You might have read in recent months about the backlog of cargo vessels at the Port of Los Angeles in the beginning of the year and supply chain disruptions.

The number of ships waiting offshore at the Port of Los Angeles dropped from 84 vessels to 44 vessels from mid-November 2022 to January 2022 — a 47% decline. But those figures are limited to the queue in what’s called the Safety and Air Quality Area (SAQA), which extends 150 miles west of Los Angeles and 50 miles to the north and south.

This decline was due to the fact that the Biden Administration imposed steep fines on vessels in the SAQA that could not get their cargo unloaded in a timely way. The fines were ridiculous because no one wanted the cargo offloaded faster than the shippers themselves. The reason for the backlog was not that shippers were dilatory. It was because the port itself was jammed. There weren’t enough trucks or railcars to move the containers. As a result, there was nowhere to put new ones.

To avoid fines, the vessels simply moved outside the SAQA. Using GPS and the Pacific Maritime Monitoring System (PacMMS), the Marine Exchange of Southern California was able to determine that the total number of vessels in the queue for the Port of Los Angeles had actually increased to an all-time record of 96 ships between 25 October (the day the penalties were announced) and 29 November — a 27% increase:

|

|

The ships were still in the queue for Los Angeles but had moved down the coast to Mexico’s Baja Peninsula or were even backed up in Taiwan and Japan, waiting for the chance to deliver in Los Angeles. Some vessels were closer to LA but waited further out to sea, outside the SAQA. What had been a backlog in Los Angeles had now become a transpacific traffic jam.

‘I’m from the government, and I’m here to help’

This turn of events is a good lesson in the law of unintended consequences. Biden’s regulatory ‘solution’ only made things worse and spread out the problem. It’s also a lesson in how complex supply chain logistics really are. Glib headlines about an easing in the backlog of unloaded ships are not only wrong but also give a false sense of accomplishment to government bureaucrats. Analysts of the situation need to rely on logistics experts, not government officials, if they want to understand what’s happening.

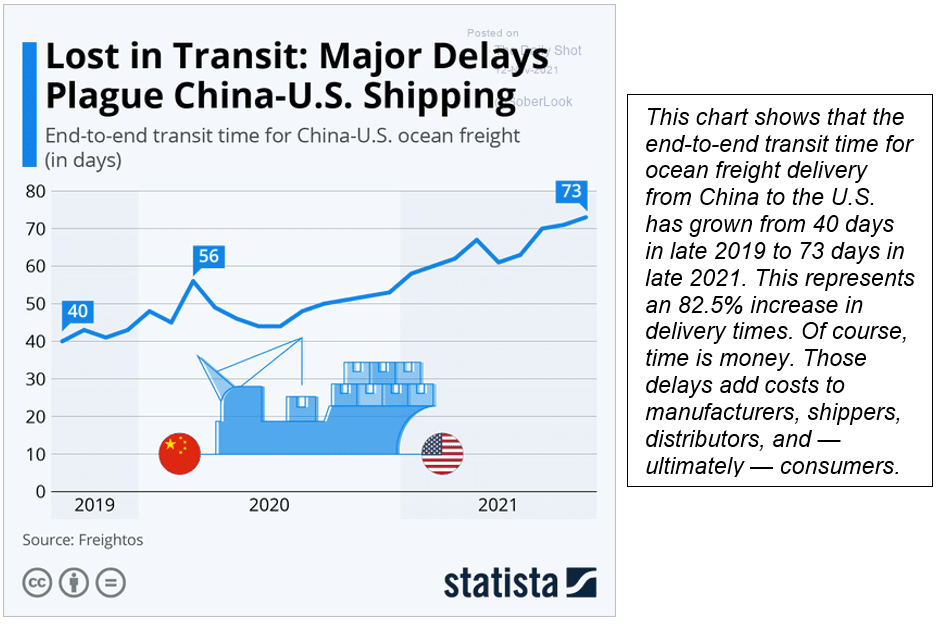

The number of ships waiting to unload cargo in Los Angeles and other major American ports such as Tacoma, Miami, Houston, and New York are not the only measure of the extent of the supply chain bottleneck. Another measure is the number of days it takes to deliver cargo from China to the US.

As shown in the chart below, the end-to-end transit time for ocean freight delivered from China to the US has grown from 40 days in late 2019 (before the pandemic) to 73 days in late 2021:

|

|

|

Source: Statista |

We can’t make the supply chain breakdown go away. What we can do is analyse it, understand it, and make solid recommendations for surviving it from an investor’s perspective. The store shelves may be bare, but your portfolio should be fully stocked with great ideas to weather the crisis.

Regards,

|

Jim Rickards,

Strategist, The Daily Reckoning Australia

This content was originally published by Jim Rickards’ Strategic Intelligence Australia, a financial advisory newsletter designed to help you protect your wealth and potentially profit from unseen world events. Learn more here.