In today’s Money Morning…the wonks repeat the same mantras in lockstep…do you trust the Fed and the White House?…here are some options on how to play inflation…and more…

[Editor’s note: In this episode of the Money Morning Podcast, I sit down to chat with Callum Newman of Catalyst Trader about iron ore and gold mining stocks, and his strategy for trading these companies. Since we last caught up, turns out Callum was right on iron ore.]

So the US Consumer Price Index (CPI) numbers came out overnight, and shock, horror!

Highest inflation in the US in 13 years.

Mainstream outlets paint this shift as ‘transitory’ and trot out various professional economists that side with Jerome Powell on whether inflation is here to stay.

The wonks repeat the same mantras in lockstep.

Things like, ‘Supply chain disruptions’, ‘Current numbers are referencing a pandemic-ravaged economy a year ago’, ‘Pent-up demand will fade’.

I don’t buy it, and neither should you.

And today, I’ll lay out what investment opportunities are out there for Aussie investors in a high-inflation environment.

But first, a couple questions.

Do you trust the Fed and the White House?

There are all sorts of contradictory narratives out there when it comes to US inflation.

Take this snippet from the AP:

‘The Fed and the White House have made clear their belief that the current bout of inflation will prove temporary. As supply chain bottlenecks are resolved and the economy returns to normal, they suggest, the price spikes for such items as used cars, hotel rooms and clothing will fade. Some economists, along with Wall Street investors, have indicated that they agree.

‘“The headline inflation numbers have been eye-popping in recent months, but underlying inflation remains under control,” said Gus Faucher, an economist at PNC Financial Services. “Once again a few categories — used vehicles, airfares, rental cars, hotels — are experiencing huge price gains because of the recovery from the pandemic.’

And the bigwigs then also say wage growth will come and it’ll be great.

But get this, inflation is still a flash in the pan.

Those two claims together don’t pass the pub test.

If consumers start making more money, they can buy more things, demand for goods goes up — prices have to increase.

If a supplier knows people have more cash in their pocket, they will know that they can charge more.

Don’t like the price? I’ll find someone who does.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

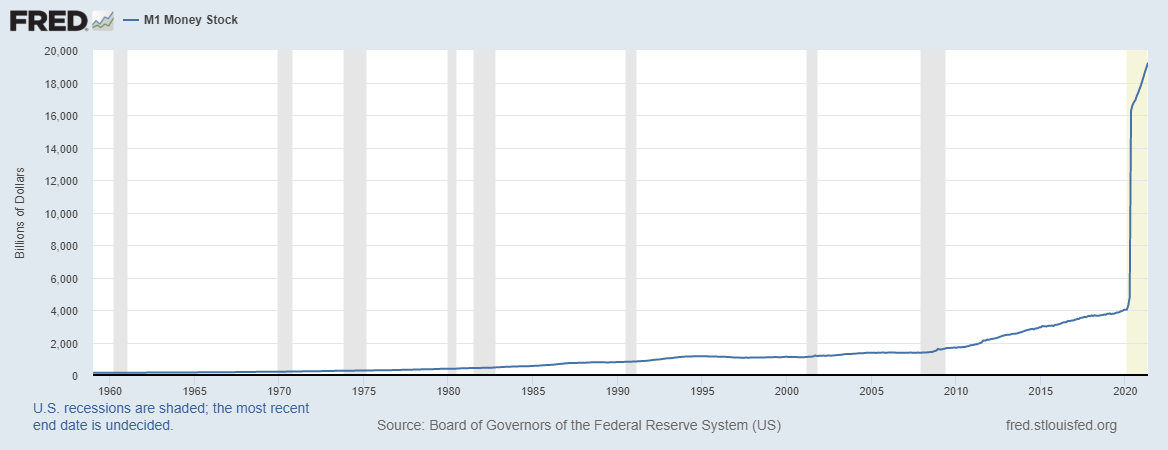

Here’s the only thing I think that really matters in the inflation debate, though:

|

|

|

Source: fred.stlouisfed.org |

That’s what the Fed did — an avalanche of cash. This is all you need to know.

The bears’ concern that a debt unwinding event will smash the economy and trigger deflation is a risk, but a small one, I believe.

That’s because central bankers will roll out central bank-backed digital currencies (CBDCs), Modern Monetary Theory (MMT), helicopter cash, you name it.

Things that will just accelerate inflation.

Their behaviour is predictable. They just won’t let a crash happen. They can’t afford to let it happen.

That means it’s now ‘hot’ inflation or hyperinflation.

There’s also the public optics dimension to consider when the Fed and the White House say this isn’t an issue.

Imagine if they came out and said, ‘Look people, we definitely stuffed this up — inflation is coming in a bad way.’

Since when have the bigwigs ever admitted their own folly, let alone decided to trigger a panic by doing so?

Never explain, never complain. Nothing to see here folks.

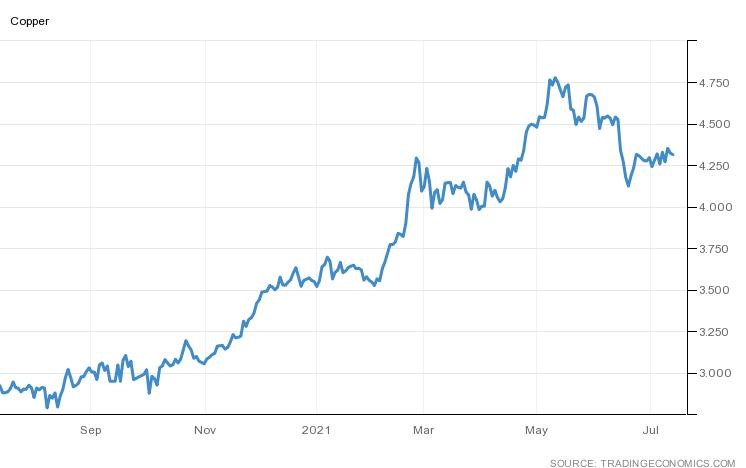

Or these charts?

Copper is holding up:

|

|

|

Source: tradingeconomics.com |

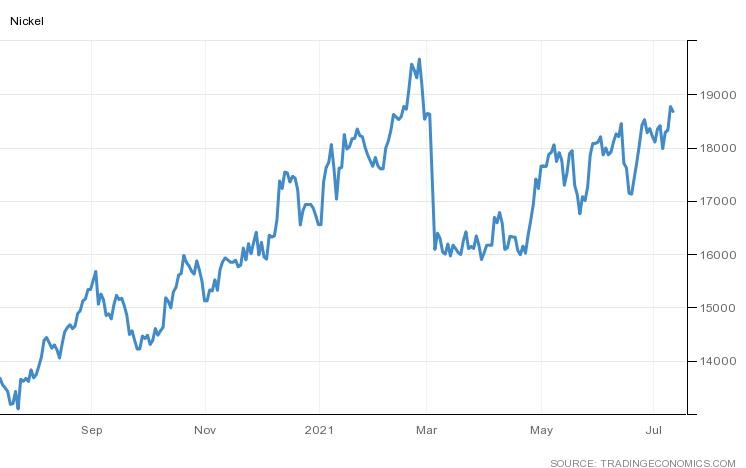

Nickel is moving again:

|

|

|

Source: tradingeconomics.com |

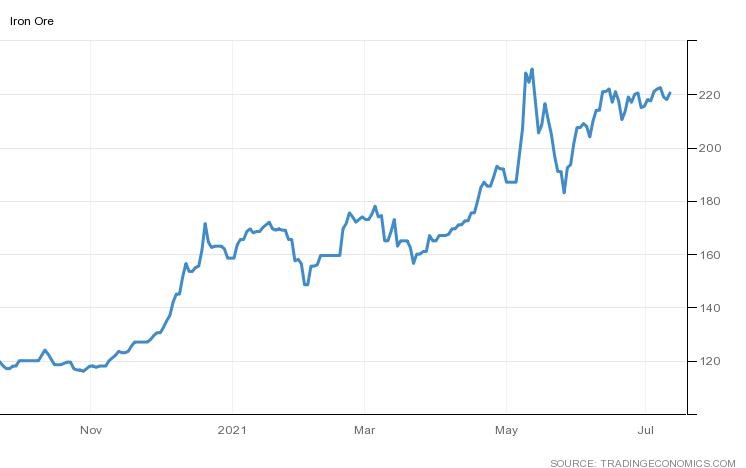

Iron ore is defying expectations:

|

|

|

Source: tradingeconomics.com |

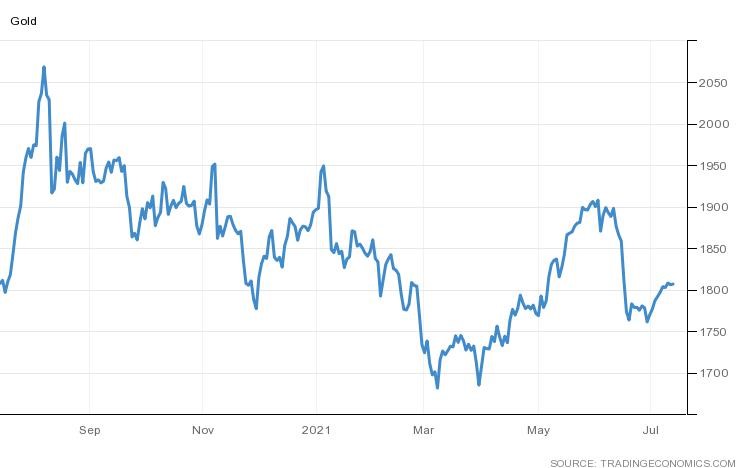

And gold is hardly going down the drain:

|

|

|

Source: tradingeconomics.com |

Put together, the movements in these commodities defy the narrative out of the Fed and the White House.

The charts don’t lie even when the bigwigs do.

So here are a few options for Aussie investors if you want to take the contrarian outlook on inflation.

Here are some options on how to play inflation…

You could get a bit of gold, some mining stocks, and some crypto.

Gold is the traditional inflation hedge; commodities are another one, and so is crypto (even if that’s supposedly debatable).

If you’re lost on how to go about picking up some of these things, and want a better understanding of the risks involved, the good news is we’ve got services that cover all of these different investments.

On the gold front, there’s the excellent Strategic Intelligence Australia.

Callum Newman of Catalyst Trader, who I recently interviewed for The Money Morning Podcast, is into trading gold stocks and iron ore stocks at the moment, too.

Then if you want to take a dip into the crypto world — there’s the brand-new service we call New Money Investor, where you can find in-depth explanations of how to generate bank-busting interest from crypto.

Whatever you do, standing still isn’t a viable option. When inflation comes, those who put their trust in the tripe emanating from the Fed and professional economists may be smarting from the inevitable consequences of the infinite cheap money response to the pandemic.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.