Online travel business Webjet [ASX:WEB] released its 1H23 update on Wednesday, sending WEB shares higher as bookings track at 95% of pre-pandemic levels.

WEB shares rose as high as 9% on Wednesday.

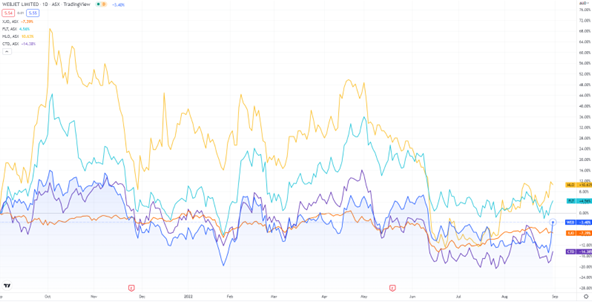

That said, the travel stock has been mostly flat when considering the past year. WEB shares are down 1% over the past 12 months.

Source: www.tradingview.com

Webjet officially back in profit

On Wednesday, Webjet announced all three of its businesses are ‘profitable for FY23 trading year to date’.

Webjet expects cash surplus from its operations to exceed $100 million as at 1H23.

Webjet also provided some FY22 business metrics.

Total transaction value (TTV) went from $453 million in FY21 to $1.6 billion in FY21. However, TTV is still well down on FY19, which came in at $4.3 billion.

Revenue rose from $24.4 million in FY21 to $138 million in FY22, but still trails FY19’s revenue of $409 million.

WEB was able to pare its EBITDA losses in FY22, shaving a loss of $118.2 million in FY21 to an EBITDA loss of $15 million in FY22.

Unsurprisingly, FY22 EBITDA loss is still well down on WEB’s FY19 EBITDA profit of $158 million.

Interestingly, while TTV and revenue rebounded strongly on FY21, Webjet kept its expenses steady.

FY22 expenses rose modestly from $142.6 million to $153 million.

And while Webjet was seeing strong recovery across its businesses, it was most pleased with a rebound in its WebBeds segment.

Webjet’s Managing Director John Guscic commented:

‘July was the record TTV month in the history of WebBeds and August has surpassed July. By driving efficiencies and pivoting our focus to target growth wherever we saw opportunities, we’ve seen our market share grow and EBITDA margins are on track to be higher than 50% for the first half of FY23.

‘During the peak seasonal months of July and August, we hit our aspirational “8/3/5” profitability target and we have full confidence that EBITDA margins will expand beyond prepandemic levels as the business continues to scale.

‘Before Covid hit, Webjet was delivering $157.8 million in EBITDA. When travel stopped, we did the hard work necessary to transform our businesses to ensure they would emerge more efficient, more profitable and with higher market share when travel returned. We are now seeing our strategy play out. Based on current performance, we expect the Company to exceed pre-pandemic earnings in FY242, well ahead of when the broader travel market is anticipated to return to 2019 levels. We are excited for the limitless opportunities that lie ahead.’

WEB and future travel

Web claims the competitive landscape has been reshaped and demand for travel to only keep improving.

Webjet’s Chairman, Roger Sharp, reflected on the hardships faced by the travel industry during the pandemic, a time that forced the travel industry to grind without reward:

‘We continue to watch cash, cash flow and debtor risk very closely, and are obviously tuned in to the global forces threatening prosperity — war in the Ukraine, high inflation driven by rapid increases in energy and food prices, a still-broken supply chain and an on-again, off-again pandemic.’

Now, as travel makes a comeback, it’s even more important to consider how global economies are getting ready to decarbonise.

EVs are a big part of the agenda.

While lithium was hot last year, the mass adoption of EVs is also set to boost demand in lithium’s siblings: copper, nickel, cobalt, and graphite.

In fact, the lithium rush has got our team at Money Morning thinking…isn’t there a smarter way?

According to our team, yes, there is. Read about lithium’s ‘little brother’ here.

Regards,

Kiryll Prakapenka