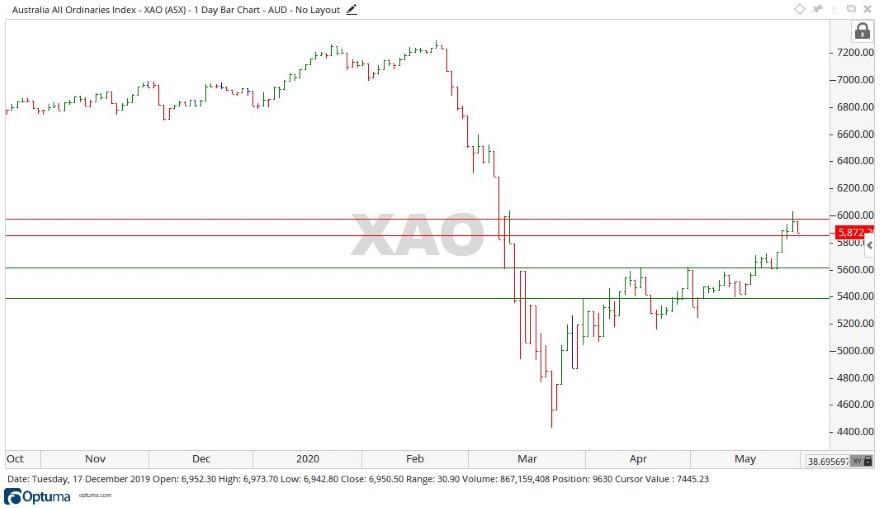

The past week saw the All Ords [XAO] crack the 6,000-point mark, only briefly, but it still made it through. In the first four trading days the market moved up 348 points, before falling back 85.6 points on Friday to close out the week. All up, a positive week for the All Ords with signs of confidence appearing in the market again.

The week ahead for the ASX

The All Ords experienced a large move up, managing to record the high of 6,029.90.

The market closed at 5,872.2, being above the psychologically important level of 5,800.

If the All Ords were to remain above the 6,000-point level and move towards 6,100, the move could gain credence as a bullish signal. But as can be seen, the levels of 5,853 and 6,000 have provided some heavy resistance back in 2017.

Source: Optuma

A closer look at the XAO

Last week saw many companies on the market moving up in line with the broader move of the All Ords. Financials had a strong week, posting gains of 11.13%, with Communications and Industrials moving up 5.83% and 3.88%, as well. The Health sector declined 2.47%.

Looking into the stocks, Australia and New Zealand Banking Group Ltd [ASX:ANZ] made a huge move up of 16.17% and Lendlease Group [ASX:LLC] also held double-digit gains of 11.66%. Bank of Queensland Ltd [ASX:BOQ] also rose 10.65%.

On the downside CSL Ltd [ASX:CSL] and Worley Ltd [ASX:WOR] fell 4.66% and 8.70%, respectively.

The broader look for the ASX

With the COVID-19 virus halting business to a large degree, the federal government made provisions for people to access a portion of their superannuation. Recent figures suggest the majority of withdrawals have been from people aged under 35.

This could be showing us that the younger group of society may have less secure income, larger spending habits, and mortgages they may not be able to afford.

With the slowdown in business and employment across the board, once this money has been used up it may present a new set of problems but also opportunities for investing.

While things look to be moving in the right direction right now in the market, patience could still be key while we are in the eye of the storm.

Another leg down may yet still come to pass.

Moving forward

Source: Optuma

With the price closing above 5,800 points last week, in this coming week sustaining that level will be an important milestone in recovery, with eyes set on the 6,000-point and above levels.

Holding firm above this level will be important, yet with only one day of trading over this level so far, it’s still a bit premature for the bulls to come out in force. Should the price start to fall back, levels of 5,618 and 5,388 may provide support to halt the move.

Here at Money Morning we aim to give readers unique insights from across the market to help them make more informed investing decisions. Money Morning is a unique publication that you can get direct to your inbox seven days a week. If that sounds like something you’d be interested in, click here to read more.

Regards,

Carl Wittkopp,

For Money Morning

Comments