Do you know what today is?

It’s April Fool’s Day.

A day for practical jokes and pranks.

Well, normally it is anyway.

This year I suspect it will be different. I don’t think many people are in the mood to be mocked.

Could you imagine if some talking head on the TV shouted ‘April fools’ right now? Declaring this whole virus was just an elaborate hoax.

My god, they’d be torn to pieces — literally — by people.

Fortunately, I don’t think that will happen. No, this lockdown is perhaps the cruellest joke of all. Not because it isn’t necessary, but simply because it will test us all.

I’m already starting to notice it among my friends and family.

Anxiety has given way to boredom. And the fear of the virus is morphing into a fear of fever…cabin fever.

Homes will seem like prisons, isolation like some form of corporal punishment. That ‘normal’ life you had before this pandemic might not be so bad after all.

But you’ll have to wait. Because things aren’t going back to the way they were just yet.

In fact, things may never be the same again…

Pause, or total reset?

What I am confident of is that this pandemic will pass.

Be it weeks, months, or even years. Eventually society will quash this viral threat. And when that happens, people will go back to the way they were. For the most part anyway.

I don’t expect isolation will radically change ‘us’ as a society. Though we could see some new trends pop up.

Cleanliness, for example, is something I expect will linger for a while in our post-corona world. Meaning more people wearing masks, washing hands, and awareness of bacteria.

However, what I do expect will radically change is the economy. One way or another.

As we’re currently seeing, governments and central banks around the world are undertaking a giant experiment. In the words of our Prime Minister, they’re trying to ‘pause’ the economy. Pumping billions or even trillions of dollars into industries to survive the collapse in demand.

It’s truly unprecedented, taking the ‘too big to fail’ mantra of ‘08 to new extremes.

Whether this ‘pause’ will be successful or not, remains to be seen.

As market movements have shown over the past week, free money is certainly welcome. But, whether it will actually save the economy is a total mystery. There is every chance we could see a total reset.

One of my colleagues, Vern Gowdie, is certainly someone who believes this reset is coming. In fact, he’s seen the writing on the wall for years now. Not that many cared to listen…

When you’re in the midst of one of the greatest bull markets of all time, no one wants to listen to the doubter. Now though, people can’t stop asking Vern for advice. People are looking for guidance on what to do to preserve their wealth.

Well, he has one simple answer for them…

I’m not going to steal Vern’s thunder though. If you wish to hear his thoughts (and I recommend you do), you can find them in this email. His latest article is just below mine. Just scroll down.

As for whether Vern will be right, well, time will tell.

Like I said, we’re all in the midst of one big experiment. And the outcome will only be clear once we’re in the thick of it.

Making the most of this lockdown

What I can tell you is that you should treat this lockdown as an opportunity.

Yes, it will be tough. And you definitely need to find ways to stay social and stay active. Both in mind and body.

Beyond the basics though, this forced isolation is the perfect chance to stop and reflect. A chance to take a break from the bustling and busy lives that we’re used to.

It may be uncomfortable; it may be boring — but that is the point. This is just another challenge to overcome.

See, we were all fooled into thinking life would always be the way it was. Now, that notion has been turned on its head.

Change is inevitable, be it in our lives, in the markets, or in the global economy. All that matters is how we react to it.

Whether things get worse or better is up to all of us individuals. As Albert Camus poignantly noted in his topical novel, The Plague:

‘The inhabitants, finally freed, would never forget the difficult period that made them face the absurdness of their existence and the precariousness of the human condition. What’s true of all evils in the world is true of plague as well. It helps men to rise above themselves.’

So, don’t worry about the foolishness of this lockdown. Worry about how you can best overcome it.

Regards,

Ryan Clarkson-Ledward,

Editor, Money Morning

TINA — You’re Simply the WORST

Vern Gowdie, Editor, The Gowdie Letter

In 2009, Tina Turner announced her retirement from live performances. This was the year when Wall Street would begin the performance of its life. Back then, Tina Turner was the most famous Tina in the world.

What a difference a decade makes.

In November 2019, Tina Turner celebrated her 80th birthday. That same month, Wall Street was playing to packed crowds. Another TINA had moved into the spotlight.

As reported in Fortune magazine on 29 November 2019 (emphasis added):

‘Quite simply: TINA, or “There Is No Alternative”— to equities,

- On Nov. 29, 2019, the S&P 500 closed at 3,140.98.

- As of Nov. 29, the consensus 12-month forward earnings estimate for the S&P 500 is about $177.

- Based on this estimate, the forward 12-month P/E ratio for the S&P 500 is 17.7 times, and the corresponding earnings yield (the inverse of the forward P/E) is 5.6%.’

TINA’s followers were in full voice, singing the praises of the performing share market.

‘You’re simply the best, better than all the rest’

They sang it so often and loud enough, it drowned out any competing voices.

The TINA tune stuck in people’s heads…

‘You’re simply the best, better than all the rest’

Over and over and over again it was being played. The lower interest rates went, the higher the volume was turned up. There is no alternative. Simply the best. There is no alternative. Better than all the rest.

On and on it went. It must be true. TINA was the only option.

Which of course was and is utter nonsense. Life is all about choices, some less good than others, but there are always alternatives.

On the surface of it, the Fortune magazine article looks like an ‘open and shut’ case for TINA.

Based on ‘the consensus 12-month forward earnings estimate’, the US share market looked fairly valued.

But let’s just scratch that surface using the faint application of a little homespun wisdom. How many times have you heard or been told, don’t count your chickens before they hatch? We’ve all it heard it during our lives. Good old-fashioned common sense.

Yet, based on unhatched earnings, the chorus rang out…quite simply…There is no alternative.

Hindsight now shows just how flawed the ‘rationale’ for TINA really was. Those consensus 12-month earnings estimates are not worth a cracker.

Consensus is a fancy word for Wall Street groupthink. They all crowd round the same numbers. No one dares buck the system.

In November 2019, when TINA was in full voice, I received this email from a reader:

‘If you [Vern] are going to claim that “It’s official…the US market is over-valued” it would be good if you could substantiate it as opposed to making broad sweeping statements or paraphrasing from someone like the IMF. The 1 year forward P/E on the S&P 500 is 16X, it doesn’t look ridiculous by itself and when valued against bonds it looks screamingly good value.’

My response was published in the 18 November 2019 issue of The Gowdie Letter. This is the shortened version:

‘There are a number of methods used to determine the value of shares.

‘In my opinion, Forward P/E is the least reliable measure.

‘Why?

‘Because it’s an estimate on next year’s earnings.

‘And, a lot can happen in markets and the broader economy from one year to the next.’

Well, a lot has happened in markets and the broader economy since November 2019. And none of it’s been all that good for those forward earnings estimates. In booms and busts, nonsense replaces common sense. It happens all the time.

This is the fourth market crash I’ve gone through…1987, 2000/01, 2008/09, and now. The pattern of mass delusion always repeats itself.

In the midst of booming markets, the irrational somehow passes for the rational. For me, the almost deafening chorus of TINA was actually music to my ears.

The lower interest rates went, the louder the (self-interested and blatantly idiotic) TINA calls became.

‘There is no alternative’.

‘Money in the bank is worthless’.

Investors need to move from cash into higher yielding alternatives. Which ones are they?

Preferably the ones being recommended/sold/managed by those singing the loudest in the TINA choir…stockbrokers/financial planners/institutional economists/fund managers.

Everyone was singing from the same hymn sheet.

‘You’re simply the best, better than all the rest’

The more TINA gained traction, the more obvious it became that people were losing their grip…on reality and their capital. All logic was being abandoned. People forgot they had a choice.

[conversion type=”in_post”]

The January 2020 issue of The Gowdie Letter warned readers about the TINA myth:

‘People continue to drive markets higher on little more than the premise of TINA — there is no alternative.

‘What they fail to see is there is an alternative…it’s cash.

‘Investors are focussed on return ON capital, when they should be looking for return OF capital.

‘It’s only when markets crash that there’ll be a change in mindset…investors clamouring to get what’s left OF their capital.’

And as reported by CNBC, on 19 March 2020, there has been an abrupt change of mindset…

‘In the age of coronavirus, cash is indeed king.

‘That’s the view, at least, of many major investors, who are selling everything from stocks to bonds to gold in order to raise cash.’

Where are they clamouring to?

The safety of the warm embrace of US three-month treasury bills…a short-term bond guaranteed by the US Government.

The yield has gone over the cliff…three-month treasury bills are returning next to nothing.

|

|

|

Source: CNBC |

Marvellous how a collapsing market can make you re-evaluate your priorities. Now it’s all about return OF capital (safety) and not return ON capital (interest rate).

Anyone who, in recent times, was taken in by the TINA nonsense has taken a bath.

They must surely be harbouring regrets about the day they chose the alternative.

At what point do you yield?

But what about those who looked for better yielding alternatives several years ago? How are they going?

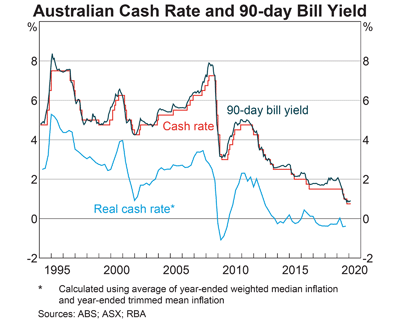

Firstly, let’s look at how the alternative has performed. Cash and term deposits: in 2015, the cash rate was around 2.5%. Term Deposits (TD) were paying around 4% for 12–18 months. Since then, 12-month TD rates have fallen to around 2%.

Let’s assume, money in the bank — on average — has returned around 3% per annum over the past five years.

|

|

|

Source: RBA |

The alternative, the most popular dividend stocks on the Aussie market — the Big Four banks and Telstra — have paid dividends around 8% per annum.

On a yield basis, shareholders have been rewarded with an additional 5% per annum over the past five years…around 25% better than what term deposits have paid over the same period.

However, contrary to what some investors seemed to believe, the market does not give you that extra return for free. There’s always a catch. Now, I know, mentioning that fact may seem rather silly.

However, I can assure you, the TINA mentality did make the irrational seem rational. Anyway, here in graphic detail is the catch.

The following chart illustrates the nonsense in the investment industry’s ‘chasing yield’ fable. Those various coloured lines represent the share price performances of the Big Four and Telstra since 2015.

Here’s a tip for the TINA groupies…performance charts falling from left to right are not good.

|

|

|

Source: Yahoo Finance |

CBA — the blue line — is the best of a bad bunch, with MINUS 20%. The other four (ANZ, NAB, Westpac, and Telstra) are all grouped around the MINUS mid-40% range.

On average — over the past five years — these five dividend paying stocks are down 40% in value. Ouch.

Let’s do the maths. Add back the superior INCOME return of 25% and the yield-chasers are 15% worse off than those who left their money in term deposits.

But, but I know, you were told money in the bank was worthless…there was no alternative.

You know what was worthless…the advice that demonised cash. And for shareholders, you can be assured there’s more bad news to come.

Markets have only just began taking back those ‘free’ lunches. My guess is markets are going lower (a lot lower) compounding those losses. And, with bad debts bubbling to the surface in the coming weeks, months and years ahead, bank dividends are going to be cut…and cut hard.

Double, triple ouch. TINA. Cash is trash.

These were songs being sung by the investment industry’s Pied Pipers. TINA has taken investors over a cliff…and they are yet to hit the rocks below.

TINA was simply the worst advice people could have listened to. Those with cash in the bank are now quietly humming…

‘You’re simply the best, better than all the rest.’

Regards,

Vern Gowdie,

Editor, The Gowdie Letter