The Westpac Banking Corporation [ASX:WBC] share price is trading 9.58% lower this afternoon, following more news of measures to curb COVID-19 and special measures to be introduced by the banks.

Last week, Westpac unveiled its plan to support small business customers and consumers by delivering financial support in the form of interest rate cuts.

Westpac’s acting CEO, Peter King, said the bank is acting now to support Australia and its customers during an extraordinary moment in our history.

‘We are determined to assist customers through this extraordinary period. This is a once in a lifetime event and a united response by government, regulators and corporate Australia is exactly what we need.’

Westpac shares fall harder: Is it time to say goodbye to your favourite income stocks?

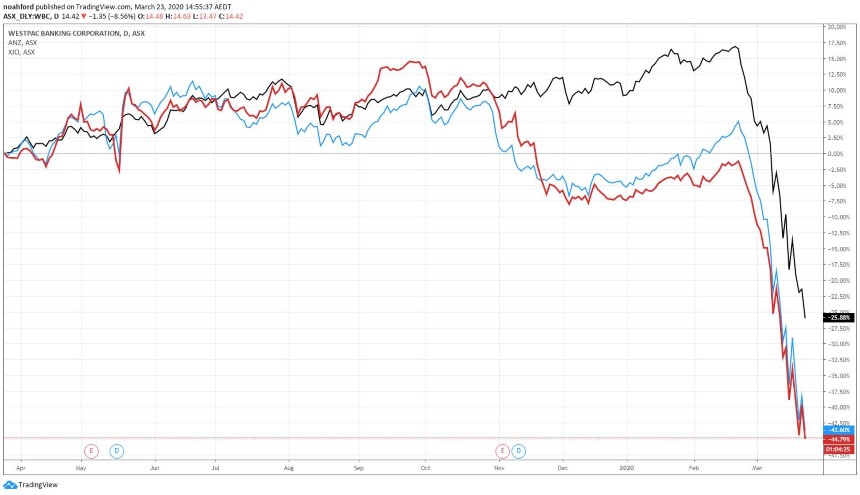

Shares in each of Australia’s largest banks, including Westpac and Australia and New Zealand Banking Group Ltd [ASX:ANZ], are getting hit harder than the ASX as a whole:

WBC and ANZ began underperforming the ASX 200 back in Nov 2019

WBC and ANZ began underperforming the ASX 200 back in Nov 2019

Source: tradingview.com

WBC (red) and ANZ (blue) against the ASX 200 (black)

With both banks now offering assistance amid the ongoing pandemic, their profit margins could continue to be squeezed.

Dividend cuts are potentially being discussed, and it could be more a matter of how much, not if.

For a more in-depth look at the threat to bank dividends, our Editor Ryan Dinse’s recent report on bank dividends is well worth a read. You can download it here.

Though there may be optimism in some corners that the market will kick back into high gear once this coronavirus pandemic blows over, this might not be the case for the banks.

A recession (maybe even depression) is looming like Damocles’ sword, people are losing their jobs, meaning households may go overdue or default on their loans, and that spells trouble for the banks.

When a bank incurs bad debt it directly affects profit, which in turn affects dividend payments.

If we see a continued rise in bad debts and unemployment due to the COVID-19 pandemic, then we could see a pretty bad run for the Big Four banks’ profits over the medium to long term.

Some National Australia Bank Ltd [ASX:NAB] shareholders might remember that it took the bank well over five years to rid itself of the bad loans incurred during the GFC.

Coupled with the current extremely low interest rate environment, I wouldn’t be surprised to see the banks struggle to maintain profitability.

Splintering of the financial sector on the cards

Only time can tell what will become of Australia’s financial behemoths.

If the Big Four banks continue struggling to keep their heads above water, we could see Australia’s financial sector begin to splinter.

Recent years have seen some notable names enter the financial services industry, each keen to chip away at the profits of the traditional banking sector.

Though I don’t expect Australia’s banks will go bust in the current market crash, they are certainly vulnerable emerging fintechs.

There are some great fintechs that come to mind when taking on the banks, which are detailed in the report below.

We’ve titled them ‘Bank Busters’, three ASX fintech stocks that could outsmart the banks.

What they do is carve out a specific niche for their products, and then optimise it.

For example, one is responsible for stealing CommBank’s credit card profits. Download here.

Regards,

Lachlann Tierney,

For Money Morning