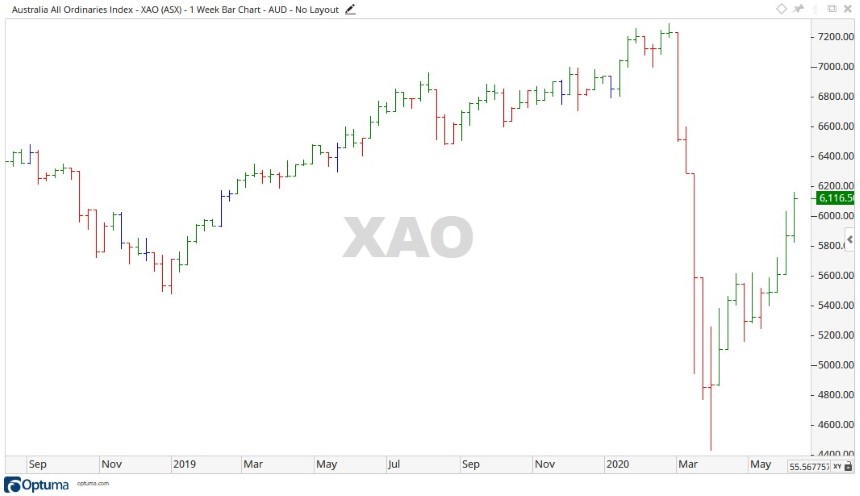

The past week saw the All Ords [XAO] not only break the 6,000-point level but close well above it at 6,116 points. It was quite a good week for the All Ords with all trading days finishing in the green, showing some confidence returning to the Australian market.

Source: Optuma

The week ahead

With the All Ords being able to hold itself above 6,000 points last week, it is possible this week the momentum will continue.

The close last week of 6,116 puts the market within striking distance of the historical resistance level of 6,248 points.

The next level above this is 6,458, and after four solid weeks of moving up, it will be interesting to see if the market can maintain this push and move up to the higher level.

Source: Optuma

A closer look at the ASX

Some sectors left behind by the upwards push gained ground last week.

Financials and Consumer discretionary moved up 7.39% and 4.83%, respectively.

While Healthcare and Information Technology saw the smallest gains, moving up 1.73 and 2.48%, respectively.

With regards to stocks BlueScope Steel Ltd [ASX:BSL] and Qantas Airways Ltd [ASX:QAN], both had excellent weeks. BlueScope moved up 18.03% and Qantas gained 16.33%. Bank of Queensland Ltd [ASX:BOQ] also had a stellar week, gaining 17.17%.

Gold lost a bit of its lustre in the wake of the bullish move in stocks and a stronger AUD.

Gold giants Newcrest Mining Ltd [ASX:NCM] and Evolution Mining Ltd [ASX:EVN] fell back 4.79% and 8.20%, respectively.

The broader look — what’s the ute index?

While the All Ords has moved up over the last few weeks, there are still some worries out there.

Recently, BetaShares published a report on the growth of ETFs through the month of April.

For those who are unsure what an ETF is, it is a type of security that involves a collection of investments — usually stocks, playing on a specific theme.

These products are used extensively by investment houses and super funds.

One interesting comment in the report stated (my emphasis):

‘Industry Funds under management grew by $4.1B (7.2% month on month increase) to end April at $61.3B. This growth represents the 2nd largest absolute growth in dollar terms on record.’

While on the surface this all looks peachy, there are still looming issues to be considered.

Back in 2019 reports started to surface of a decline in the ‘ute index’ — the amount of new commercial vehicles being sold — an indicator of the trades slowing down coupled with a collapse in construction jobs being advertised.

Now with the COVID-19 virus still in effect, we are finding ourselves in an exceedingly difficult position as Australia is now reported to be in a recession.

With this in mind, it is possible another leg down is to come and those considering flying back into the market via ETFs and index funds may want to pause for thought before doing so.

Now is a time where patience and diligence can pay off in the long run. It’s a ‘stock picker’s’ market out there.

Key levels for the All Ords moving forward

Source: Optuma

That being said, this week coming looks to be positive for the All Ords after the strong week just passed. If the uptrend continues, then the price levels of 6,253 may be broken, which would then bring 6,485 points into focus. Conversely, should it turn to the downside and retrace, then levels of 6,018 and 5,700 may come into play.

This morning, our editor Ryan Dinse looked at the exciting world of fintech and his ‘Great Bank Unbundling’ portfolio. If you want to get Money Morning direct to your inbox seven days a week, you can subscribe here. It’s a great free way to stay ahead of the curve when it comes to your wealth and investments.

Regards,

Carl Wittkopp,

For Money Morning