lot about this since 2017. But I think the crypto opportunity is still there for you, if you’re willing to do your research and get in before it’s ‘obvious’.

If you’re interested in learning how to buy Bitcoin, check out this free report.

The $10k breach is a good timely reminder that bitcoin hasn’t gone away in the bear market of 2018 and 2019.

Indeed, my friend and colleague Bernd Struben reminded me yesterday that I wrote in Money Morning on 16 December 2019:

‘Today I want to remind you that bitcoin isn’t dead.

‘In fact, there are signs that the 2020s could be a very big decade for crypto indeed…

‘Right now, sentiment is down for cryptocurrencies in the mainstream. Just as the big players are making their moves.

‘To me, that smells like opportunity.’

The bitcoin price was at US$7,087 when I wrote that.

Of course, it goes without saying, it’s speculative and risky. But the upside is that you don’t need to risk too much of your portfolio to give yourself some exposure.

Beyond bitcoin, there’s actually an emerging opportunity that could be the real money spinner at the end of it all.

And it looks like it’ll take a lot of investors — and tech companies — by surprise.

First, let me explain why 2020 could be such a big year for bitcoin, then we’ll touch upon the amazing implications of web 3.0…

2020 and the halving

Don’t get me wrong, most cryptocurrency projects will fail.

Just like most dotcom era stocks failed after the 2000 bust.

But like the first internet boom, I think the cryptos that succeed will go on to be the next Amazons, Googles, and Facebooks of the 2020s.

In my opinion finding those select key cryptos will be the best investments of the 2020s.

Right now, bitcoin is still leading the crypto charge.

It’s the oldest, most well-known, and most battle-hardened of the lot. Which means it’s usually the first port of call for new investors.

And there’s an upcoming catalyst for the bitcoin price which could see this new money start to flow in fast.

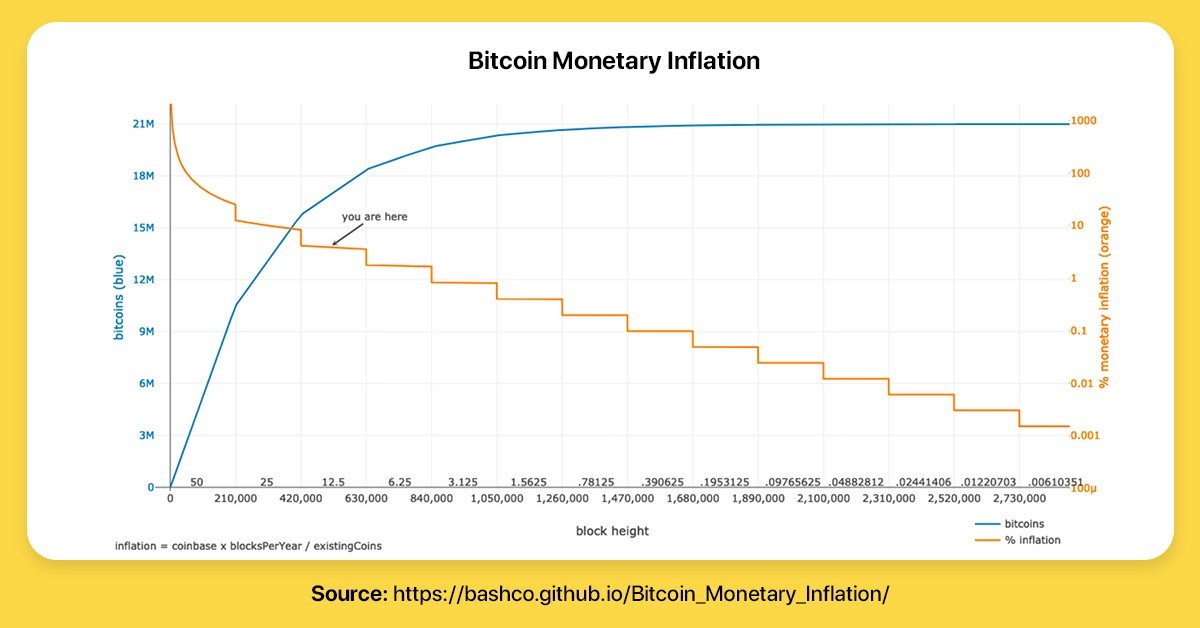

You see in May this year, the supply of newly minted bitcoin is set to fall by half. You can see the supply schedule (blue line) below:

|

|

| Source: Bitcoin Monetary Inflation |

To be clear, no single person decided this change in monetary policy. It was simply part of the original 2009 code and will kick in as a matter of due process.

Think about that for a second…

Compare bitcoin’s transparency and predictability in the chart above to the current central bank system of money printing and backroom Davos deals.

The world is starting to wake up to this, and events like ‘the halving’ just bring them into focus.

Both the halving in May, and the proliferate money printing from central banks, are two key reasons the bitcoin price is on the rise.

It’s a basic case of supply and demand.

Supply is going down, while at the same time more and more people are sold on the idea of holding a part of their wealth ‘outside’ the current corrupted financial system.

But the deeper reality — the thing that most still don’t get — is that there is a much bigger change coming behind it.

Let me explain…

[conversion type=”in_post”]

The real deal with crypto is web 3.0

When bitcoin was born 10 years ago, it showed that something previously thought impossible, was possible.

A system could exist to allow you to transfer value to someone else with no central party sitting in between.

This was a radical disruption to the status quo.

And, like Pandora’s Box, once it was out, there was no putting it back in.

Think how many products and companies you use that exist solely to facilitate trust between two or more unknown parties.

The entire financial services industry is built upon that problem.

But the trust issue expands to different types of data too.

Usually we trust a central party to protect such data because we have to if we want to use a certain product or service.

You’ve got to give your health details to a government database to get medical treatment. You’ve got to give your personal details to Facebook to take part in social media. You’ve got to allow Google some access to your preferences to utilise their ‘free’ search function.

This all comes with risks. Some obvious, others less so.

A central pot of data is a honeypot for hackers. And over the last year we saw some huge data hacks.

Check out this list from CNBC:

|

|

| Source: CNBC.com |

That’s your personal details now in the hands of criminals. Not good.

Then there’s the hidden risks.

The risk of totalitarian governments using your data against you. This might seem a bit sci-fi, but in China right now such things are happening.

For example, they’ve a social credit score that uses big data to track people’s daily lives. The score will literally decide your fate in life.

Buying too much alcohol or playing too many video games might see you barred from taking trains or flying.

Do something really bad and you could see your kids banned from good schools.

It’s a horrible vision of the future and an example of the power of big data falling into the wrong hands.

Don’t think it can happen here?

I wouldn’t be so sure…

Regardless, I say don’t give them the opportunity.

That’s where web 3.0 comes in…

Web 3.0 is all about changing the way data runs through the internet.

According to an article in Forbes:

‘A new wave of networking technologies, also known as Web 3.0, promises to return the internet to the hands of users.

‘This movement utilises advances in peer-to-peer (p2p) technology like blockchains to build services that protect users over profits.

‘Its decentralised, peer-to-peer nature provides a hard-technological cap to the possible accumulation of power and data in the hands of monopolists.’

Web 3.0 will spell the end for ‘big tech’ dominance and the start of true data self-sovereignty.

Crypto tech is at the heart of this coming change. That’s the real value proposition behind the cryptocurrency movement.

When you realise that, you then realise this:

Buying bitcoin seems nothing less than a necessary first act of freedom and self-sovereignty.

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: We believe these rapid fire market opportunities are a fantastic way to grow your wealth. Which is why you’ll find us talking about the big trends that can uncover them. If that is something up your investment alley, then click here to learn more.

Comments