Lithium stocks are showing signs of life.

Yesterday, shares for Core Lithium [ASX:CXO] closed 15% higher, Pilbara Minerals [ASX:PLS] was up 12%, and Allkem [ASX:AKE] increased close to 14%.

The star of the day though — and the reason for the wake-up call — was Liontown Resources [ASX:LTR], who shot up a whopping 70%.

Shares moved after Liontown’s board rejected a $5.5 billion takeover cash bid from lithium giant Albemarle. Albemarle offered to pay $2.50 a share for the company, or an around 64% premium over Monday’s close price.

Liontown’s board response was thanks, but no thanks.

Not only did the board feel that the offer ‘substantially’ undervalued the company, but they even remarked on the ‘opportunistic timing’ of the proposal.

Liontown’s Kathleen Valley Lithium Project, which the company expects will be one of the largest lithium mines in the world, is expected to start production mid-2024.

And then, of course, lithium stocks haven’t been doing that well lately. In fact, there’s been plenty of shorting on lithium stocks like Liontown, that is, punters betting the stock price will fall. That’s certainly backfiring now.

But this isn’t the first time that Albemarle has tried to buy Liontown, who has supply deals with Ford and Tesla. Albemarle made offers back in October at $2.20 a share and at the beginning of March at $2.35.

Liontown’s share price sped past the offer price, closing at $2.57 a share yesterday.

But the entire ordeal shows that while lithium stocks have fallen out of favour recently, companies are still finding it hard to source lithium.

We’re going to need more lithium…

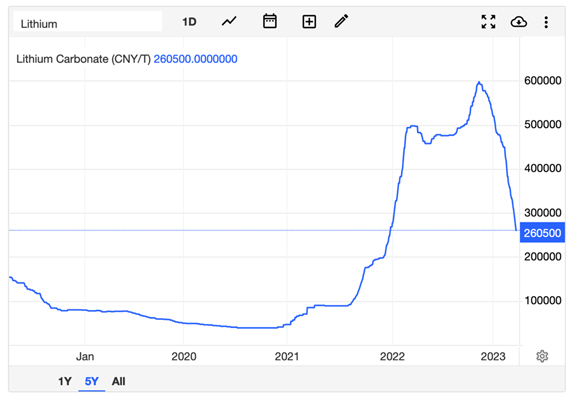

Lithium stocks have been bogged down all year after lithium prices cratered. As you can see below, the price for lithium carbonate in China has dropped dramatically since the end of 2022:

|

|

|

Source: Trading Economics |

While lithium prices have been tanking, the big picture shows that producers are still selling lithium at higher prices than in 2020 and 2021.

And with carmakers pledging to make more EVs, battery costs having fallen, and a push to create battery supply chains outside of China, demand for lithium will likely continue to be a trend.

We’re going to need to build more lithium-mining capacity, but also refining capacity.

While lithium is mined mostly in Australia and Chile, most of the refining of lithium (about 60%) still happens in China.

And there are plans to build a refining capacity out of China to diversify the supply chain, but to also decrease bottle necks.

Ford, for example, is planning to make two million batteries a year by 2026 for its EVs.

As Ford’s CEO, Jim Farley, told Yahoo! Finance:

‘First of all, batteries are the constraint here. Both lithium and nickel are really the key constraining commodities. We normally get those from all over the world — South America, Africa, Indonesia. We want to localize that in North America, not just the mining but the processing of the materials.’

It’s something we heard from Tesla too, during their recent investor day. Tesla unveiled plans to build a lithium refinery in Texas.

It’s something that Liontown is also exploring. The company is looking at setting up a refinery in the Kathleen Valley Project to upgrade their product into lithium hydroxide monohydrate. If that happens, the company says it could be one of the largest refineries outside of China.

But the point is, we’re going to see a lot of money flow into the mining and refining of minerals to build battery supply chains.

Don’t miss out on the underlying story

While there’s plenty of concern about the global economy heading into a recession, central banks continuing to raise interest rates, and the strength of the banks, I see plenty of opportunity in commodities.

Not only in lithium but also copper, nickel, iron ore, and gold, to name a few.

There’s a lot of money flowing into building supply chains outside of China.

Not to mention that when there’s so much doom and gloom around, commodities are real assets.

When it comes to investing in mined commodities, there are plenty of choices. You can invest in established players — companies that are coming close to production, or even look at the tiny explorers.

In fact, geologist and colleague James Cooper is looking closely at this sector. Tiny explorers that can be extremely risky, but if their first drill hits it big, they could really pay off.

And tomorrow, he will be holding a presentation on his method on finding these small explorers with potential. What’s more, he will even name a stock he’s been watching.

So, if you want to learn more about this sector, make sure you check out James’s free presentation tomorrow. You can secure your spot here.

All the best,

|

Selva Freigedo,

Editor, The Daily Reckoning Australia