Dynamic developer of gold mines in outback WA, Westgold Resources [ASX:WGX] has posted strong production of gold for its preliminary production results Q3 FY23.

Westgold produced 60,512 ounces of gold, even with disruptive weather across the Murchison gold project.

The gold miner has produced 188,740 ounces of gold so far in 2023, and the group remains on track to earn the upper end of guidance for the year.

WGX was trading for around $1.51 earlier this morning, the gold mining stock having climbed more than 2% in share price.

In the year so far, WGX has risen 72.5% in value, demonstrating strength in 2023 even if its longer-term metrics leave a little to be desired, considerably down on the S&P 200, and the full year:

Source: TradingView

Westgold delivers preliminary update for Q3

Outer WA-based gold mining corporation Westgold has today delivered a preliminary update for its collective gold production in Q3, 2023.

The group said it managed to deliver another solid quarter by producing 60,512 ounces of gold.

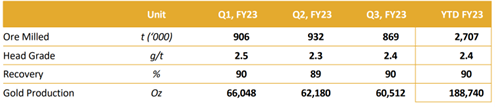

This result was somewhat down from its gold delivery in the second quarter (62,180 ounces of gold production) and down again from the first quarter (66,048 ounces).

WGX did say it had managed solid gold production even with a major rainfall event across the Murchison, which had restricted operations but had not completely stopped milling towards the end of the quarter.

All in all, this has taken the group’s year-to-date gold production to 188,740 ounces for FY2023, which Westgold says keeps it on track for achieving its upper end of production guidance, 240,000–260,000 ounces for FY23.

Source: WGX

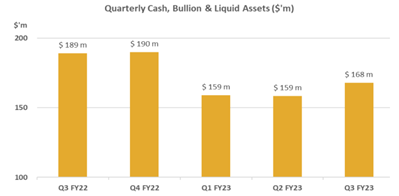

Westgold remains in a strong position even after a quarter that experienced less production than prior periods, and shared that its cash, bullion, and liquid assets were at $168 million by the end of the quarter.

This represents a capital increase of $9 million on the prior quarter’s $159 million.

Westgold’s Managing Director Wayne Bramwell commented:

‘Westgold’s Q3 results show changes made around operating discipline, mining efficiency and cost management are beginning to deliver the financial results we expect from our mines. The turnaround this quarter is encouraging considering the investment in resource drilling, earthworks associated with our hybrid power stations and solar farms and a major rainfall event across the Murchison late in the quarter that impacted our Meekatharra and Fortnum operations.

‘Our team continues to find ways to simplify our business and drive efficiencies. Profitability and building our cash position is the objective this year and at the end of Q3, FY23, we remain on track to deliver our FY23 guidance.’

Source: WGX

The group will provide its full third-quarter operational and financial update in a comprehensive quarterly report, to be published in two weeks’ time.

Recently the group provided an update on its Big Bell expansion drilling in support of its Pre-Feasibility Study at Cue, Western Australia.

Westgold posted results at 50.37m at 5.05g/t Au from 746.63m in 22BBDD0120A, 200 metres below its current expansion plan.

News of ‘spectacular gold intersections’ were also reported for Great Fingall deposit, also at Cue, suggesting potential upside to current mine plan.

As optimisation and drilling continues at both sites, the group will be providing further updates.

The drilling boom in Australia

There’s an industry making massive bull market-like gains in the face of recession, interest rates, and wider market sentiment.

In fact, the drilling business is booming…or will be.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Our experts definitely say so — but how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

He’s found six ASX mining stocks that are heading to top the charts.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia