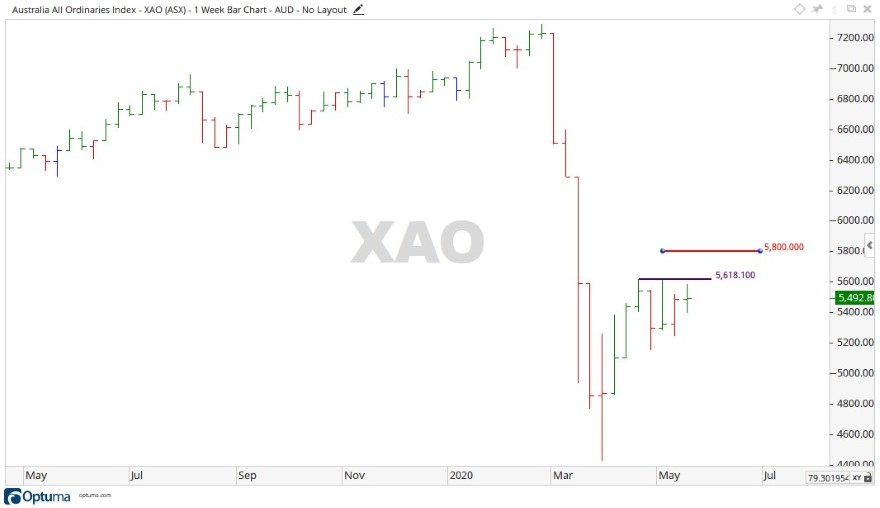

Last week saw a relatively steady week for the ASX All Ordinaries [XAO]. It opened at 5,488 points, trading up on the Monday only to fall back over the rest of the week with a minor recovery on Friday, closing out the week at 5,492 — to record a movement of four points for the week.

The week ahead

The market moved largely sideways last week, closing relatively close to its open. As mentioned in the last weekly market wrap, the most recent high of 5,618 is still the high water mark that would need to be broken for the market to show strength, with the next level being 5,800. If this higher level cannot be broken, the price may move back to negative ground.

Source: Optuma

A closer look

In line with the All Ords this previous week, the individual sectors made marginal movements. Materials and Communications moving up 2.82% and 2.17%, respectively, with Energy and Technology falling back 2.43% and 2.42%.

Moving down into the stocks, Newcrest Mining Ltd [ASX:NCM] surged forward 9.09%, along with Amcor Plc [ASX:AMC] and Ansell Ltd [ASX:ANN] moving up 3.59% and 5.21%, respectively.

One of the recent big gainers, Myer Holdings Ltd [ASX:MYR] fell back 24.24%, along with FlexiGroup Ltd [ASX:FXL] and Incitec Pivot Ltd [ASX:IPL] falling 19.65% and 9.59%, respectively.

The broader look of the ASX

Interest in trading and investing looks to have exploded, with over 4,000 Australians pouring into the market per day. ASIC reported that from 23 February to 3 April more than 140,000 new investors signed up to brokers. While this influx of new business can be seen as great for the brokers, for the inexperienced trader or investor, rushing into the market in uncertain times like now can end in financial ruins.

On CFD trading platforms losses appear to have been even higher. Between 16–22 March 2020, net losses from trading CFDs were $234 million from 12 CFD providers.

With a lot of people losing their jobs in the current climate, any financial loss in trading can really put more financial pressure on you.

Right now, is a time where you really need to understand the market you are trading and the instrument you are using to trade. Forex, stocks, contracts for difference, whatever it is, it takes time to get educated and understand what you are doing. Failing to do so may cause financial problems only your wildest dreams can imagine.

Moving forward

Source: Optuma

At the risk of sounding like a broken record…5,618 and 5,800. These appear to hold a lot of resistance; the market would have to break through to be considered to show strength.

If the All Ords were to start a fall away, levels of 5,141 and 4,902 may come into focus.

Here at Money Morning, we aim to give readers unique insights from across the market to help them make more informed investing decisions. Money Morning is a unique publication that you can get direct to your inbox seven days a week. If that sounds like something you’d be interested in, click here to read more.

Regards,

Carl Wittkopp,

For Money Morning