I don’t know about you, but some people roll their eyes at the thought of reading another forecast for the year ahead.

I take the counterargument. This is the time of year when market commentators let loose.

It takes guts to make bold predictions about the year ahead and put your views on the line. The Christmas spirit seems to make that easier.

Or at least you don’t need to front up to your colleagues for a little while, so they’ll probably forget what you stitched up anyhow.

Whether you agree with these outlooks or not, I think any well-thought-out argument that’s true to the author’s thoughts deserves consideration.

So, here goes, my unabated opinion on what we could expect in 2026…

Two Forces Converge:

Tech vs Commodities

Except for a brief hiccup in April and November this year, 2025 has been a blockbuster year for virtually every asset class.

Except tech has taken the limelight, yet again.

However, at long last, commodities are starting to show signs of life, particularly in the precious metals market.

My latest glimpse shows gold up about 50% this year, but it has been outpaced by silver and platinum, both of which have risen over 70%.

But is there a divergence forming between these two very different sectors?

Last month, markets began pricing in genuine concerns about Big Tech’s significant investment in AI infrastructure.

Increasingly, this market is being dominated by narratives…

Bold claims on the future prospects of AI. Undoubtedly aimed at fuelling the unrelenting surge in AI investment.

But whenever this market stumbles or fails to reach a new daily high, AI figureheads like Sam Altman (OpenAI) are wheeled out onto the stage, touting the unlimited potential.

Over much of 2025, I’ve detailed the risks and overblown case for getting caught up in AI investments.

In fact, in one piece, I suggested that the AI investment theme was destined to blow up in investors’ faces, just as it did with renewables two years ago.

For much of 2025, I’ve been a lone voice.

But now, that voice is getting much, much louder.

Investors are paying closer attention to company balance sheets as they compete on AI infrastructure build-outs.

Take Meta…

This year, the company is expected to deliver free cash flow of around $20 billion, way below the $54 billion it generated in 2024.

Clearly, the company’s blockbuster AI investment is having a hefty impact on its bottom line. But that’s the era we’re in. Tech is throwing in all its chips on this one.

So will the bet pay off?

I can’t answer that, but what I dislike about this investment theme is the lack of visibility.

Perhaps I’m just naïve about AI and the tech sector in general, but who are the future customers that will ultimately justify this historic build-out?

Now, compare that to capital expenditure (capex) investment in the mining industry.

A mining firm looking to increase production will boost spending on items such as drilling, staff, and machinery to access additional ore.

And here the build-out is far more visible; there are customers at the other end of a mine expansion.

That’s because miners are producing something measurable, real, and tangible!

History has plenty of examples of tech down, commodities up. And that’s the era I believe we’re approaching.

2026: The key turning point

Let’s run through some evidence on why that’s looking more likely…

Tech and AI are driving historic valuations in US equities. On a relative basis, the US market is overvalued across numerous metrics.

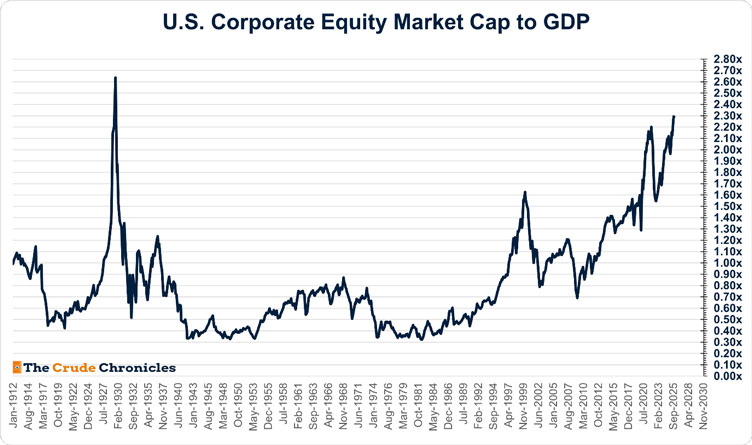

One measure is the total US corporate equity market cap relative to GDP… Also known as the Buffett Indicator.

As you can see, we are now approaching levels of relative overvaluation not seen since the 1929 market peak:

Source: Crude Chronicles

[Click to open in a new window]

Concerned? The majority aren’t.

However, if the bulk of your assets are tied to passive investment vehicles, such as the US S&P 500 or Nasdaq 100, then it may be time to become a little more strategic.

Will the Buffett Indicator

hit 1929 levels next year?

There’s some irony with the timing of Buffett, his indicator and where markets are potentially heading next year.

You see, Warren Buffett was born in 1930, the start of the Great Depression.

But some have pointed out that this was also the beginning of a decades-long bull market in the US economy.

Buffett, America’s most famed investor, was born into the very infancy of America’s long-term economic dominance.

But next year, Buffett will be officially hanging up his hat at Berkshire Hathaway.

That means he’ll be out of the markets just as his indicator nears the infamous levels of 1929.

Does Buffett see the writing on the wall? Probably.

If you link all of this together, it’s a rather poetic ending for this legendary investor.

But for the rest of us, it could be a disaster.

That’s why I think you should have one eye on strategic investment opportunities in 2026, but the other glued to the heightening risks.

Why not just go 100% Cash?

As you’ve seen, US markets have breached any zone of normality.

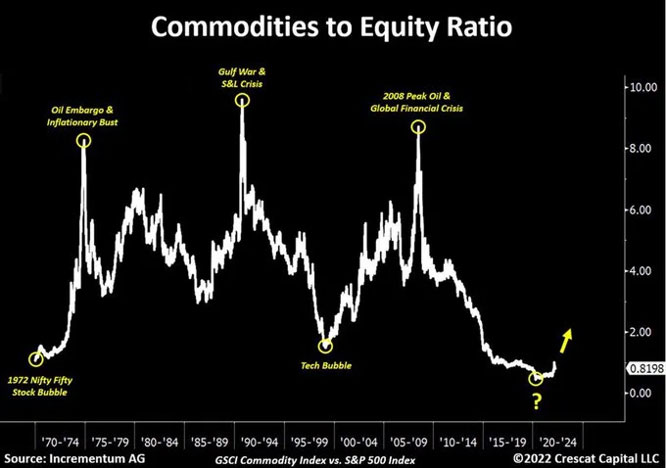

In fact, relative to commodities, US equity valuations now exceed the Tech bubble of 2000 and the 1972 ‘Nifty Fifty’ stock bubble:

Source: Crescat Capital

And that makes the task of AI spruikers like Sam Altman that much harder.

However, the chart also highlights the relative value of commodity-based investments.

A true diversifier for your portfolio as we enter a riskier phase in the equity cycle.

We’ve seen the unstoppable run-up in tech stocks over the last ten years, but that is starting to show signs of stress.

Tech firms once held the advantage of minimal capital outlay to get underway…A domain name, a couple of employees and an idea…

That was all a start-up tech firm needed to become a billionaire giant.

But the game has changed.

Now it’s all about competing on massive infrastructure development so tech firms can remain relevant in the AI arms race.

Tech’s business model has undergone a fundamental shift; it is now a capital-intensive sector.

Funnily enough, that’s the very reason investors fled mining stocks more than a decade ago!

But there are two clear differences between tech and commodities today.

Tech has experienced a historic inflow of investment, but mining hasn’t.

So, where will capital flow

in 2026 and beyond?

My money’s on sectors producing real things and holding real customers; mining and energy stocks certainly fit that criteria.

There are just too many details missing in how tech firms actually aim to make money from AI and justify its historic buildout.

To balance out the risks in this market, I’d consider weighting your portfolio towards a handful of high-quality miners, high-yielding oil and gas producers, and cash.

That’s how I’ll be playing the markets in 2026.

If you’d like help selecting resource stocks that can help build a margin of safety into your portfolio, this Christmas we’re offering a hefty 50% off my Mining: Phase One service.

To get an edge in the phase we’re moving into, you need to understand the rocks. As an experienced geologist, this is my wheelhouse.

If you want to join this premium advisory for HALF PRICE, you can.

But only until midnight New Years’ Eve.

Just remember this is a very little window to get this massive price reduction…it expires midnight 31 December.

Have a great rest of your break and see you in the New Year!

Regards,

James Cooper,

Mining: Phase One and Diggers and Drillers

Comments